102

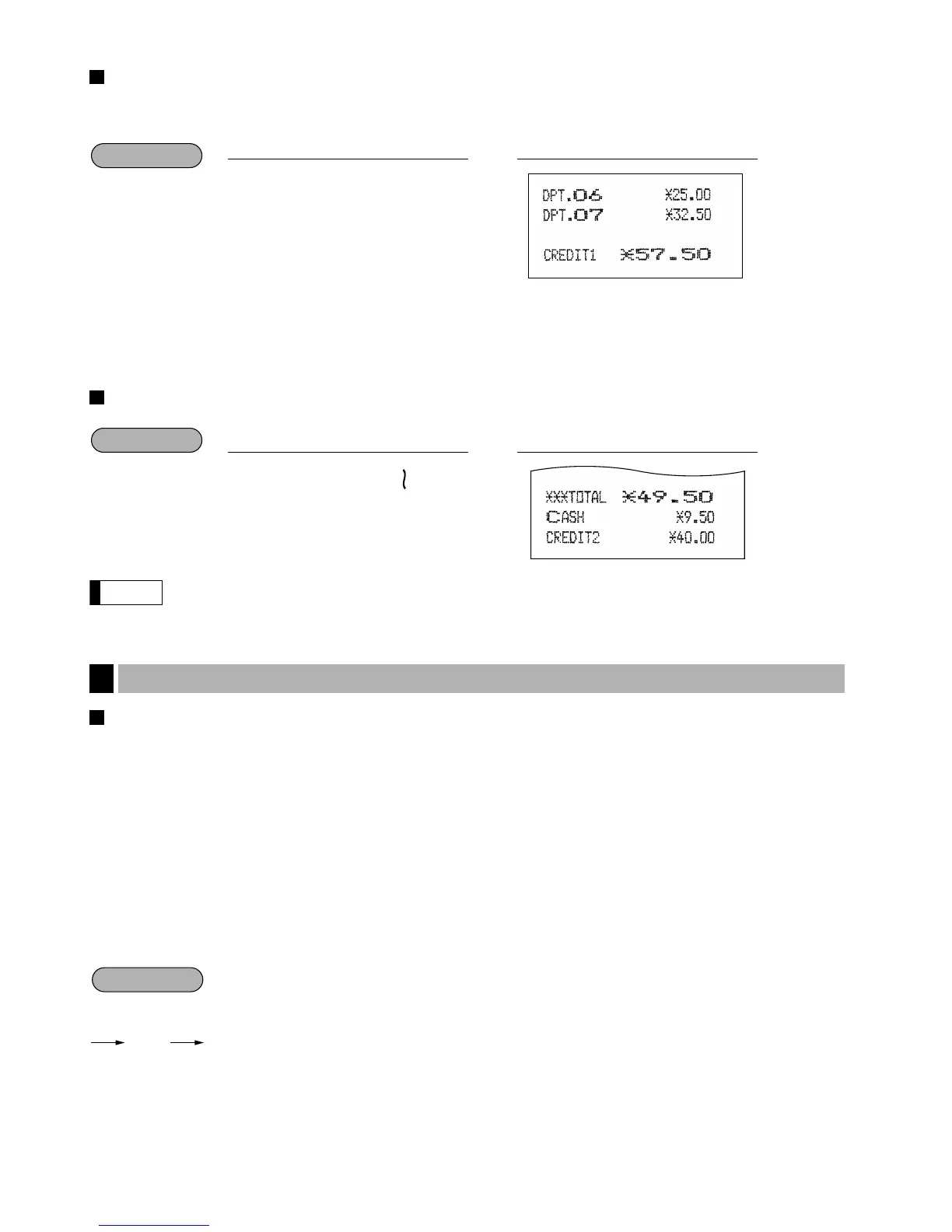

Credit sale

Enter items and press the corresponding credit keys (

]

through

’

).

Amount tendering operations (i.e., change calculations) can be achieved by the

]

through

’

key when a

PGM2 programming allows them.

