31

• If the tax is not provided for every cent, modify the tax table by setting the tax for every cent

in the following manner.

When setting the tax, consider the minimum breakpoint corresponding to unprovided tax to be the same as the

one corresponding to the tax provided on a large amount.

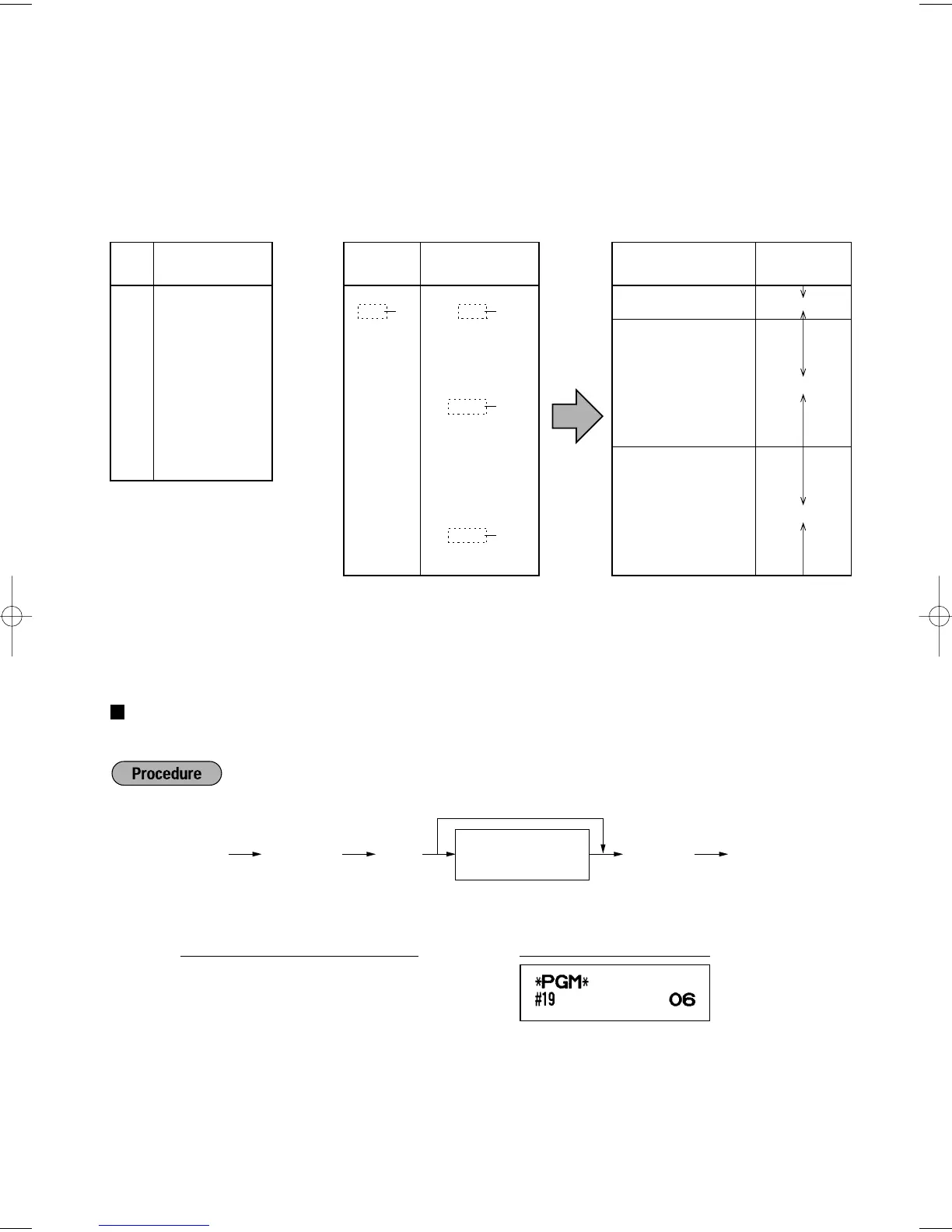

Sample tax table Modification of the left tax table

Example 8%

From the modified tax table above;

