Investment Analysis 53

12c platinum / 12C

RPN Keystrokes

12c platinum

ALG Keystrokes

Display Comments

1500\ 1500³

1700t 1700t

-628.09

5th year.

300\ 300³

1700t 1700t

-226.44

6th year.

300\ 300³

1700t 1700t

-309.48

7th year.

300\ 300³

1700t 1700t

-388.81

8th year.

300\0t 300³0t

-1,034.72

9th year.

300\0t 300³0t

-1,080.88

10th year.

750\ 750³

750.00

Buy back.

1:3-§ 1-:3§~³

390.00

After tax buy back

expense.

g(043t g(036t

239.43

Present value.

:2 :2

-150.49

Net lease advantage.

Break-Even Analysis

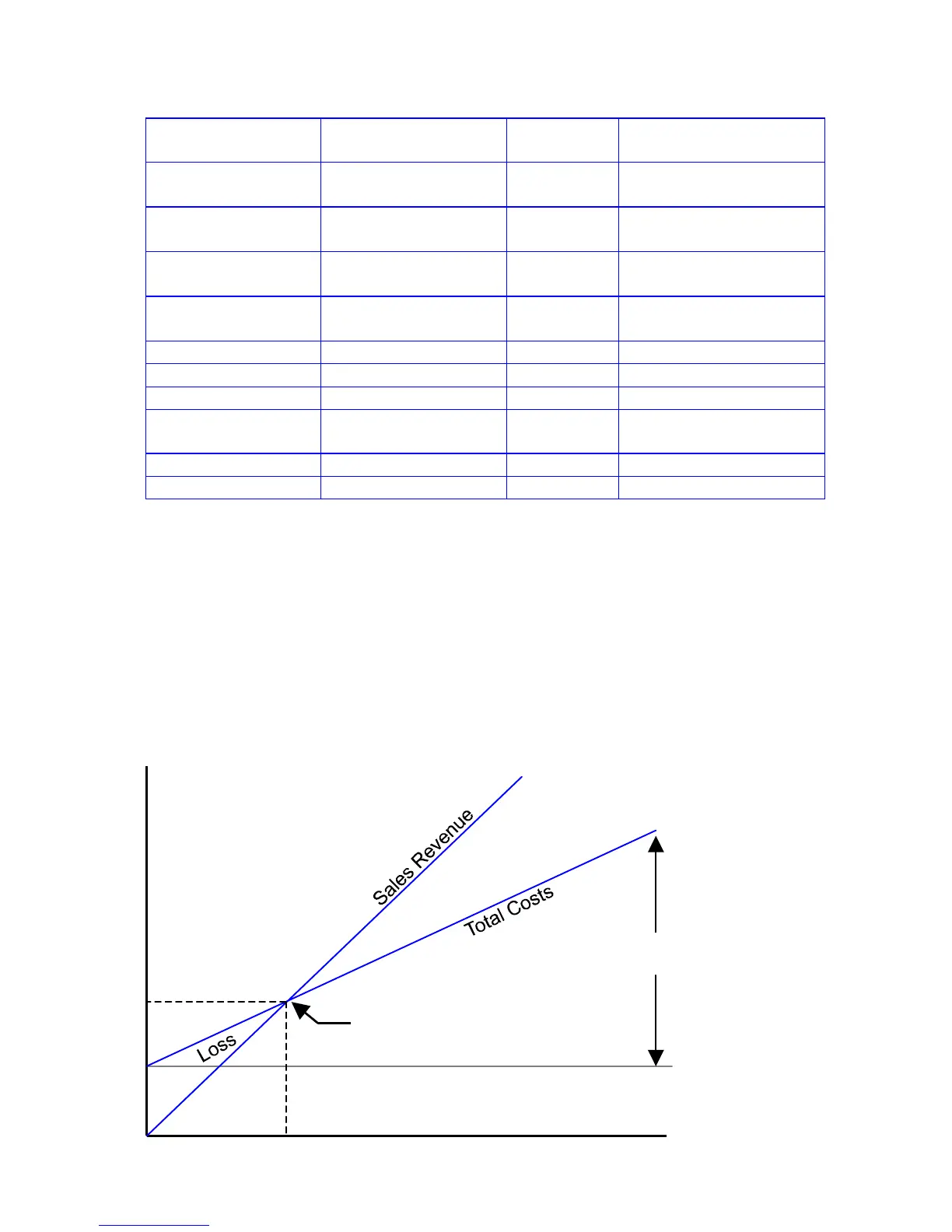

Break-even analysis is basically a technique for analyzing the relationships among fixed

costs, variable costs, and income. Until the break-even point is reached at the intersection

of the total sales revenue and total cost lines, the producer operates at a loss. After the

break-even point each unit produced and sold makes a profit. Break-even analysis may be

represented as follows.

Fixed Costs

Profit

Break-even Point

Variable

Costs

Loading...

Loading...