66 Securities and Options

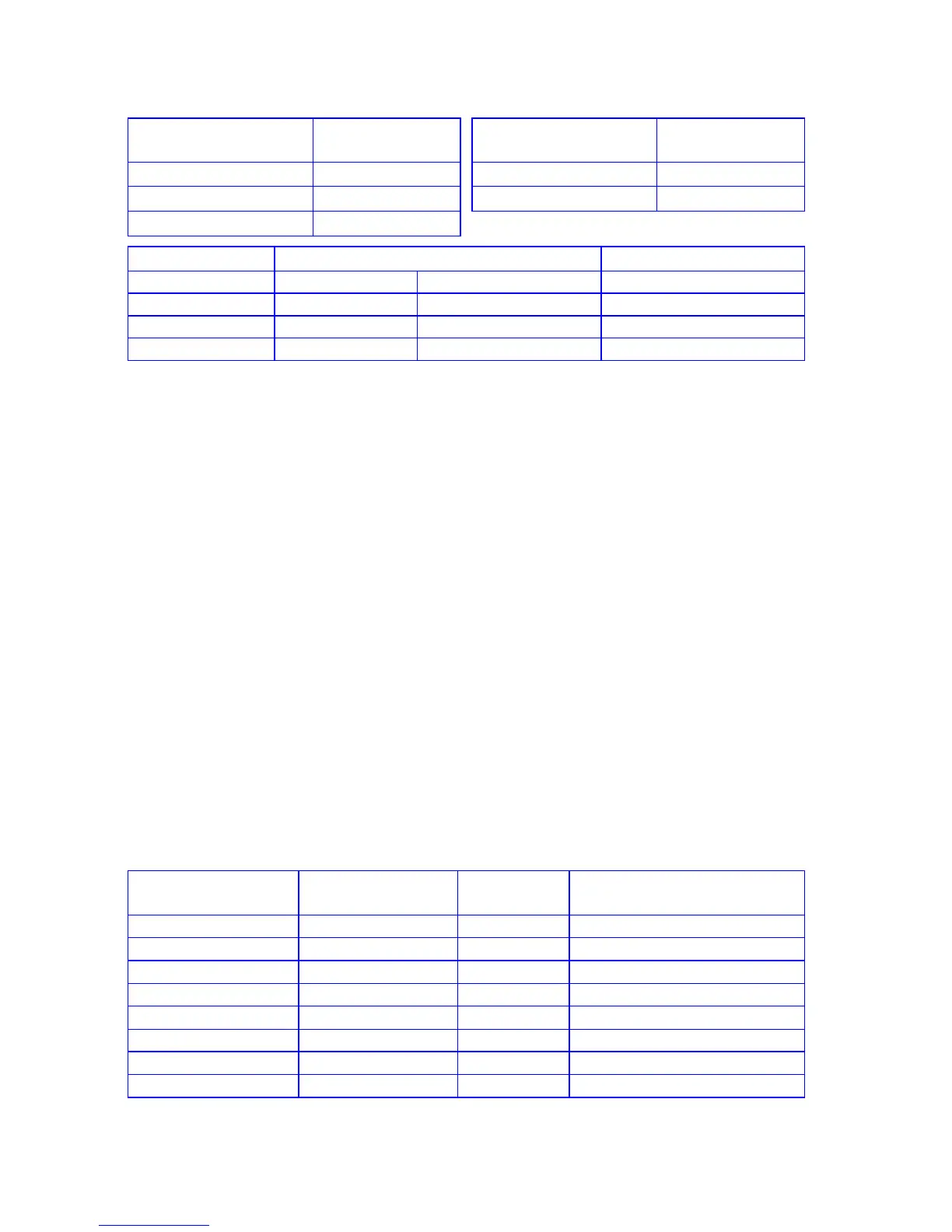

12c platinum / 12C

RPN KEYSTROKES

DISPLAY

12c platinum

ALG KEYSTROKES

DISPLAY

fS

030, 42 22

g(000

030,43,33,000

g(000

031,43,33,000

fs

fs

REGISTERS

n: Unused i: Yield PV: Used PMT: Used

FV: 0 R

0

: Used R

1

: Purchase price R

2

: Sales price

R

3

: Coupon rate R

4

: Capital rate R

5

: Income rate R

6

: Used

R

7

: Used R

8

-R

.5

: Unused

Program Instructions:

1. Key in the program.

2.

Key in the purchase price and press ?1.

3.

Key in the sales price and press ?2.

4.

Key in the annual coupon rate (as a percentage) and press ?3.

5.

Key in capital gains tax rate (as a percentage) and press ?4.

6.

Key in the income tax rate (as a percentage) and press ?5.

7.

Press gÕ.

8.

Key in the purchase date (MM.DDYYYY) and press \(³).

9.

