56

E

Advanced Operations

Reductions

This section describes how to register reductions.

Registering reductions

The following examples show how you can use the m key in various types of registration.

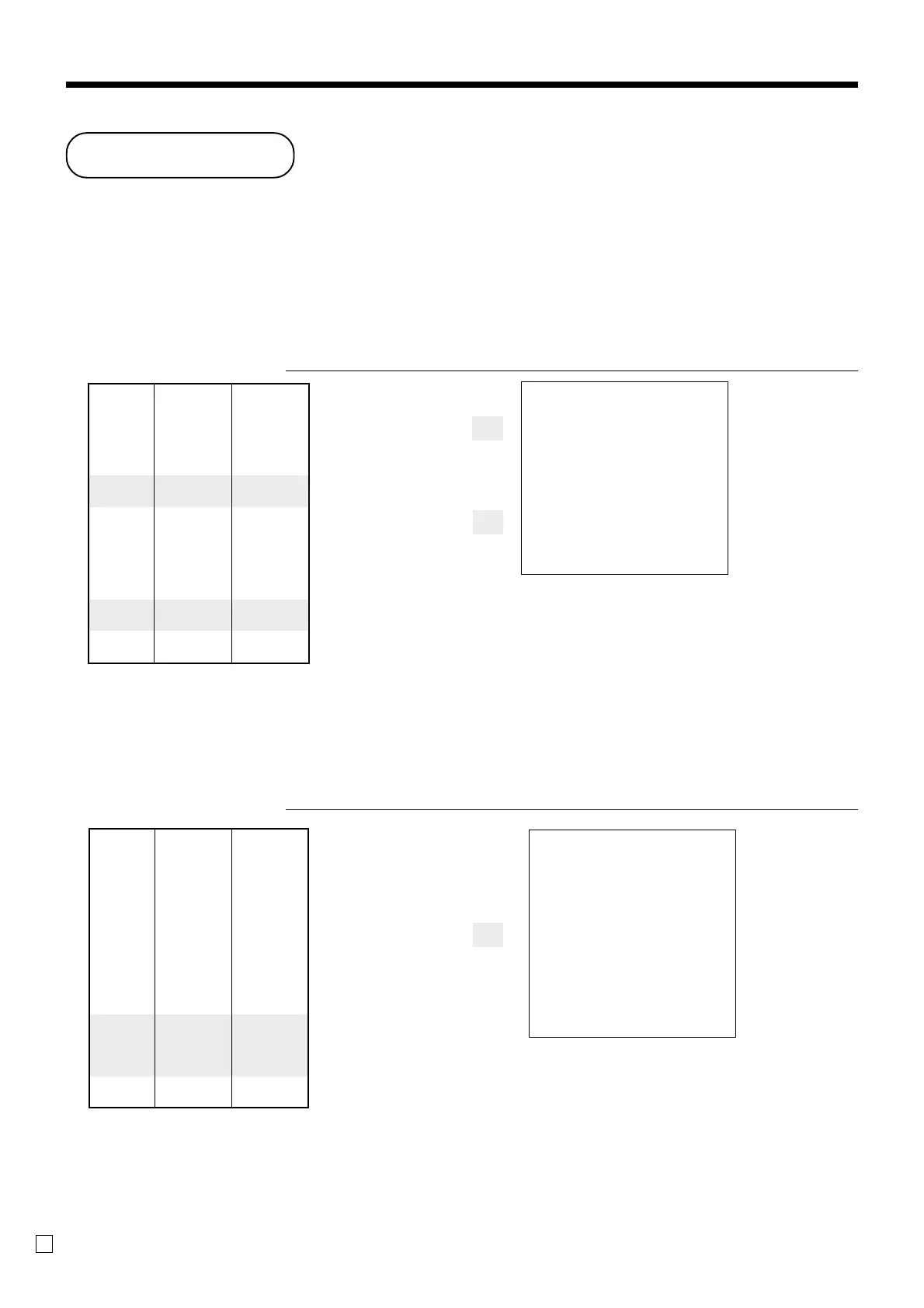

Reduction for items

OPERATION RECEIPT

5-!

25m

45+

m

s

11-F

• You can manually input reduction values up to 7 digits long.

• If you want to subtract the reduction amount from the department or PLU totalizer, program “Net totaling.”

