60 Investment Analysis

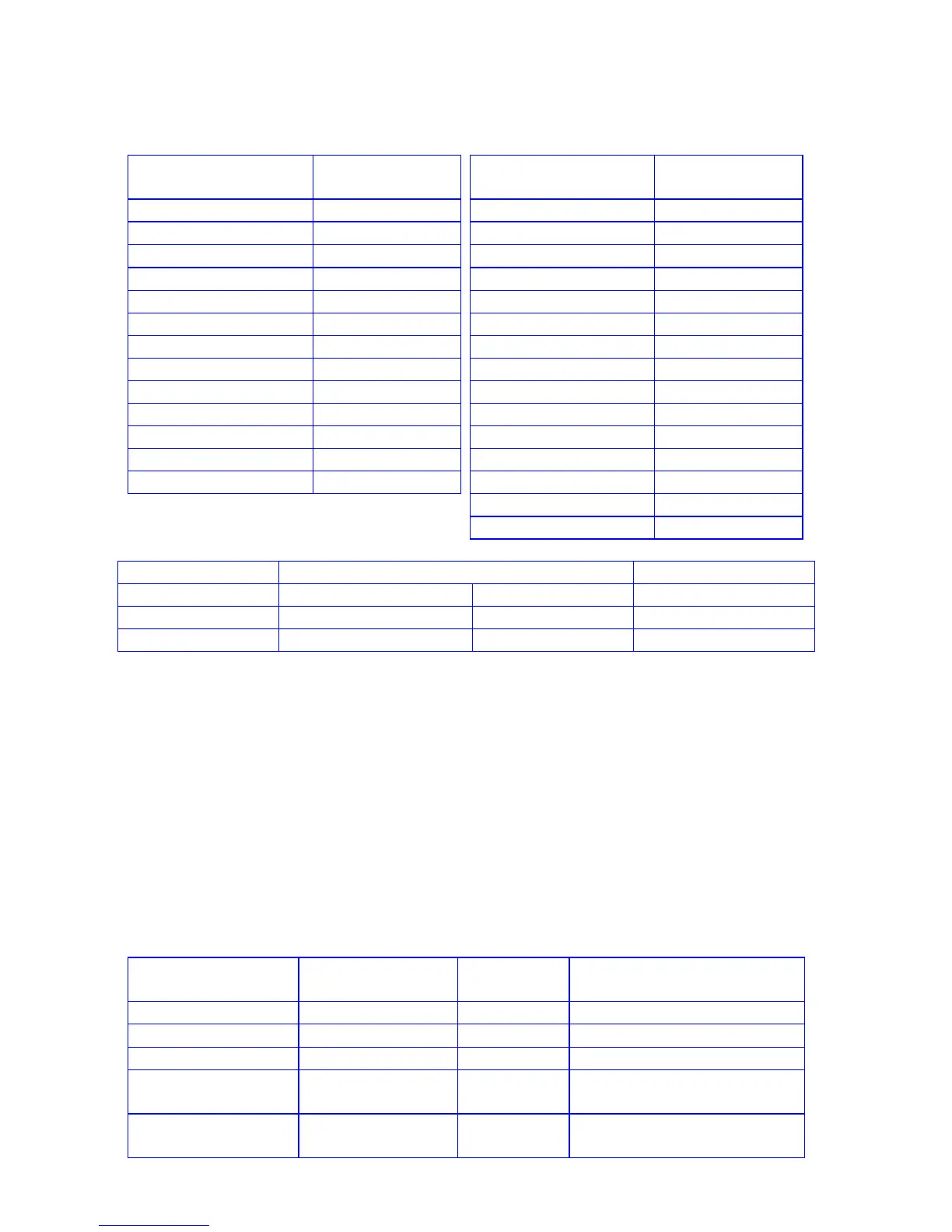

For repeated calculations the following HP 12C Platinum program can be used:

12c platinum / 12C

RPN KEYSTROKES

DISPLAY

12c platinum

ALG KEYSTROKES

DISPLAY

fs

fs

fCLEARÎ

000,

fCLEARÎ

000,

:3

001, 45 3

:3

001, 45 3

:2

002, 45 2

-

002, 30

-

003, 30

:2

003, 45 2

§

004, 20

§

004, 20

\

005, 36

~

005, 34

\

006, 36

³

006, 36

:1

007, 45 1

:1

007, 45 1

-

008, 30

à

008, 24

z

009, 10

b

009, 25

g(000

010,43,33,000

Þ

010, 16

fs

y

011, 22

g(000

012,43,33,000

fs

REGISTERS

n: Unused i: Unused PV: Unused PMT: Unused

FV: Unused R

0

: Unused R

1

: F R

2

: V

R

3

: P R

4

-R

.8

: Unused

Program Instructions:

1. Key in the program.

2. Key in and store input variables F, V and P as described in the Break-Even Analysis

program.

