2

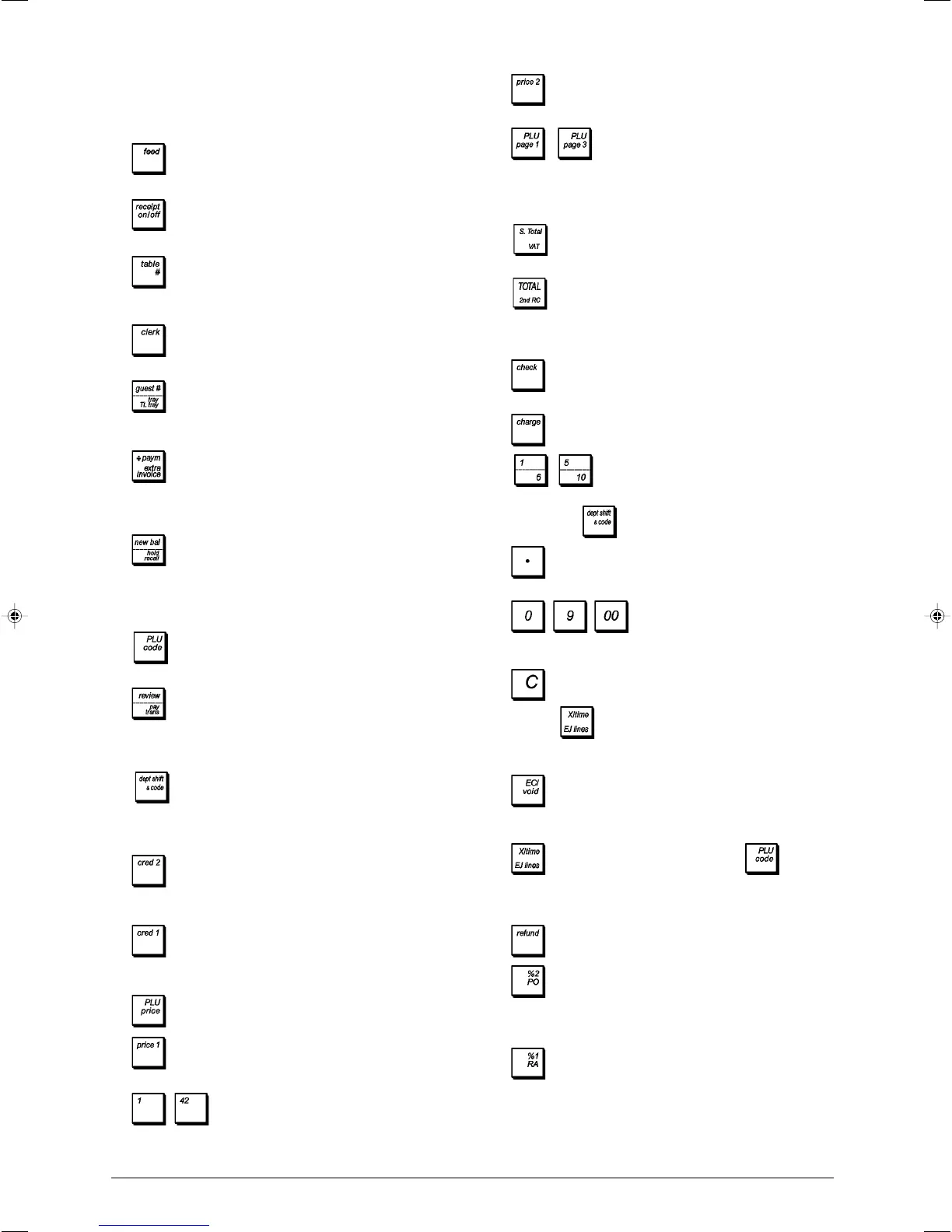

Transaction Keypad Functions

With the transaction keypad sheet installed and with refer-

ence to figure 5:

1.

- Advances the receipt or journal paper one line

feed; advances the paper continuously when held down.

2.

- Toggles the cash register between printing and

not printing the sales receipt in the REG or MGR mode.

3. - Opens a table, calls back the items ordered at a

determined table and closes the table when the

transaction is concluded.

4.

- Confirms an entered clerk number. Used during

caption programming.

5.

- As the Guest key, enters the number of guests at

a determined table. As the Tray T-Tray key, provides the

order total of a determined guest tray in a guest party.

6.

- As the divide payment key, divides the total

amount among the guests at a table. As the Extra Invoice

key, issues an additional invoice requested by the guest

after the ordinary invoice is issued.

7. - As the New balance key, temporarily closes the

orders of a determined table until the final invoice is

issued. As the Hold/recall key, holds and then recalls a

sales transaction so that a second transaction can be

performed in the meantime.

8.

- Registers a preset price of an individual article to

the appropriate department.

9. - As the Review key, prints a proforma receipt

before finalizing the sales transaction, As the Pay Trans

key, transfers payment from one form of payment to

another after the finalization of a sales transaction.

10. - Allows price entries for departments 6-10. For

departments 11-60, press this key, then manually enter

the department number using the numeric keypad and

then press this key again.

11.

- Registers sales that are put on a credit card that

is alternative to Credit Card 1 or the one used for Charge

tenders.

12.

- Registers sales that are put on a credit card that

is alternative to Credit Card 2 or the one used for Charge

tenders.

13.

- Used to manually enter a price for a PLU article.

14. - Used to enter the first price assigned to a

determined PLU.

15.

- - Used together with [PLU page], register

the prices associated to the related PLU article.

16.

- Used to enter the second price assigned to a

determined PLU.

17. - - Direct access to PLU prices. PLU Page

1 (default) is used to select PLUs 1 to 42, PLU Page 2 to

select PLUs 201 to 242 and PLU Page 3 to select PLUs

301 to 342. You can program the PLUs associated to

these three pge keys.

18.

- Subtotals a sale, and used for the programming of

VAT rates.

19.

- Totals exact cash transactions, computes change

and totals transactions that are split tendered with check

or credit card and cash together. Prints one or more

copies of the last sales receipt.

20.

- Registers sales paid by check. Confirms the

clerk three-digit code entered.

21.

- Registers sales that are charged.

22.

- - Departments 1 through 5, to enter single

or multiple item sales to a particular department. When

pressed after

, registers to Departments 6 through 10.

23.

- Enters a decimal point for defining product

quantities with decimals during sales transactions.

24. - / - Input amounts, indicate how many

times a particular item repeats, add and subtract

percentage rates and input department code numbers.

25.

- Clears an entry made from the numeric keypad

or with before finalizing a transaction with a

Department or function key. Also used to clear error

conditions.

26.

- Deletes the last item entered, and corrects a

particular entry after it is processed and printed, or full

entries after a subtotal.

27.

- Multiplies [DEPARTMENT] or entries,

toggles between displaying the current date and the

current time. Press three times to view the number of

sales data lines still available in the Electronic Journal.

28.

- Subtracts an item that is returned for refund.

29.

- As the %2 key, when programmed accordingly

subtracts or adds a percentage from an item or sales

total. As the PO key, registers any money taken out of the

cash drawer that is not part of a sale.

30. - As the %1 key, when programmed accordingly

subtracts or adds a percentage from an item or sales

total. As the RA key, registers any money received on

account that is not part of a sale; for example, the start-

up money put in the drawer at the start of each business

day can be registered as an RA.

Loading...

Loading...