7

ENGLISH

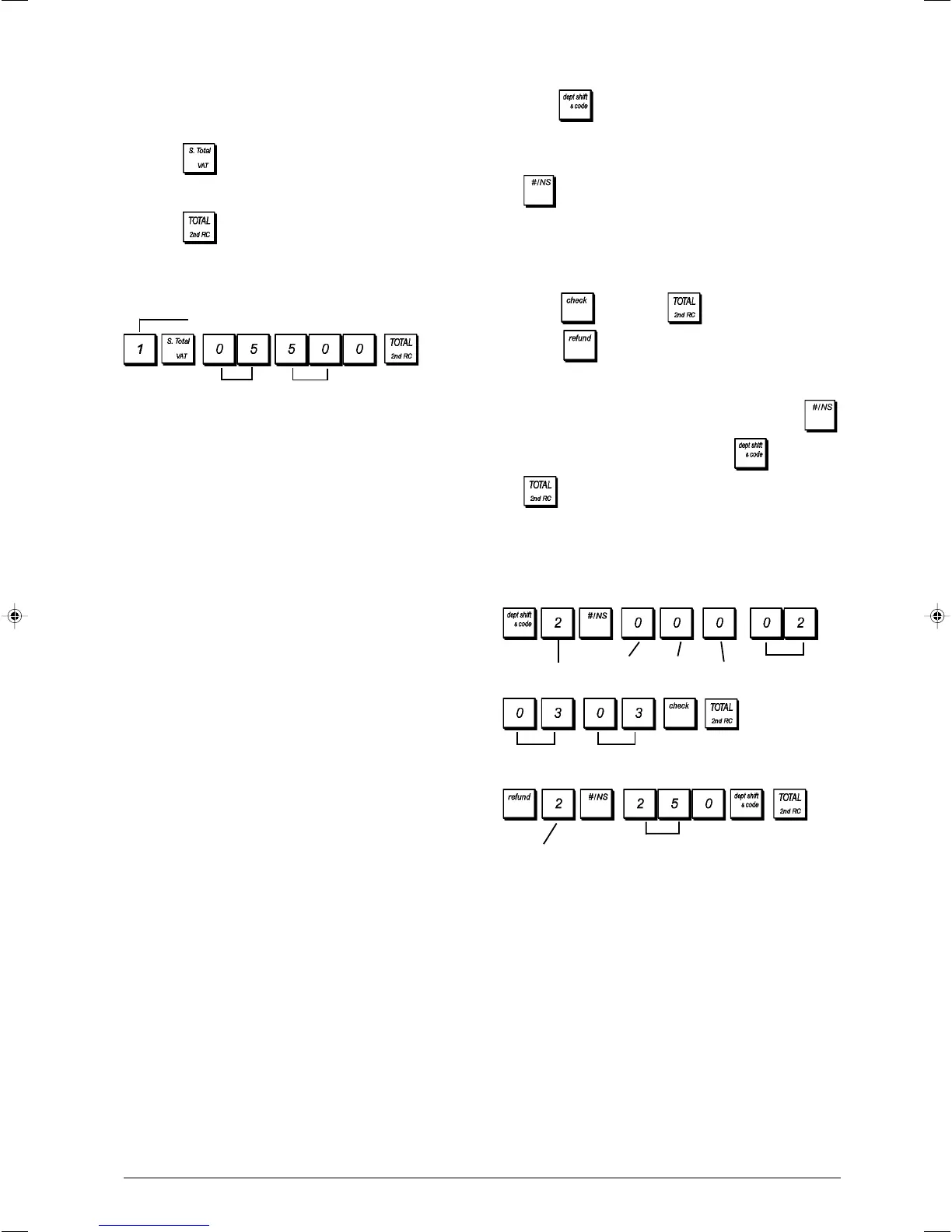

5. Set a Fixed VAT Rate

1. Control lock key position: PRG.

2. Type the [number] that represents the VAT (1 for VAT1,

2 for VAT2, 3 for VAT3 and 4 for VAT4).

3. Press

.

4. Type the VAT rate. Five digits can be used and you MUST

enter three digits after the desired decimal place.

5. Press

.

Example: Set a VAT1 rate of 5.50%.

Type/Press:

NOTE: Before changing a VAT rate, print a Z Financial

report. See "X1 and Z1 Financial Reports".

See sections "Fraction Rounding for VAT Calculation" and

"Printing VAT Information on Receipt" for other VAT-related

features.

6. Program the Departments

A total of 60 departments are available. Programming a

department means defining a department status and an

associated price.

The department status consists of a 9-digit code that char-

acterizes the department as follows:

• positive or negative sales

• single or multiple item sales

• High Digit Lock Out (HDLO) status, whereby you prohibit

item entries for a certain number of digits and above.

• previously programmed tax status

• use of an alternative tax status (for example, take-out tax)

with respect to the one programmed, according to the item

sold.

• link to one of up to 10 merchandise categories.

You can then assign a preset price to the department.

