Investment Analysis 63

4. To calculate list price:

a. Do steps 2 and 3b, c, d, e above.

b.

RPN: Press :3tz1g(014tzg(000.

b.

ALG: Press :3t~z~³1g(014t

~z~ ³g(000.

5. To calculate discount:

a. Do steps 2 and 3a, c, d, e above.

b.

RPN: Press :3tg(029t.

b.

ALG: Press :3tg(022t.

6. To calculate manufacturing cost:

a. Do steps 2 and 3a, b, d, e, above.

b.

RPN: Press g(013tg(001t§.

b.

ALG: Press g(013tg(001t§~³.

7. To calculate operating expense:

a. Do steps 2 and 3a, b, c, e, above.

b.

RPN: Press g(012ttg(038t.

b.

ALG: Press g(012ttg(031t.

8. To calculate net profit after tax:

a. Do steps 2 and 3a, b, c, d, above.

b.

RPN: Press g(012ttg(043t.

b.

ALG: Press g(012ttg(039t.

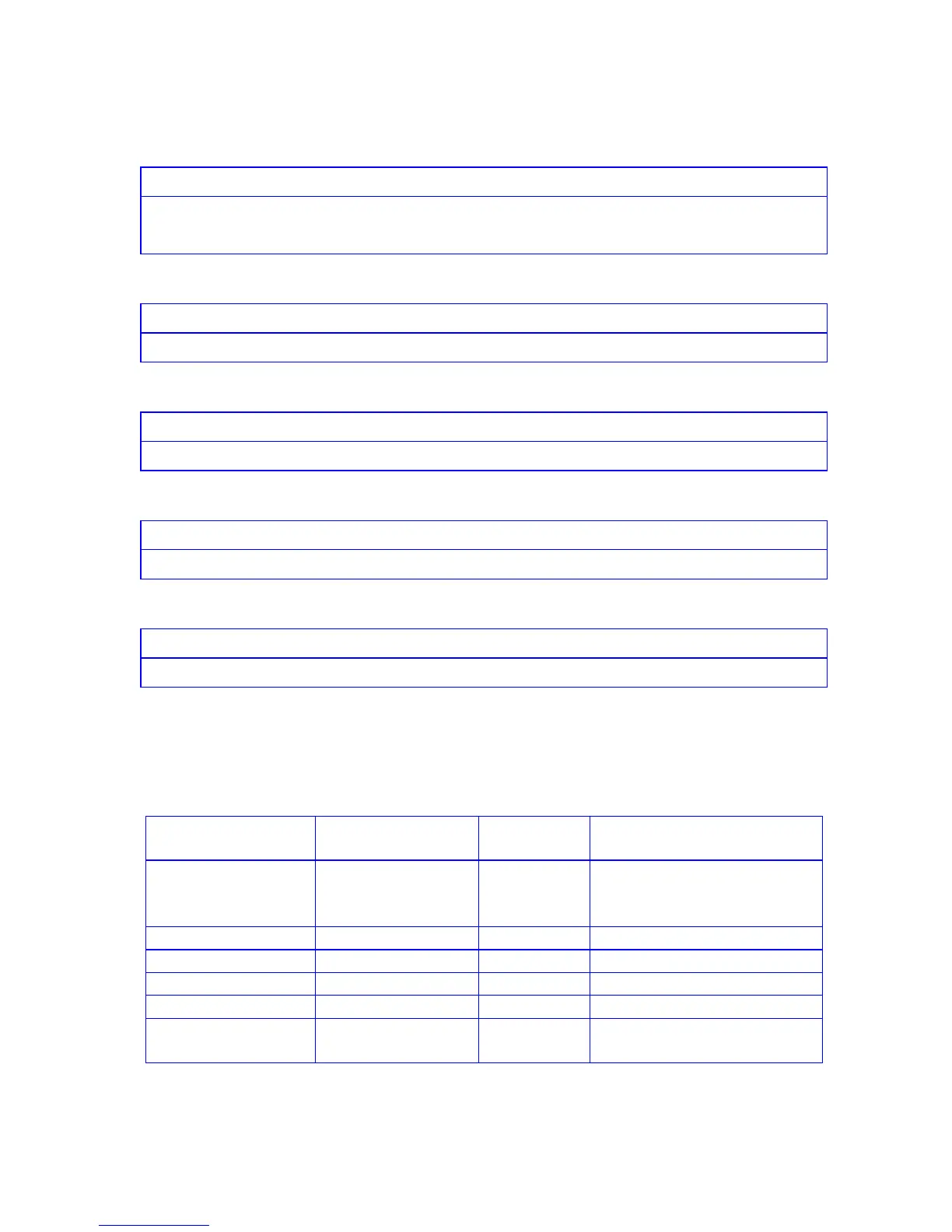

Example: What is the net return on an item that is sold for $11.98, discounted through

distribution an average of 35% and has a manufacturing cost of $2.50? The standard

company operating expense is 32% of net shipping (sales) price and tax rate is 48%.

12c platinum / 12C

RPN Keystrokes

12c platinum

ALG Keystrokes

Display Comments

fCLEARH fCLEARH

100?0 100?0

100.00

1\.48-?6 1-.48³?6

0.52

48% tax rate.

11.98?1 11.98?1

11.98

List price ($).

35?2 35?2

35.00

Discount (%).

2.50?3 2.50?3

2.50

Manufacturing cost ($).

32?4 32?4

32.00

Operating expenses (%).

g(012tt g(012tt

67.90

g(043t g(039t

18.67

Net profit (%).

Loading...

Loading...