62 Investment Analysis

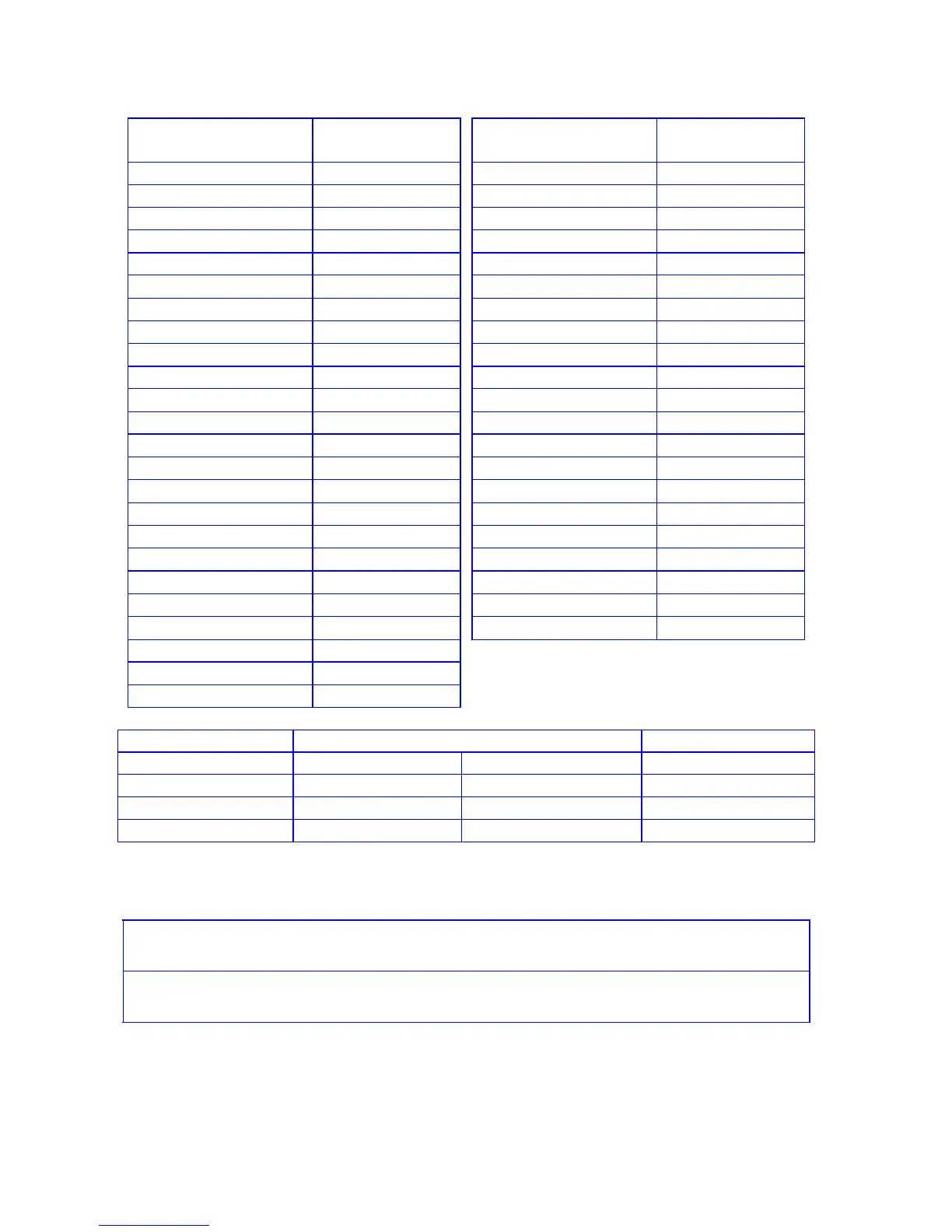

12c platinum / 12C

RPN KEYSTROKES

DISPLAY

12c platinum

ALG KEYSTROKES

DISPLAY

+

025, 40

³

025, 36

:0

026, 45 0

:1

026, 45 1

§

027, 20

~

027, 34

g(000

028,43,33,000

à

028, 24

z

029, 10

Þ

029, 16

Þ

030, 16

g(000

030,43,33,000

:1

031, 45 1

:5

031, 45 5

+

032, 40

z

032, 10

:1

033, 45 1

:6

033, 45 6

z

034, 10

-

034, 30

:0

035, 45 0

~

035, 34

§

036, 20

~

036, 34

g(000

037,43,33,000

³

037, 36

:5

038, 45 5

g(000

038,43,33,000

:6

039, 45 6

-

039, 30

z

040, 10

:4

040, 45 4

-

041, 30

§

041, 20

g(000

042,43,33,000

:6

042, 45 6

:4

043, 45 5

³

043, 36

-

044, 30

g(000

044,43,33,000

:6

045, 45 6

fs

§

046, 20

g(000

047,43,33,000

fs

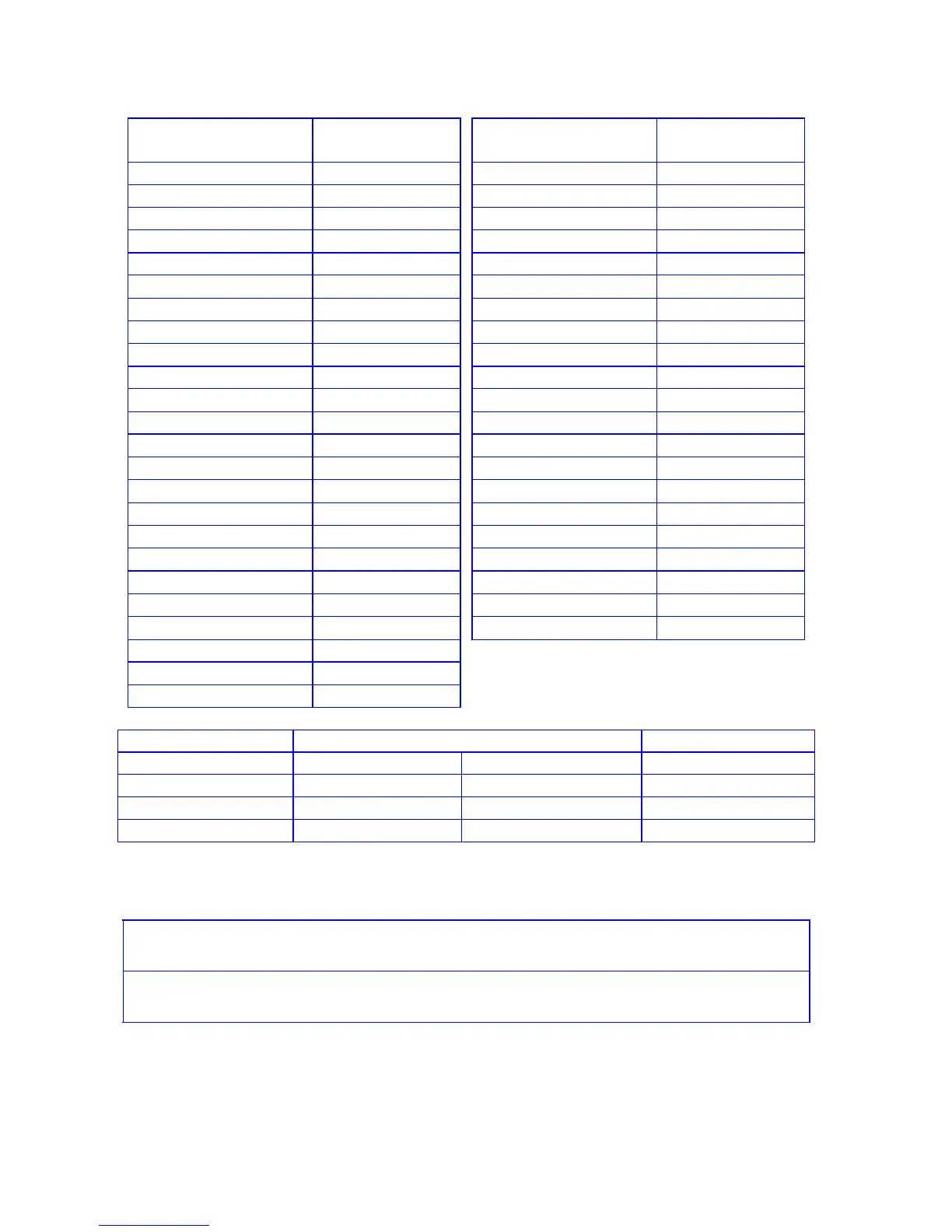

REGISTERS

n: Unused i: Unused PV: Unused PMT: Unused

FV: Unused R

0

: 100 R

1

: list price R

2

: % discount

R

3

: mfg. cost R

4

: % op. exp. R

5

: % net profit R

6

: 1-% tax

R

7

-R

.3

: Unused

Program Instructions:

1.

Key in the program and press fCLEARH, then key in 100 and press ?0.

2.

RPN: Key in 1 and press \, then key in your appropriate tax rate as a decimal and

press -?6.

2.

ALG: Key in 1 and press -, then key in your appropriate tax rate as a decimal and

press ³?6.

3. a.

Key in the list price in dollars (if known) and press ?1.

b.

Key in the discount in percent (if known) and press ?2.

c.

Key in the manufacturing cost in dollars (if known) and press ?3.

d.

Key in the operating expense in percent (if known) and press ?4.

e.

Key in the net profit after tax in percent (if known) and press ?5.

Loading...

Loading...