10

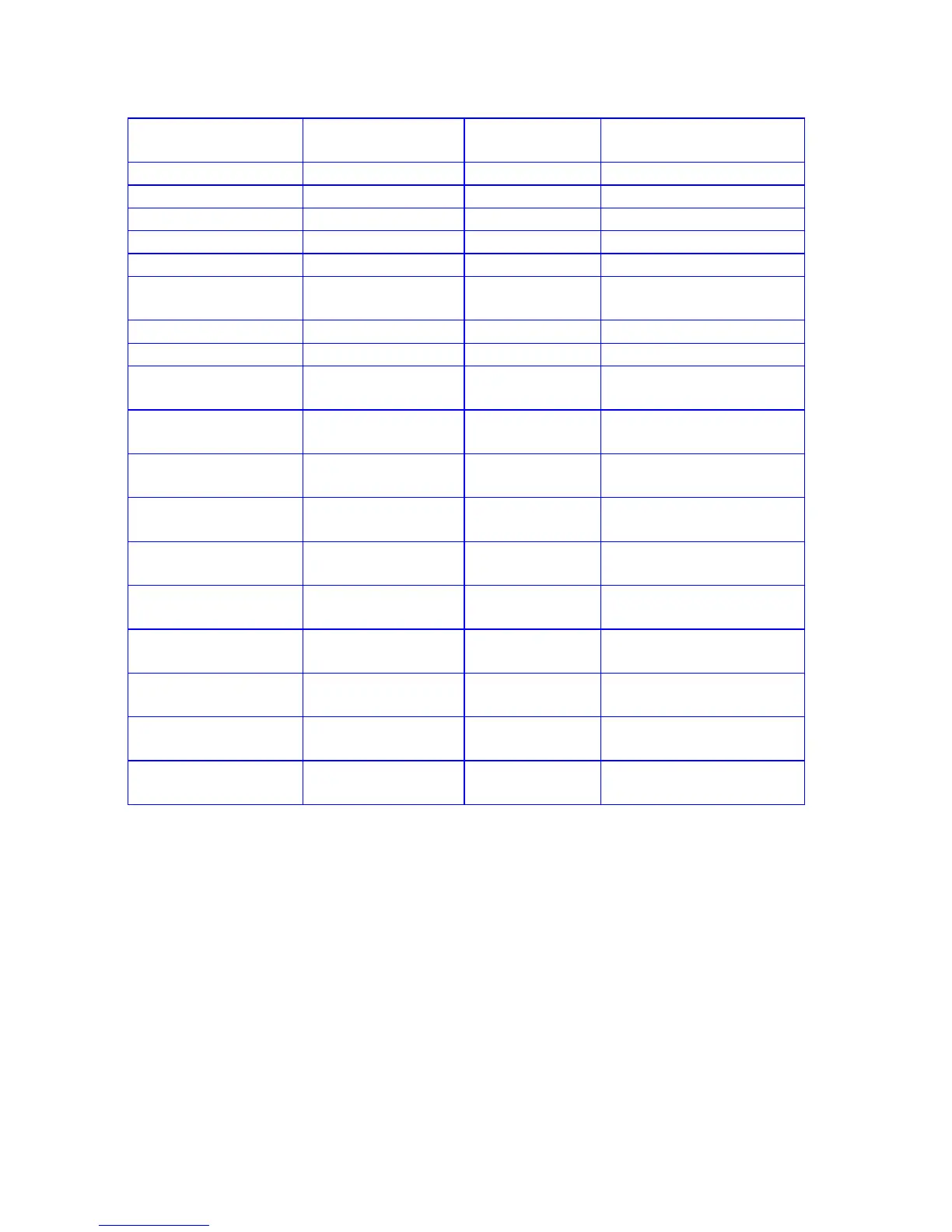

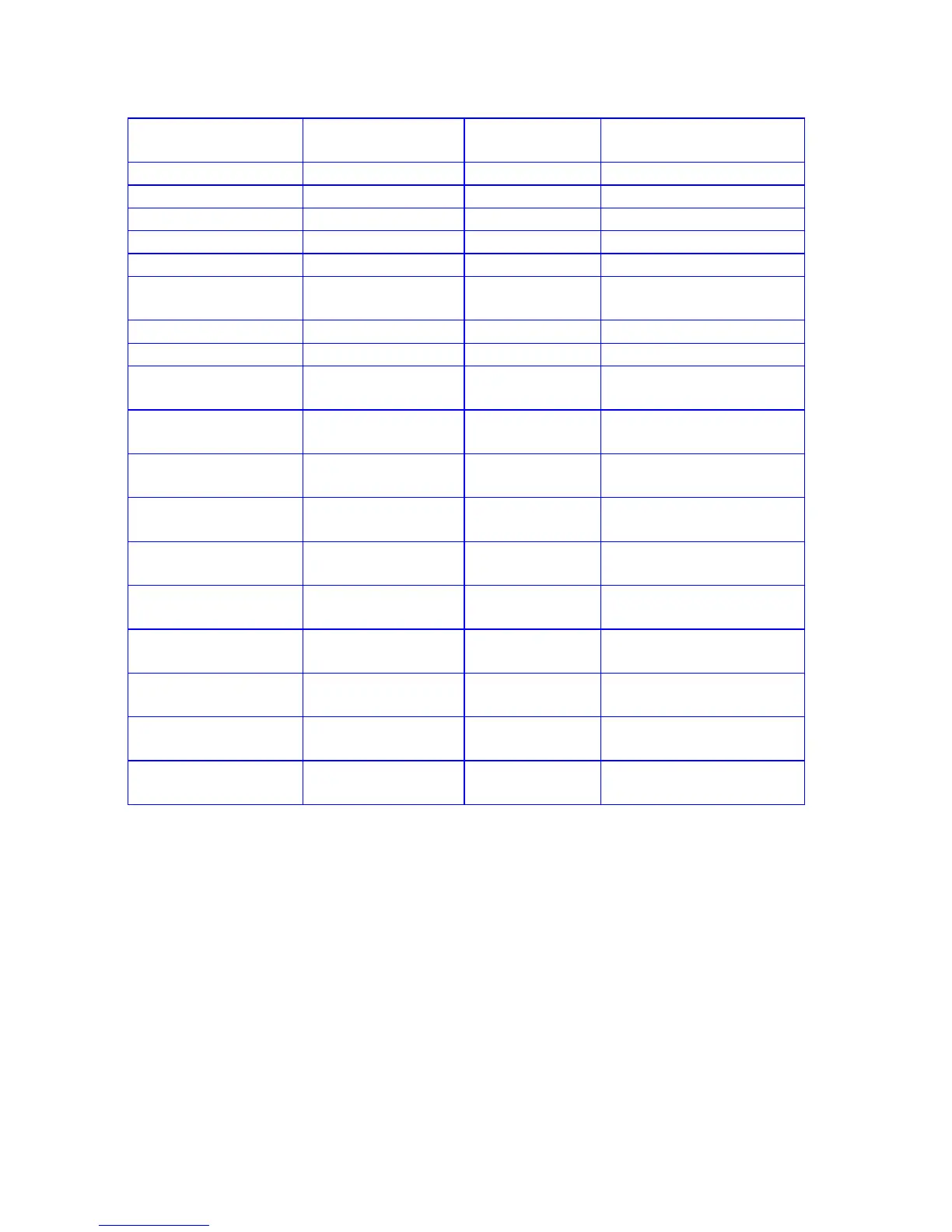

Example 2: An office building was purchased for $1,400,000. The value of depreciable

improvements is $1,200,000 with a 35 year economic life. Straight line depreciation will

be used. The property is financed with a $1,050,000 loan. The terms of the loan are 9.5%

interest and $9,173.81 monthly payments for 25 years. The office building generates a

Potential Gross Income of $175,200 which grows at a 3.5% annual rate. The operating

cost is $40,296.00 with a 1.6% annual growth rate. Assuming a Marginal Tax Rate of

50% and a vacancy rate of 7%, what are the After-Tax Cash Flows for the first 5 years?

Loading...

Loading...