Statistics 99

4.

Press 1

gRg>0gRg> to obtain A in the equation above.

RPN Mode:

5.

Press

~dzg° to obtain B.

6.

Press

g>1- to obtain the effective growth rate (as a decimal).

ALG Mode:

5.

Press

z~d³g° to obtain B.

6.

Press

g>-1³ to obtain the effective growth rate (as a decimal).

7.

To make a y-estimate, key in the x-value and press

gRg>.

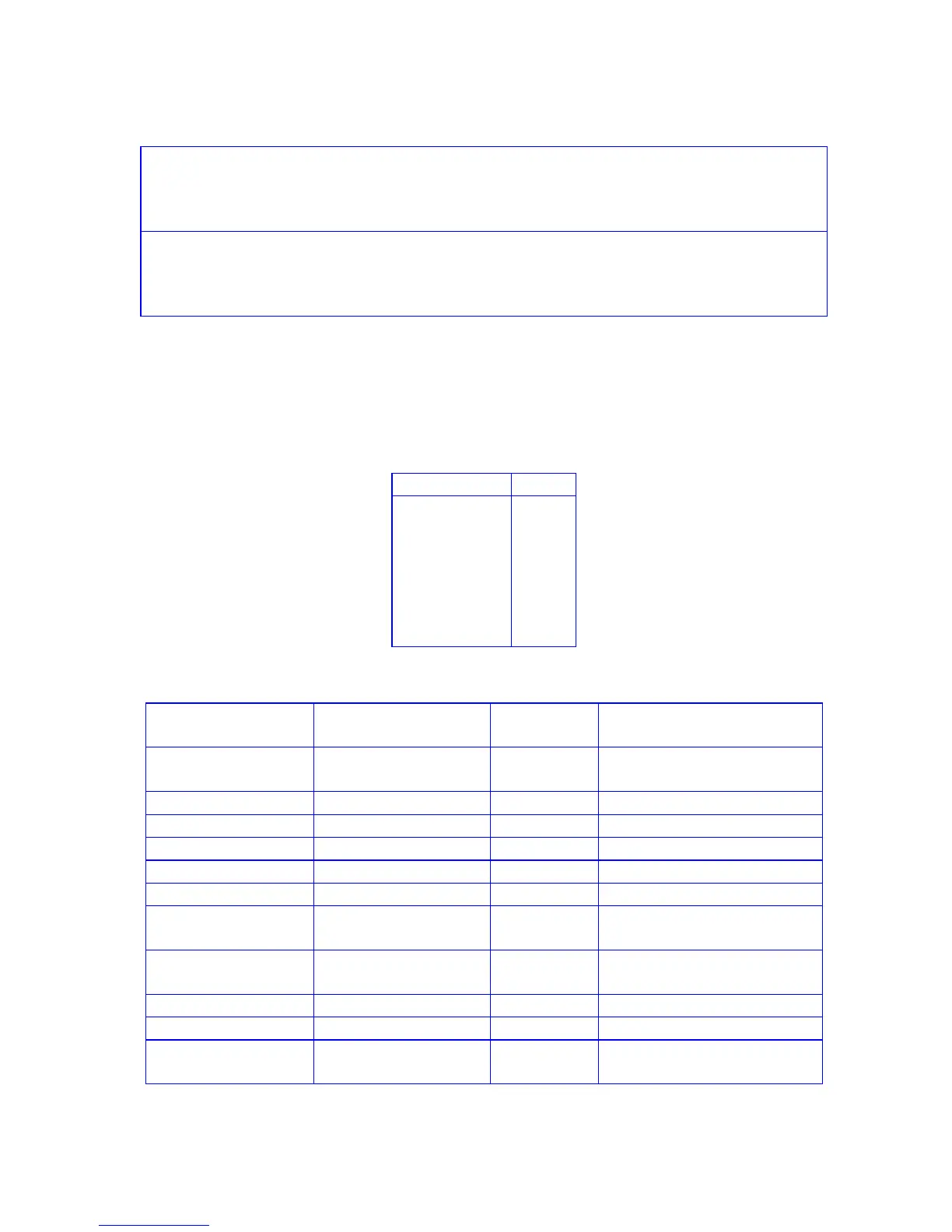

Example 1: A stock's price in history is listed below. What effective growth rate does this

represent? If the stock continues this growth rate, what is the price projected to be at the

end of 2004 (year 7)?

End of Year Price

1998(1) 45

1999(2) 51.5

2000(3) 53.75

2001(4) 80

2002(5) 122.5

2003(6) 210

2004(7) ?

12c platinum / 12C

RPN Keystrokes

12c platinum

ALG Keystrokes

Display Comments

fCLEARH fCLEARH

45g°1_ 45g°1_

1.00

First data pair input.

51.5g°2_ 51.5g°2_

2.00

Second data pair input.

53.75g°3_ 53.75g°3_

3.00

Third data pair input.

80g°4_ 80g°4_

4.00

Fourth data pair input.

122.5g°5_ 122.5g°5_

5.00

Fifth data pair input.

210g°6_ 210g°6_

6.00

Sixth data pair input.

gR~ gR~

0.95

Correlation coefficient

(between ln y and x).

1gRg> 1gRg>

0gRg> 0gRg>

27.34

A

~dzg° z~d³g°

0.31

B

g>1- g>-1³

0.36

Effective growth rate.

7gRg> 7gRg>

232.35

Projected price at end of year

7 (2004).

Loading...

Loading...