126 Personal Finance

11.

Press

t to compute the total dividends paid.

12.

Press

t to compute the future value when, after retirement, money is withdrawn at

a rate causing the tax rate to equal ½ the rate paid during the pay in period.

13.

Press

t to compute the diminished purchasing power, in terms of today's dollars,

of the future value assuming a 10% annual inflation rate.

14.

Press

t to compute the future value of an ordinary tax investment.

15.

Press

t to compute the diminished purchasing power of the ordinary tax

investment.

Example: Assuming a 35 year investment period with a dividend rate of 8.175% and an

income tax rate of 40%:

1. If you invest $1500 each year in a tax free account, what will its value be at

retirement?

2. How much cash will be paid in?

3. What will be the value of the earned dividends?

4. After retirement, if you withdraw cash form the account at a rate such that it will be

taxed at a rate equal to one-half the rate paid during the pay-in period, what will be

the after-tax value?

5. What is the diminished purchasing power of that amount, in today's dollars, assuming

10% annual inflation?

6. If you invest the same amount ($1500 after taxes for a non-Keogh or non-IRA

account) each year with dividends taxed as ordinary income, what will be the total

tax-paid cash at retirement?

7. What is the purchasing power of that figure in terms of today's dollars?

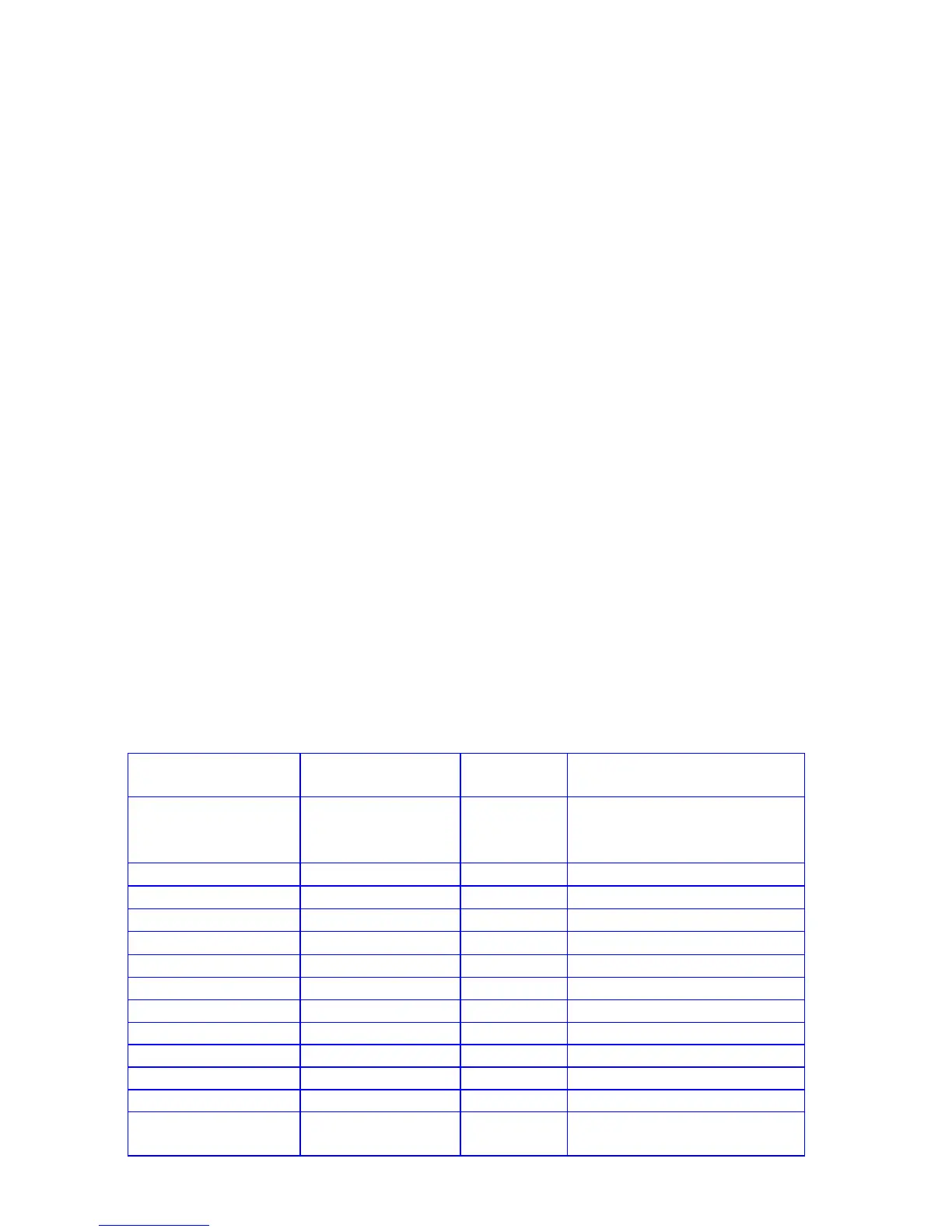

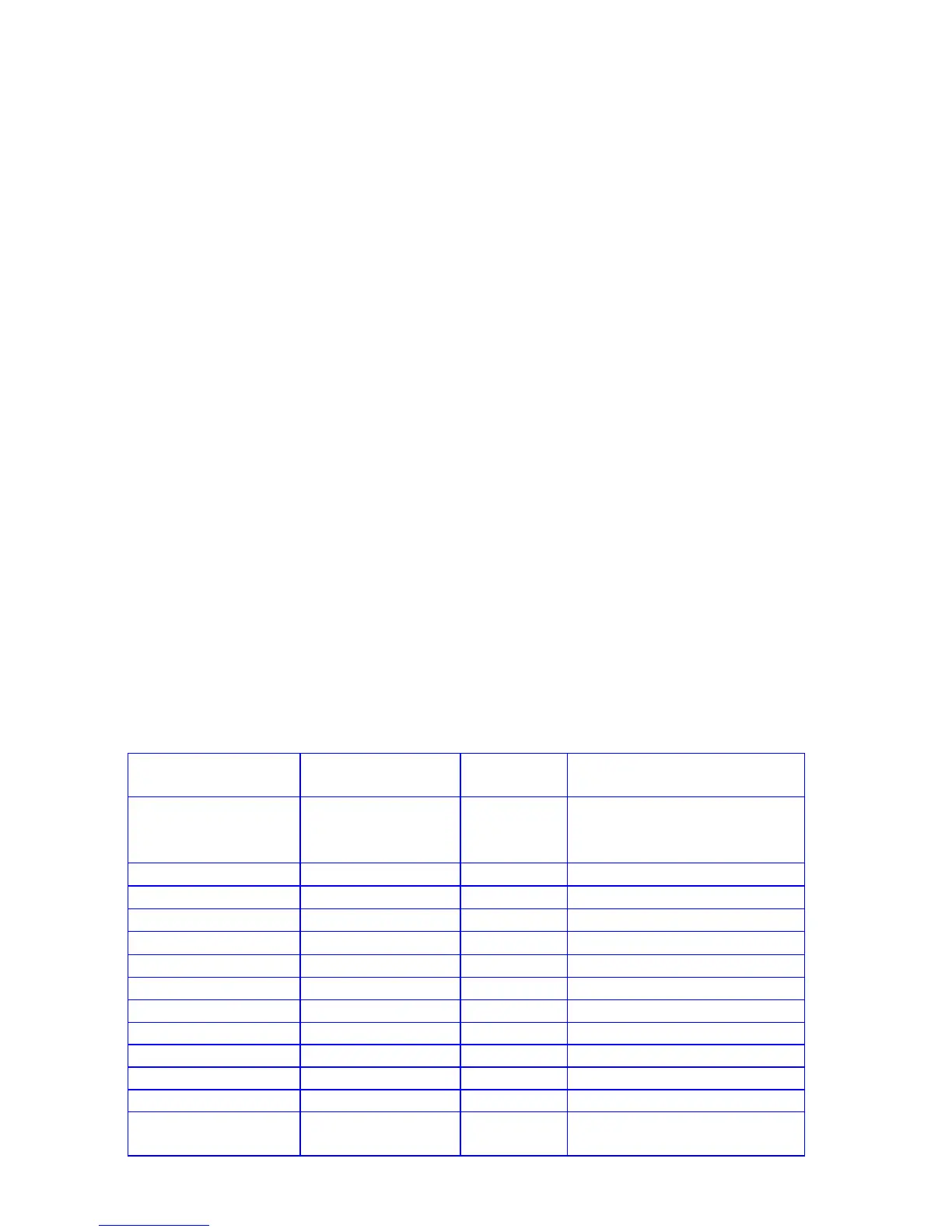

12c platinum / 12C

RPN Keystrokes

12c platinum

ALG Keystrokes

Display Comments

fCLEARH fCLEARH

g× g×

40?1 40?1

40.00

Dividend tax rate.

20?2 20?2

20.00

Withdrawal tax rate.

10?3 10?3

10.00

Inflation rate.

35n 35n

35.00

Years to retirement.

8.175¼ 8.175¼

8.18

Dividend rate.

1500ÞP 1500ÞP

-1,500.00

Annual payment.

M M

290,730.34

Future value at retirement.

t t

-52,500.00

Cash paid in.

t t

238,230.34

Earned dividends (untaxed).

t t

232,584.27

After-tax value.

t t

8,276.30

Diminished purchasing power.

t t

139,360.09

Tax-paid cash at retirement.

t t

4,959.00

Purchasing power of tax-paid

cash at retirement.

Loading...

Loading...