52 Investment Analysis

salvage value. An accountant informs management to take the 10% capital investment tax

credit at the end of the second year and to figure the cash flows at a 48% tax rate. The

after tax cost of capital (discounting rate) is 5 percent.

Because lease payments are made in advance and standard loan payments are made in

arrears the following cash flow schedule is appropriate for a lease with the last payment in

advance.

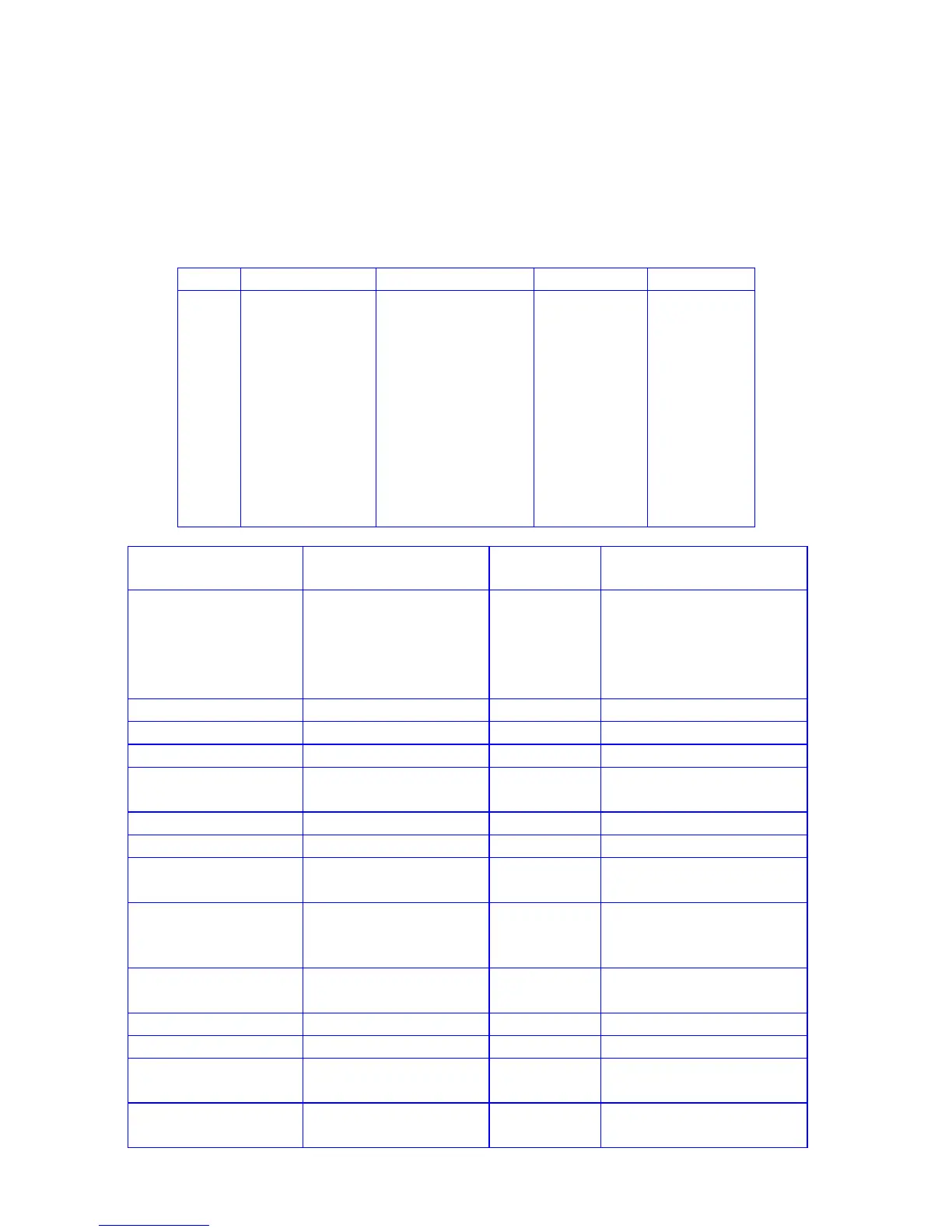

Year Maintenance Lease Payment Tax Credit Buy Back

0 1700+1700

1 200 1700

2 200 1700 1000

3 200 1700

4 200 1700

5 1500 1700

6 300 1700

7 300 1700

8 300 1700

9 300 0

10 300 0 750

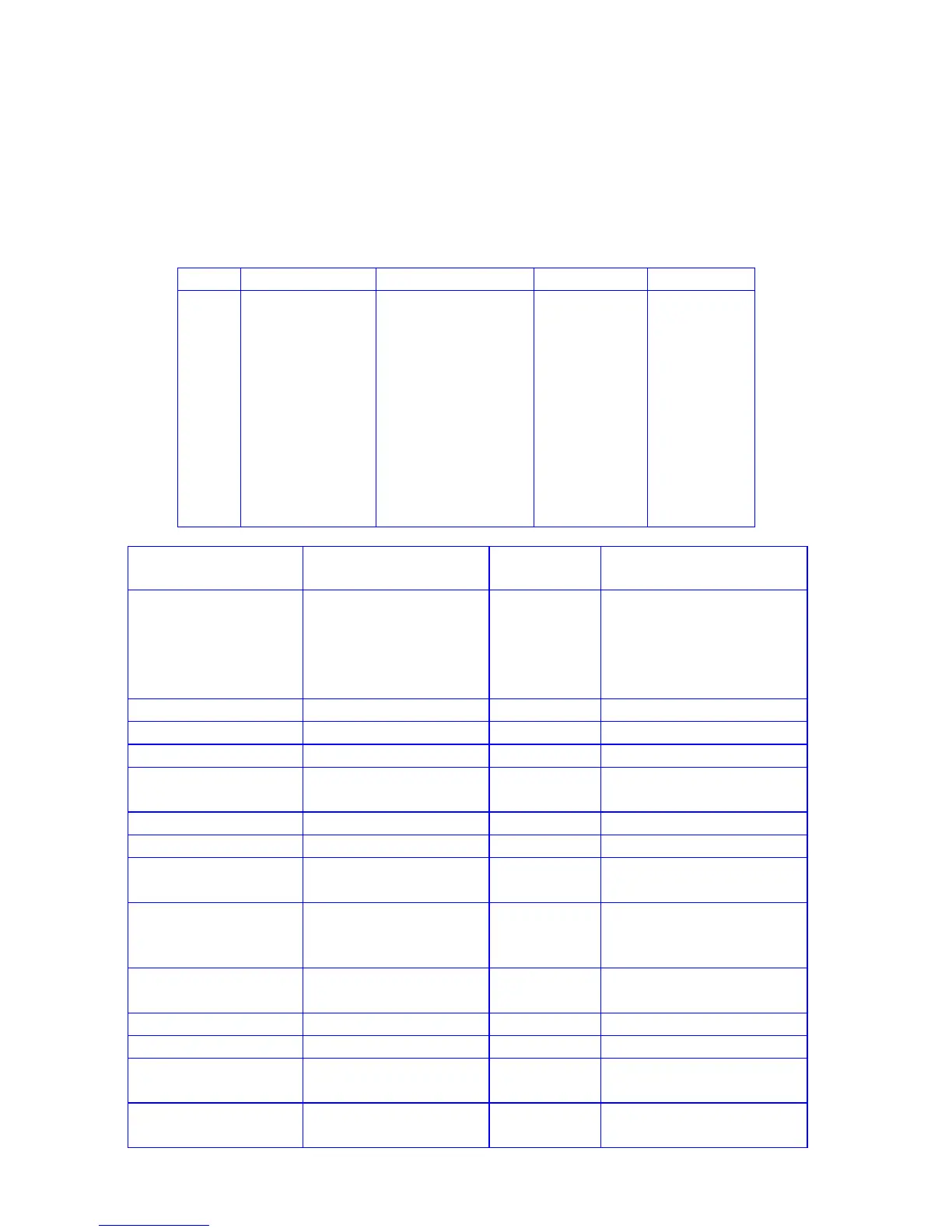

12c platinum / 12C

RPN Keystrokes

12c platinum

ALG Keystrokes

Display Comments

g gÂ

fCLEARH fCLEARH

0.00

10n12¼ 10n12¼

10000Þ$ 10000Þ$

-10,000.00

Always use negative loan

amount.

P P

1,769.84

Purchase payment.

.48?3 .48?3

0.48

Marginal tax rate.

.05\1+?4 .05+1³?4

1.05

Discounting factor.

10000\ 10000-

1500-?5 1500³?5

8,500.00

Depreciable value.

10?6 10?6

10.00

Depreciable life.

1700\+ 1700+³

3,400.00

1st lease payment.

1:3-§?2 1-:3§~

³?2

1,768.00

After-tax expense.

200\ 200³

1700t 1700t

312.36

Present value of 1st year's

net purchase.

200\ 200³

1700t 1700t

200.43

2nd year's advantage.

1000g(043 1000g(036

1,000.00

Tax credit.

t t

907.03

Present value of tax credit.

200\ 200³

1700t 1700t

95.05

3rd year.

200\ 200³

1700t 1700t

-4.38

4th year.

Loading...

Loading...