Key in the assumed sell date (MM.DDYYYY) and press t to find the after-tax

yield (as a percentage).

10. For the same bond but different date return to step 8.

11. For a new case return to step 2.

Example: You can buy a 7% bond on October 1, 2003 for $70 and expect to sell it in 5

years for $90. What is your net (after-tax) yield over the 5-year period if interim coupon

payments are considered as income, and your tax bracket is 50%?

(One-half of the long term capital gain is taxable at 50%, so the tax on capital gains alone

is 25%)

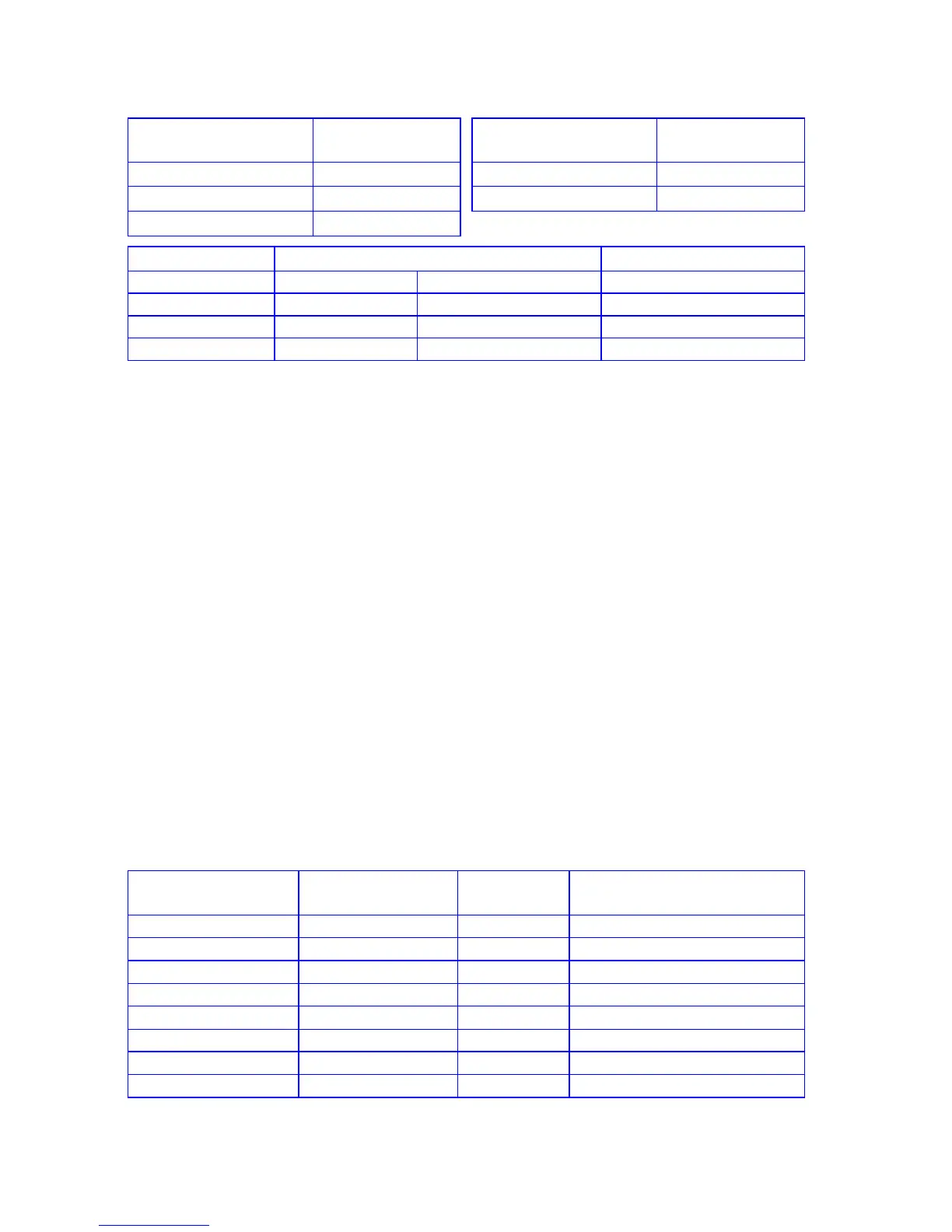

12c platinum / 12C

RPN Keystrokes

12c platinum

ALG Keystrokes

Display Comments

70?1 70?1

70.00

Purchase price.

90?2 90?2

90.00

Selling price.

7?3 7?3

7.00

Annual coupon rate.

25?4 25?4

25.00

Capital gains tax rate.

50?5 50?5

50.00

Income tax rate.

gÕ gÕ

10.012003\ 10.012003³

10.01

Purchase Date.

10.012008t 10.012008t

8.53

% after tax yield.

Loading...

Loading...