3.

Key in the sales volume and press t to calculate the operating leverage.

4. To calculate a new operating leverage at a different sales volume, key in the new sales

volume and press t.

Example 2: For the figures given in example 2 of the Break-Even Analysis section,

calculate the operating leverage at a sales volume of 9,000 and 20,000 units if the sales

price is $12.50 per unit.

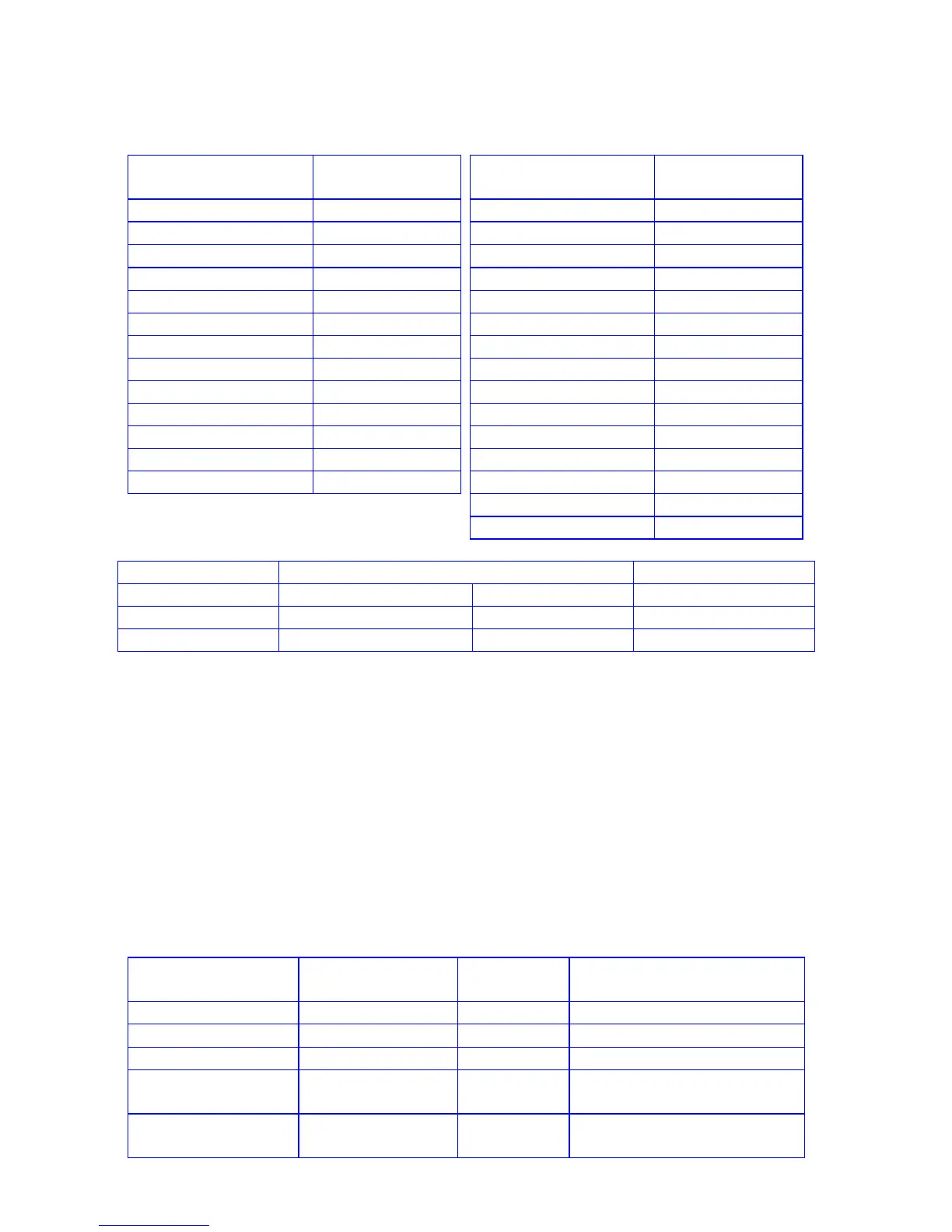

12c platinum / 12C

RPN Keystrokes

12c platinum

ALG Keystrokes

Display Comments

35000?1 35000?1

35,000.00

Fixed costs.

8.25?2 8.25?2

8.25

Variable cost.

12.5?3 12.5?3

12.50

Sales price.

9000t 9000t

11.77

Operating leverage near break-

even.

20000t 20000t

1.70

Operating leverage further

from break-even.

Loading...

Loading...