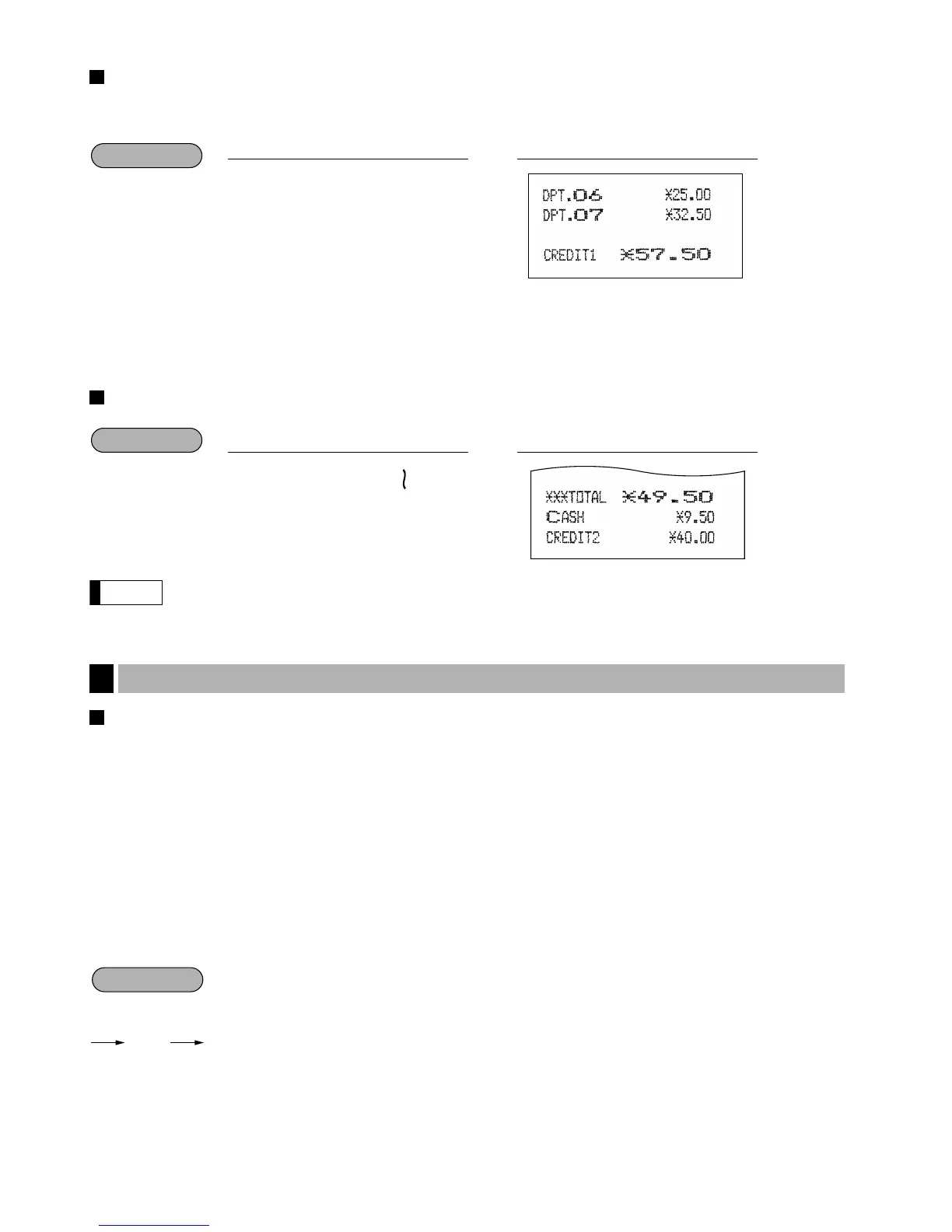

Mixed-tender sale (cash or cheque tendering + credit tendering)

Press one of the

(

through

+

keys or the

]

through

’

keys in place of the

;

key when

your customer makes payment in cheques or by credit account.

VAT/ tax system

The machine may be programmed for the following six tax systems by your dealer.

Automatic VAT 1-6 system (Automatic operation method using programmed percentages)

This system, at settlement, calculates VAT for taxable 1 through 6 subtotals by using the corresponding

programmed percentages.

Automatic tax 1-6 system (Automatic operation method using programmed percentages)

This system, at settlement, calculates taxes for taxable 1 through 6 subtotals by using the corresponding

programmed percentages, and also adds the the calculated taxes to those subtotals, respectively.

Manual VAT 1-6 system (Manual entry method using programmed percentages)

This system provides the VAT calculation for taxable 1 through 6 subtotals. This calculation is performed using

the corresponding programmed percentages when the

◊

key is pressed just after the

:

key.

Loading...

Loading...