Rate = 8(%), T = $0.01 = 1¢, Q = $0.11 = 11¢, M1 = 1.11, M2 = 2.11, M = 100

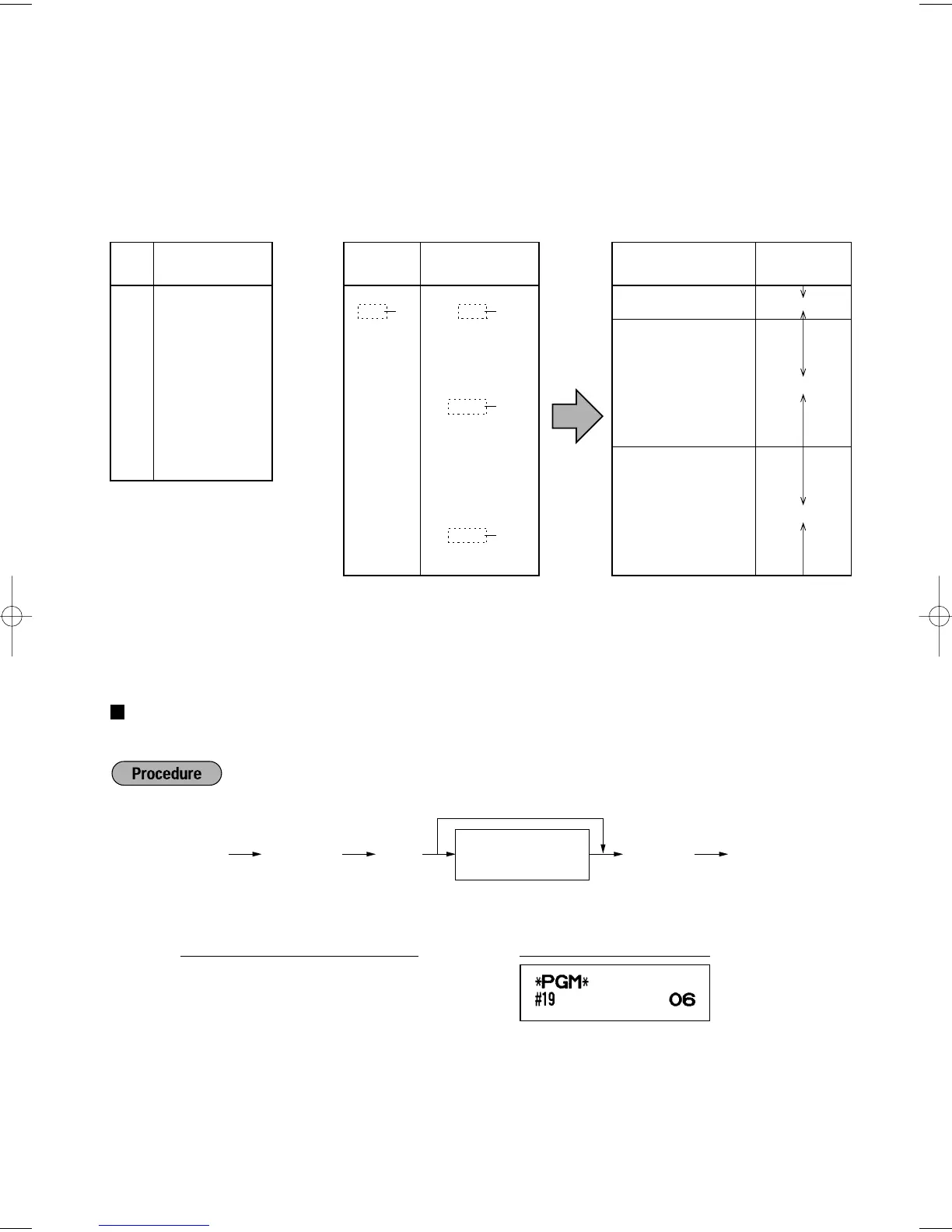

Quantity for doughnut tax exempt (for Canadian tax system)

This option is available only when the Canadian tax system is selected.

Example: To program the quantity “6”

s

19

@

6

s

A

PrintKey operation example

s @19 s A

To program zero

Q’ty for doughnut

tax exempt

(max. 2 digits: 1 to 99)

Tax

Minimum

breakpoint

.00

.01

.02

.03

.04

.05

.06

.07

.08

.09

.10

.11

.12

.13

.14

.15

.16

.17

.01

.11

.26

.47

.68

.89

.89

1.11

1.11

1.11

1.26

1.47

1.68

1.89

1.89

2.11

2.11

2.11

T Q

M1

M2

Tax

Minimum

breakpoint

.00

.01

.02

.03

.04

.06

.09

.10

.11

.12

.14

.17

.01

.11

.26

.47

.68

.89

1.11

1.26

1.47

1.68

1.89

2.11

Breakpoint

difference (¢)

1

10 (0.11-0.01)

15 (0.26-0.11)

21 (0.47-0.26)

21 (0.68-0.47)

21 (0.89-0.68)

0 (0.89-0.89)

22 (1.11-0.89)

0 (1.11-1.11)

0 (1.11-1.11)

15 (1.26-1.11)

21 (1.47-1.26)

21 (1.68-1.47)

21 (1.89-1.68)

0 (1.89-1.89)

22 (2.11-1.89)

0 (2.11-2.11)

0 (2.11-2.11)

B: Non-cyclic

C: Cyclic-1

D: Cyclic-2

A242_3 FOR THE MANAGER 06.1.10 5:19 PM Page 31

Loading...

Loading...