The 9-digit department status can be programmed using the

following options (defaults in bold):

Positive/Negative Sales Multiple/Single Item Sales

0 = Positive department 0 = Multiple item sales

1 = Negative department 1 = Single item sales

HDLO Tax Status

0 = No HDLO 00 = Non taxable

1 = 0.01 - 0.09 01 = Taxable with VAT 1

2 = 0.01 - 0.99 02 = Taxable with VAT 2

3 = 0.01 - 9.99 03 = Taxable with VAT 3

4 = 0.01 - 99.99 04 = Taxable with VAT 4

5 = 0.01 - 999.99

6 = 0.01 - 9999.99

Alternative tax status Merchandise category

00 = Non taxable 00 - 10 (category number)

01 = Taxable with VAT 1

02 = Taxable with VAT 2

03 = Taxable with VAT 3

04 = Taxable with VAT 4

1. Control lock key position: PRG.

2. Press

to enter the department status programming

mode.

3. Define the department to program by typing the

department number [1 to 60] and then press

.

4. Type the [Positive/Negative sales code], [Single/

multiple item sales code], [HDLO code], [Tax Status

code], [Alternative tax status code] and [Category

link number] by referring to the previous table. A 9-digit

status code must be entered.

5. Press

followed by to exit.

6. Press to enter the department price definition

mode.

7. Define the department to associate the price to by typing

the department number [1 to 60] and then press

.

8. Type a [unit price] to assign, press

followed by

to exit.

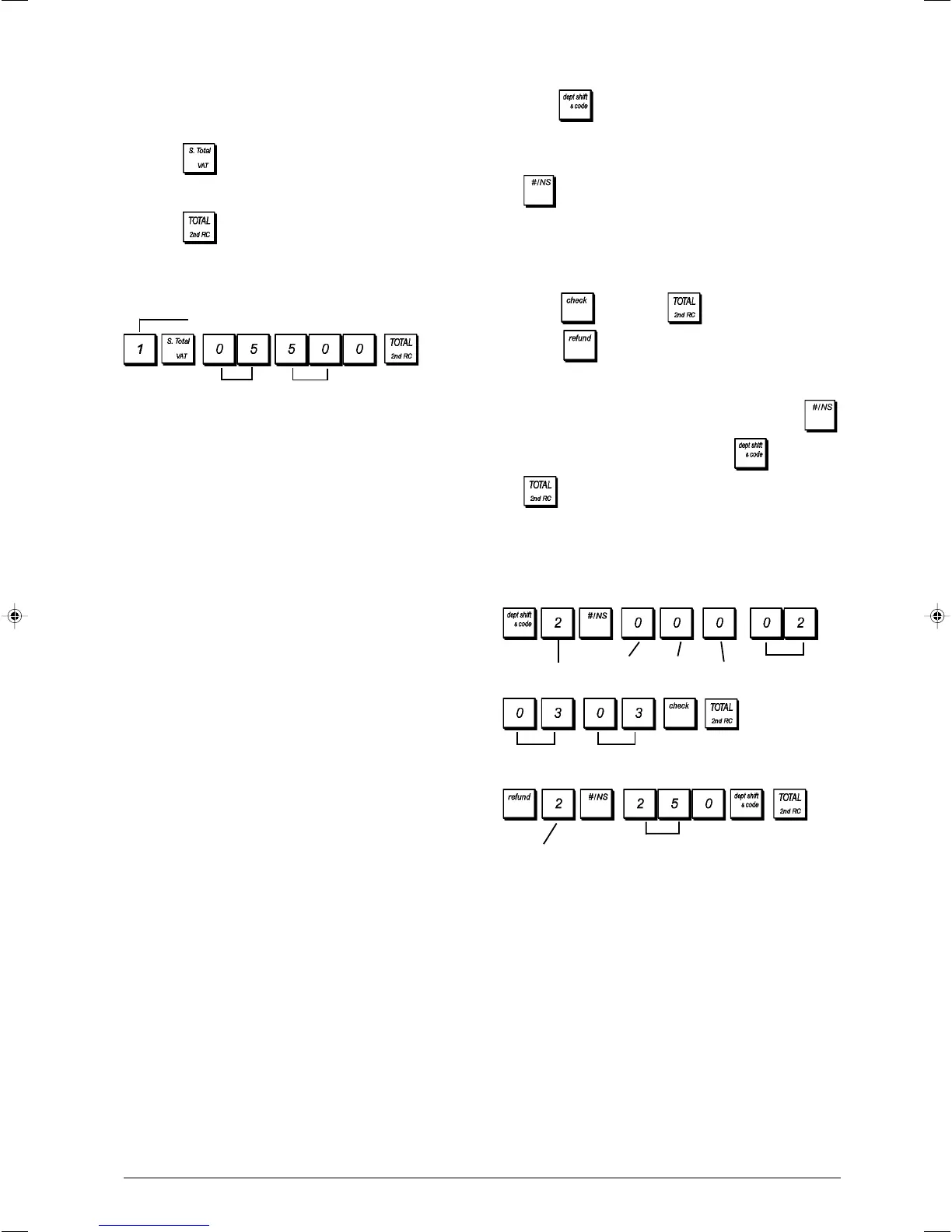

Example: Program Department 2 as follows: multiple

positive item sales, no HDLO, VAT 2, alternative VAT 3, link

to category 3 and an associated price of £2.50.

Type/Press:

After you have programmed your departments, you can print

a report that indicates the programming values. See section

"Department Programming Report" for details.

VAT number

505

Alternative

Tax status

Merchandise

category

No HDLO

Tax status

Positive

item sales

Multiple

item sales

Department

Department

Unit price

Loading...

Loading...