XE-A21S PROGRAM MODE

2 – 11

[JOB#66] OTHERS6 PROGRAMMING -- ABCDEFGH --

MRS = 10001100

[JOB#67] OTHERS7 PROGRAMMING

-- ABCDEFGH --

MRS = 00000000

[JOB#68] OTHERS8 PROGRAMMING -- ABCDEFGH --

MRS = 00100011

[JOB#69] OTHERS9 PROGRAMMING -- ABCDEFGH --

MRS = 00000000

[JOB#70] OTHERS10 PROGRAMMING -- ABCDEFGH --

MRS = 00000000

A: AFTER-TRANSACTION RECEIPT A

TOTAL ONLY 0

DETAILS 1 ★

B:

AMOUNT PRINTING WHEN PLU UNIT PRICE IS 0

B

No 0 ★

Ye s 1

C:

CONVERSION SBTL PRINTING OF NATIVE SBTL

C

Yes 0 ★

No 1

D: Not used (Fixed at “0”)

E: Compression print on journal at PGM/XZ mode E

No (Normal size) 0

Yes (Small size) 1 ★

F: Compression print on journal at REG/MGR/

VOID mode

F

No (Normal size) 0

Yes (Small size) 1 ★

Note: This selection is valid only when “PRINTING FORMAT” is

set as “JOURNAL”.

This selection is not valid for the printing data of EJ report.

It is provided another selection job for EJ.

G: Logo Text Print on Journal G

No 0 ★

Ye s 1

H: FOOTER PRINT CONTROL H

ALL RECEIPTS 0 ★

ON SELECTED FUNCTION KEY AT THE TIME

OF FINALIZATION

1

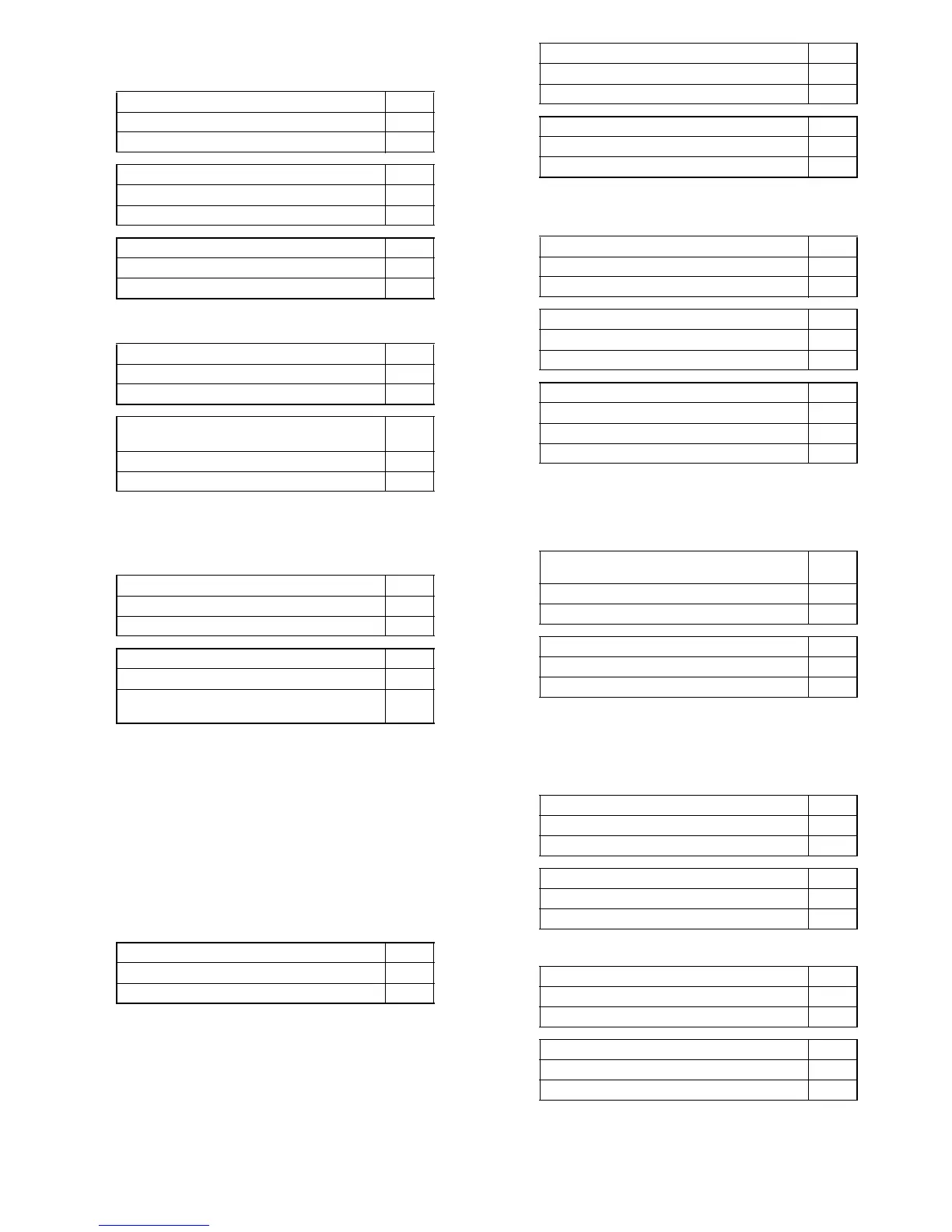

A, B, C, D, E, F, G, H:

Not used (Fixed at “00000000”)

A, B: Not used (Fixed at “00”)

C: Temporary journal printing function of transaction C

Disable 0

Enable 1 ★

Note: It is a function to print one transaction data which is not

finalized (during a transaction) when a transaction is oper-

ated at “RECEIPT OFF”.

It is available only at “RECEIPT PRINTER TYPE”.

D: EJ print and clear at general Z1 report D

No 0 ★

Ye s 1

E: PGM mode programming operation records in EJ E

DETAIL 0 ★

Header information only 1

Note: It is not effected for PGM reading and XZ reports.

PGM reading and XZ reports are always treatment as

“HEADRER ONLY”.

F: REG/MRG/VOID operation records in EJ F

DETAIL 0 ★

TOTAL 1

G: Compression print for EJ report G

No (Normal size) 0

Yes (Small size) 1 ★

H: Action when EJ file is full H

Continue (No warning) 0

Warning (near full warning) 1 ★

Lock (with near full warning) 2

A, B, C, D, E: Not used (Fixed at “00000”)

F: TAX PRINTING WHEN TAXABLE SUBTOTAL

IS ZERO

F

No 0

★

Ye s 1

G: TAX PRINTING WHEN TAX IS ZERO G

Ye s 0

★

No 1

H:

Not used (Fixed at “0”)

A:

SPLIT PRICING COUNTING

A

QUANTITY 0

★

PAC KA GE 1

B:

MULTIPLICATION ENTRY SYSTEM

B

MULTIPLICATION ONLY 0

★

SPLIT PRICING & MULTIPLICATION 1

C, D: Not used (Fixed at “00”)

E:

TAX PRINTING WHEN GST is VAT

E

Ye s 0

★

No 1

F:

GST EXEMPT on X/Z

F

PRINTED 0

★

NOT PRINTED 1

GH:

TAX SYSTEM = 00 to 11

AUTO TAX = 00

CANADA TAX (GST TYPE nn) = 01 to 11

Loading...

Loading...