DP-50 / DP-50D / MP55-B - USERS MANUAL

Note: If the default value of the identification number of the tax obligated person is

not changed, this will not permit the setting of the fiscal memory into use.

When fiscalization is made, the 9 - symbol BULSTAT code of the person (company)

should be entered, also when are fiscalized devices of company sections. The

BULSAT code of a physical person is 10-symbol and coincides with the personal

number of that person.

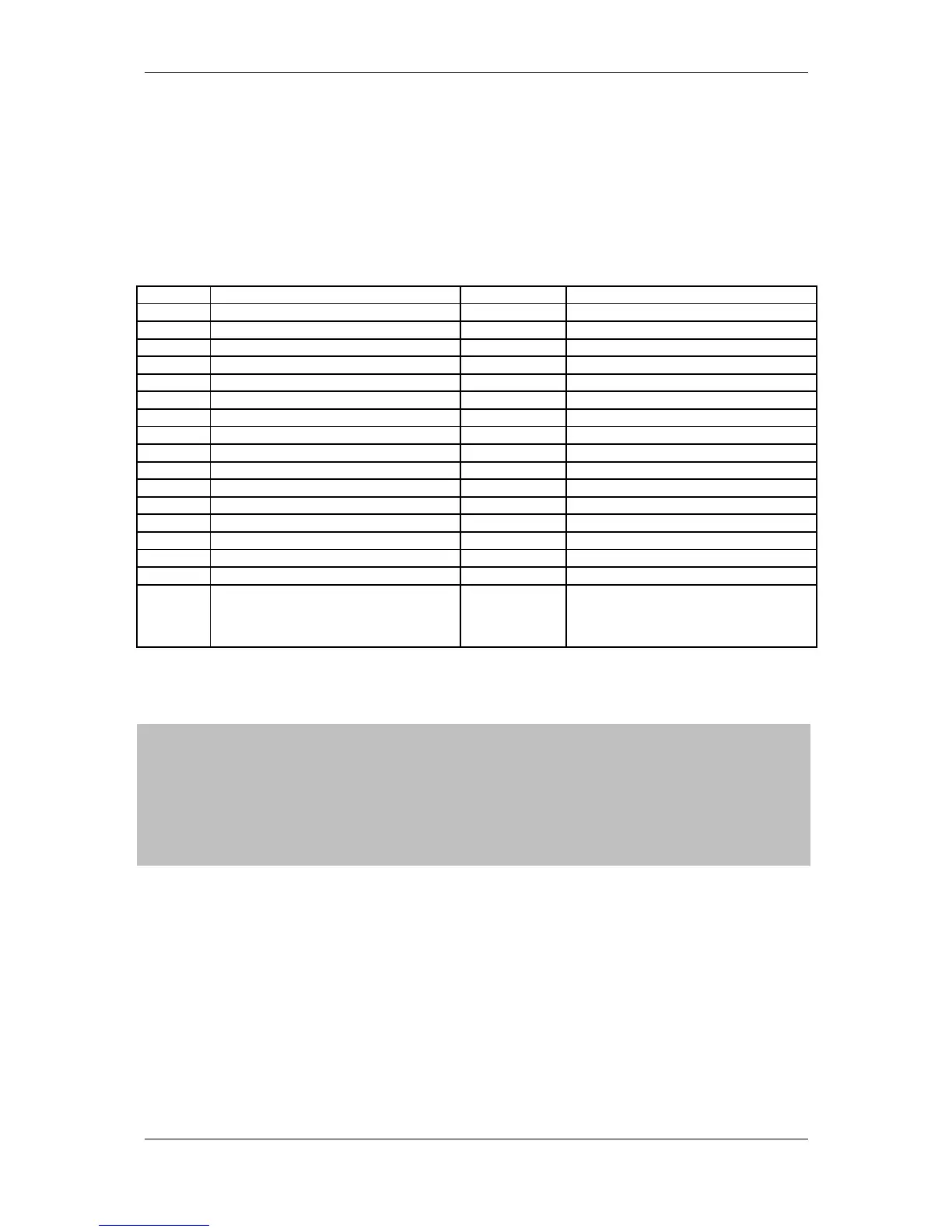

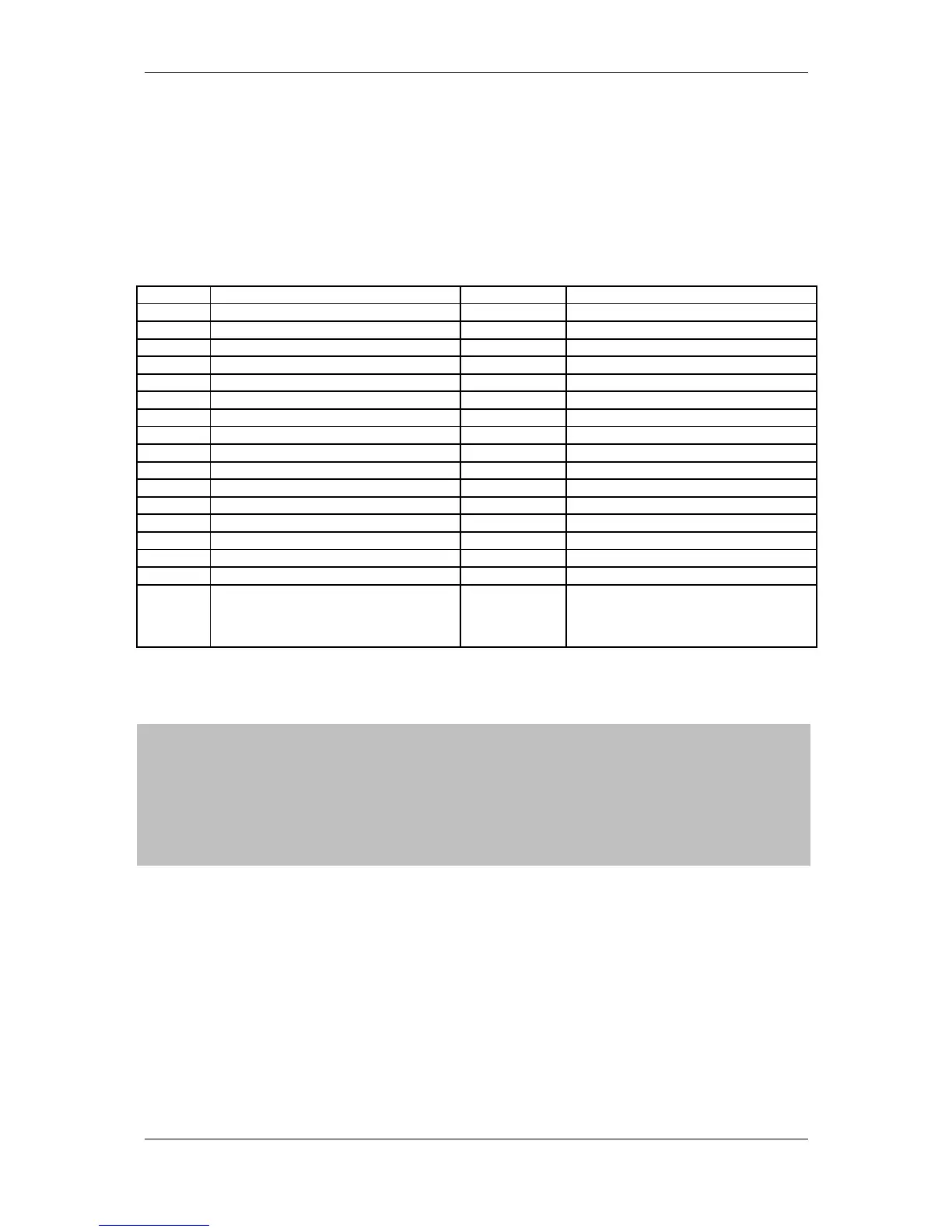

Table 04: Tax groups , 1 row, 17 fields

Field No

Description Range Note

1 Enables tax group A 0 or 1 Default: 1

2 Enables tax group B 0 or 1 Default: 1

3 Enables tax group C 0 or 1 Default: 0

4 Enables tax group D 0 or 1 Default: 0

5 Enables tax group E 0 or 1 Default: 0

6 Enables tax group F 0 or 1 Default: 0

7 Enables tax group G 0 or 1 Default: 0

8 Enables tax group H 0 or 1 Default: 0

9 Percentage for tax group A 0.00 ÷ 99.99 Default: 00.00

10 Percentage for tax group B 0.00 ÷ 99.99 Default: 20.00

11 Percentage for tax group C 0.00 ÷ 99.99 Default: 0.00

12 Percentage for tax group D 0.00 ÷ 99.99 Default: 0.00

13 Percentage for tax group E 0.00 ÷ 99.99 Default: 0.00

14 Percentage for tax group F 0.00 ÷ 99.99 Default: 0.00

15 Percentage for tax group G 0.00 ÷ 99.99 Default: 0.00

16 Percentage for tax group H 0.00 ÷ 99.99 Default: 0.00

17 The price has digits after decimal

point.

0 or 1 1: 2 digits after decimal point (0.00)

0: no digits after decimal point

Default: 1

MODE P3 - SETTING UP THE FISCAL MEMORY IN USE

The specific parameters are stored into fiscal memory.

The fiscal memory programming should be made by the manufacturer or by

authorized service! In order to set the fiscal memory in use after the ECR purchasing

and its installing into a store, it is necessary a qualified specialist from authorized

service to be called. This specialist must represent an authorized service, which has

a service contract with DATECS and which has a service contract with the trade

organization.

23

Loading...

Loading...