72 Securities and Options

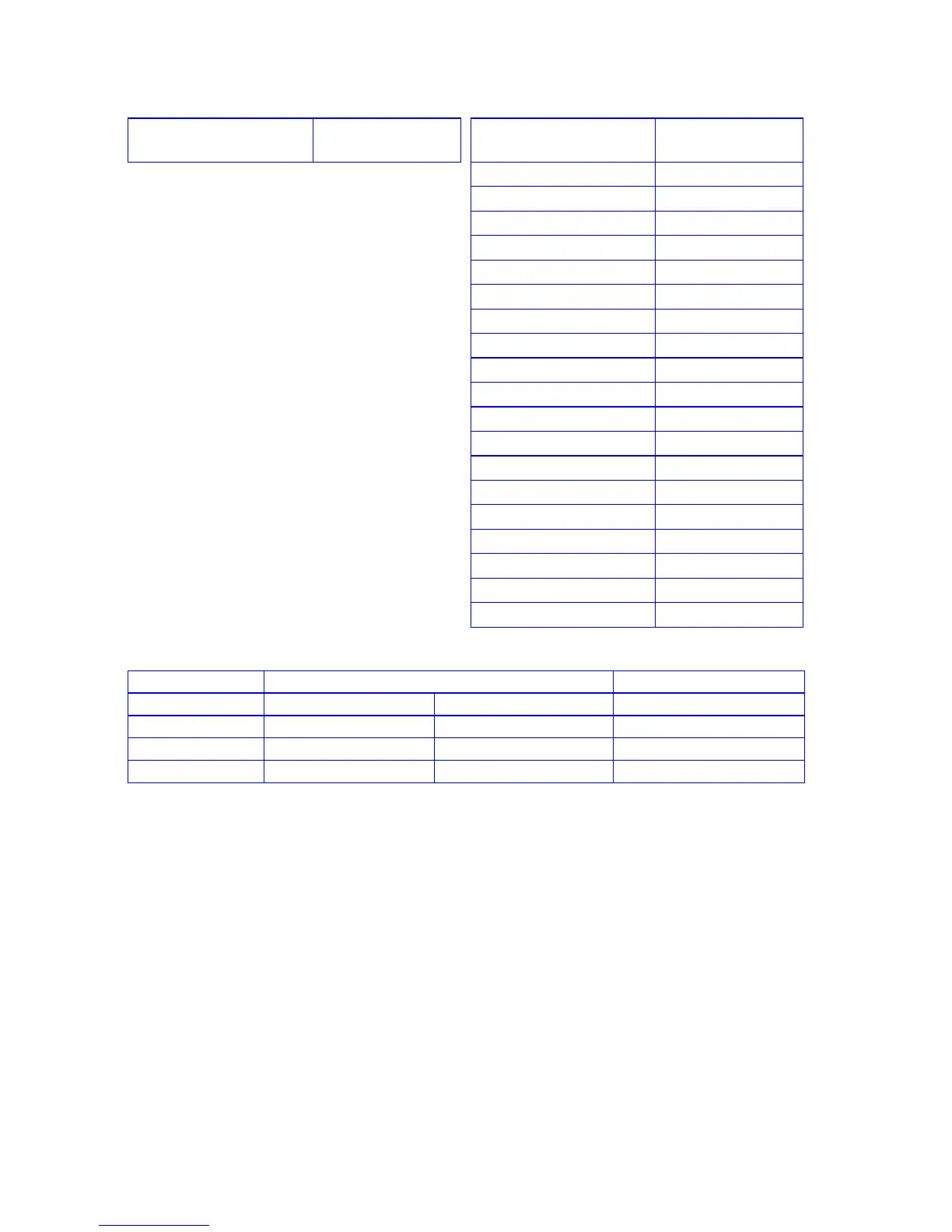

12c platinum / 12C

RPN KEYSTROKES

DISPLAY

12c platinum

ALG KEYSTROKES

DISPLAY

?6

101, 44 6

O

102, 35

?5

103, 44 5

~

104, 34

g(037

105,43,33,037

~

106, 34

:$

107, 45 13

?-4

108,44 30 4

§

109, 20

:3

110, 45 3

-

111, 30

:6

112, 45 6

³

113, 36

?+4

114,44 40 4

:4

115, 45 4

~

116, 34

?5

117, 44 5

g(000

118,43,33,000

fs

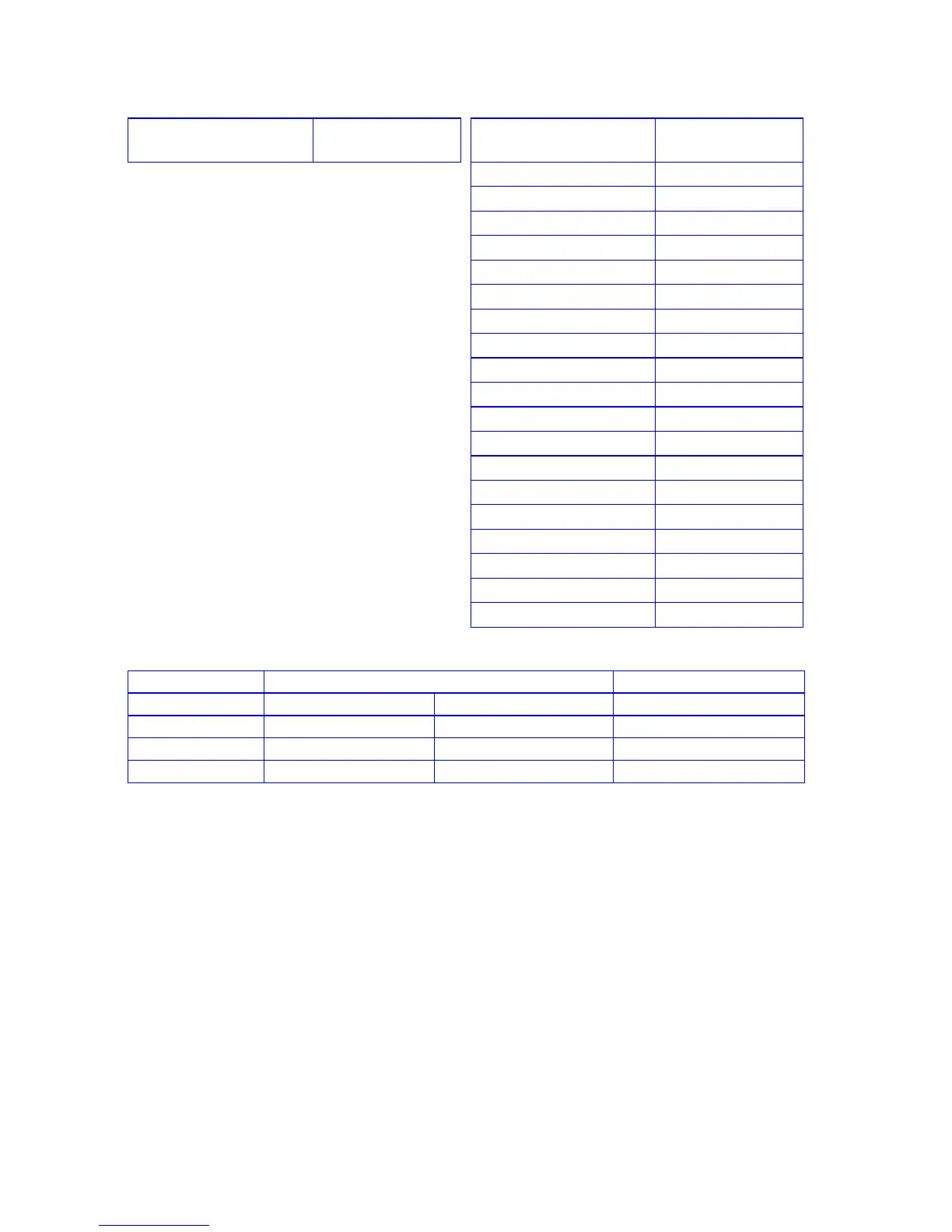

REGISTERS

n: Term to expiry i: Interest rate (%) PV: Stock price PMT: Volatility (%)

FV: Strike price R

0:

Unused R

1

: Unused R

2

: Unused

R

3

: N(d

1

) R

4

: Put value R

5

: Call value R

6

: Q·N(d

2

)

R

7

-R

.9

: Unused

Note: The n, i and PMT values must all be based on the same time unit (for example: n is

measured in years or months and i and PMT are rates per year or per month). i is a

continuous percentage rate. PMT is the standard deviation of the continuous percentage

stock return (as observed over the time unit). For sensible output, all inputs should be

positive. The PMT=0 case can be simulated by using a PMT arbitrarily close to 0.

Program Instructions

1. Key in the program.

2. Enter the five inputs into the five financial registers. These values are preserved by the

program.

a. Key in the unexpired term of the option and press n.

b. Key in the risk-free interest rate as a percentage and press ¼.

c. Key in the current (or spot) stock price and press $.

d. Key in the volatility assumption as a percentage and press P.

e. Key in the strike price and press M.

3.

Press R/S. The Call value is displayed. Press ~ to see the Put value.

Loading...

Loading...