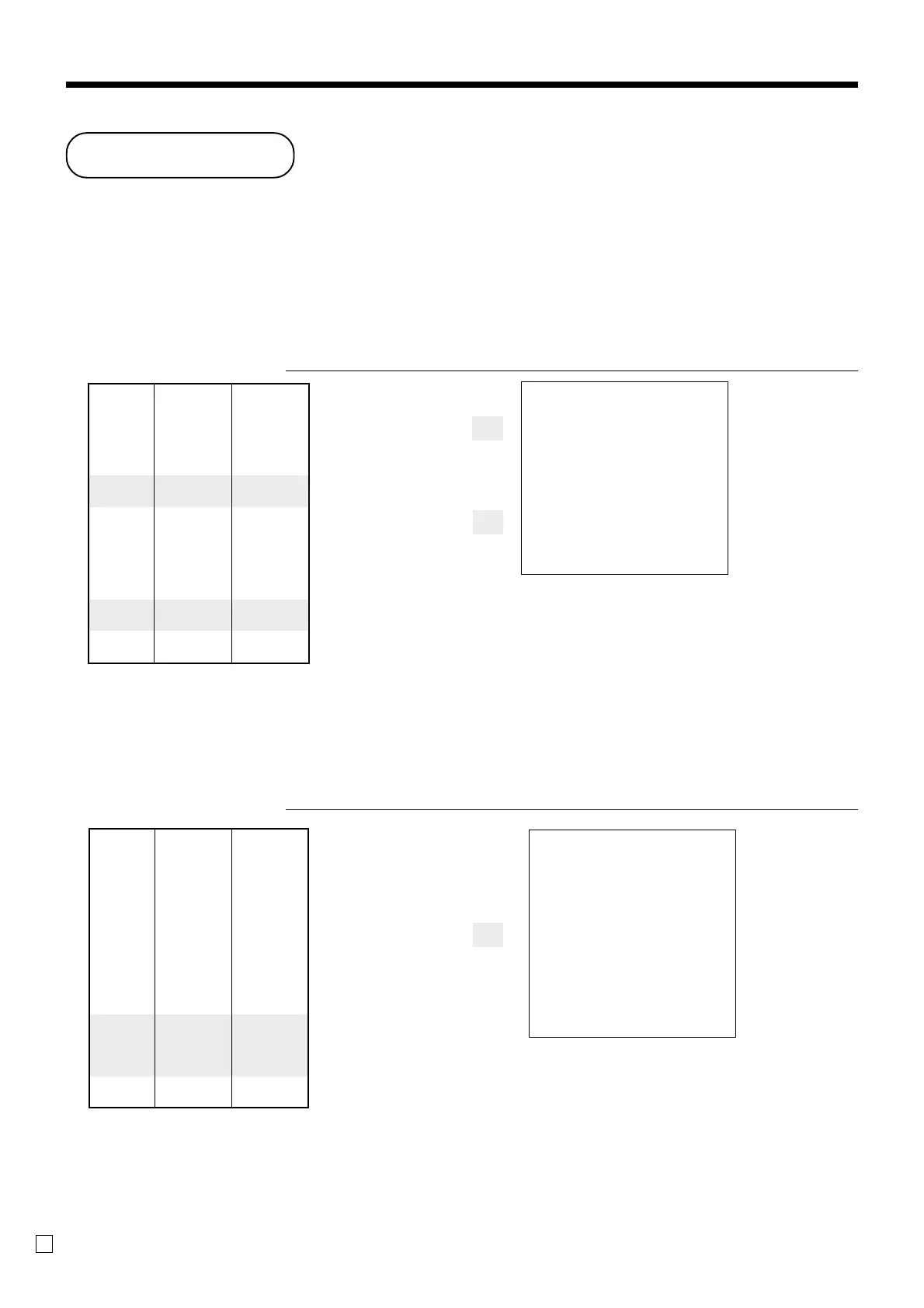

Reduction for subtotal

OPERATION RECEIPT

3-!

4-"

s

75m

s

7-F

Reduces the last amount

registered by the value input.

Dept. 1 $5.00

—————————

Item 1 Quantity 1

—————————

Taxable (1)

preset

—————————————

Reduction

Amount $0.25

—————————————

PLU 45 ($6.00)

preset

—————————

Item 2 Quantity 1

—————————

Taxable (1)

preset

—————————————

Reduction

Amount ($0.50)

preset

—————————————

Payment Cash $11.00

1 DEPT01 T1 $5.00

- T1 -0.25

1 PLU0045 T1 $6.00

- T1 -0.50

TA1 $10.25

TX1 $0.41

TL

$10.66

CASH $11.00

CG $0.34

Reduces the subtotal by the

value input here.

Dept. 1 $3.00

—————————

Item 1 Quantity 1

———————––––

Taxable (1)

preset

—————————————

Dept. 2 $4.00

—————————

Item 2 Quantity 1

———————––––

Taxable (2)

preset

—————————————

Subtotal

Amount $0.75

———————––––

Reduction

Taxable (No)

preset

—————————————

Payment Cash $7.00

1 DEPT01 T1 $3.00

1 DEPT02 T2 $4.00

- -0.75

TA1 $3.00

TX1 $0.12

TA2 $4.00

TX2 $0.20

TL

$6.57

CASH $7.00

CG $0.43

Loading...

Loading...