Depreciation Worksheet 61

Example: Computing Straight-Line Depreciation

In mid-March, a company begins depreciation of a commercial building

with a 31½ year life and no salvage value. The building cost $1,000,000.

Use the straight-line depreciation method to compute the depreciation

expense, remaining book value, and remaining depreciable value for the

first two years.

Answer: For the first year, the depreciation amount is $25,132.28, the

remaining book value is $974,867.72, and the remaining depreciable

value is $974,867.72.

For the second year, the depreciation amount is $31,746.03, the

remaining book value is $943,121.69, and the remaining depreciable

value is $943,121.69.

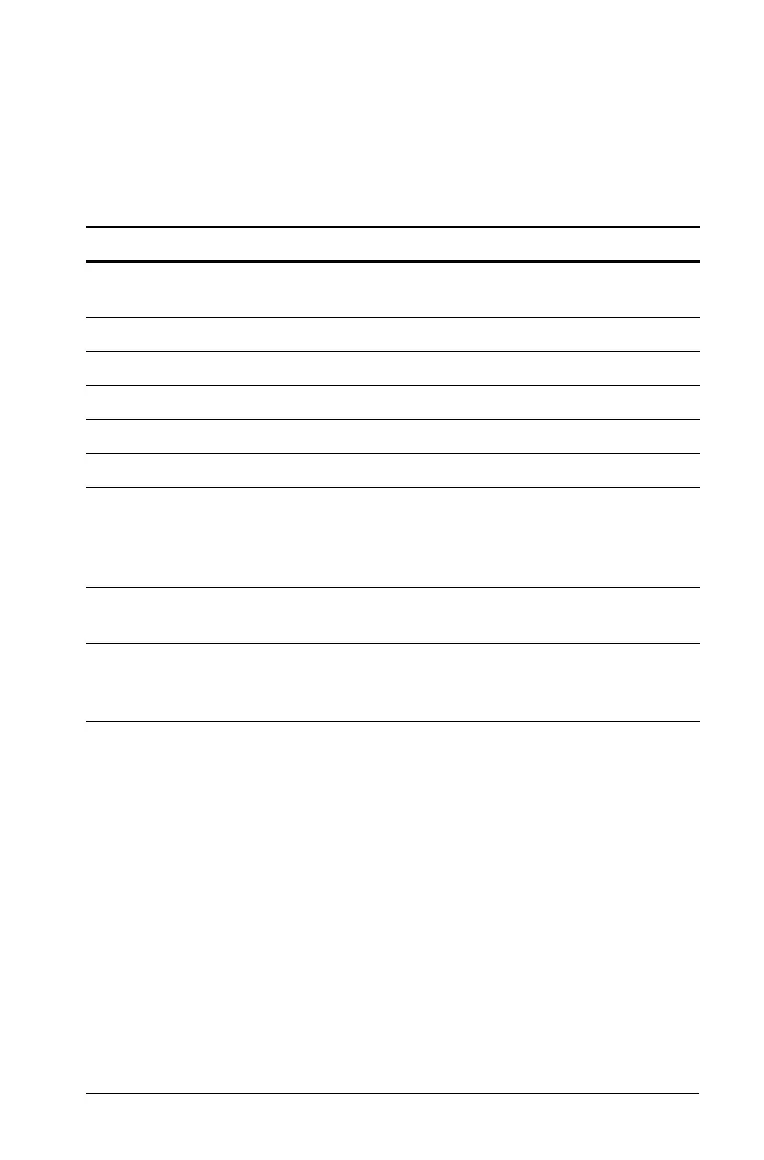

To Press Display

Access Depreciation

worksheet.

& p

SL

Enter life in years. # 31.5 !

LIF =

31.50

Enter starting month. #

3.5 !

M01 =

3.50

Enter cost. #

1000000 !

CST =

1,000,000.00

Leave salvage value as is. #

SAL = 0.00

Leave year as is. #

YR = 1.00

Display depreciation

amount, remaining book

value, and remaining

depreciable value.

#

#

#

DEP =

RBV =

RDV =

25,132.28*

974,867.72*

974,867.72*

View second year. #

%

YR =

YR =

1.00

2.00

Display second year

depreciation data.

#

#

#

DEP =

RBV =

RDV =

31,746.03

*

943,121.69*

943,121.69*

Loading...

Loading...