129

E

Appendix

Appendix

–

–

–

–

–

–

–

–

=

=

=

=

=

=

=

=

=

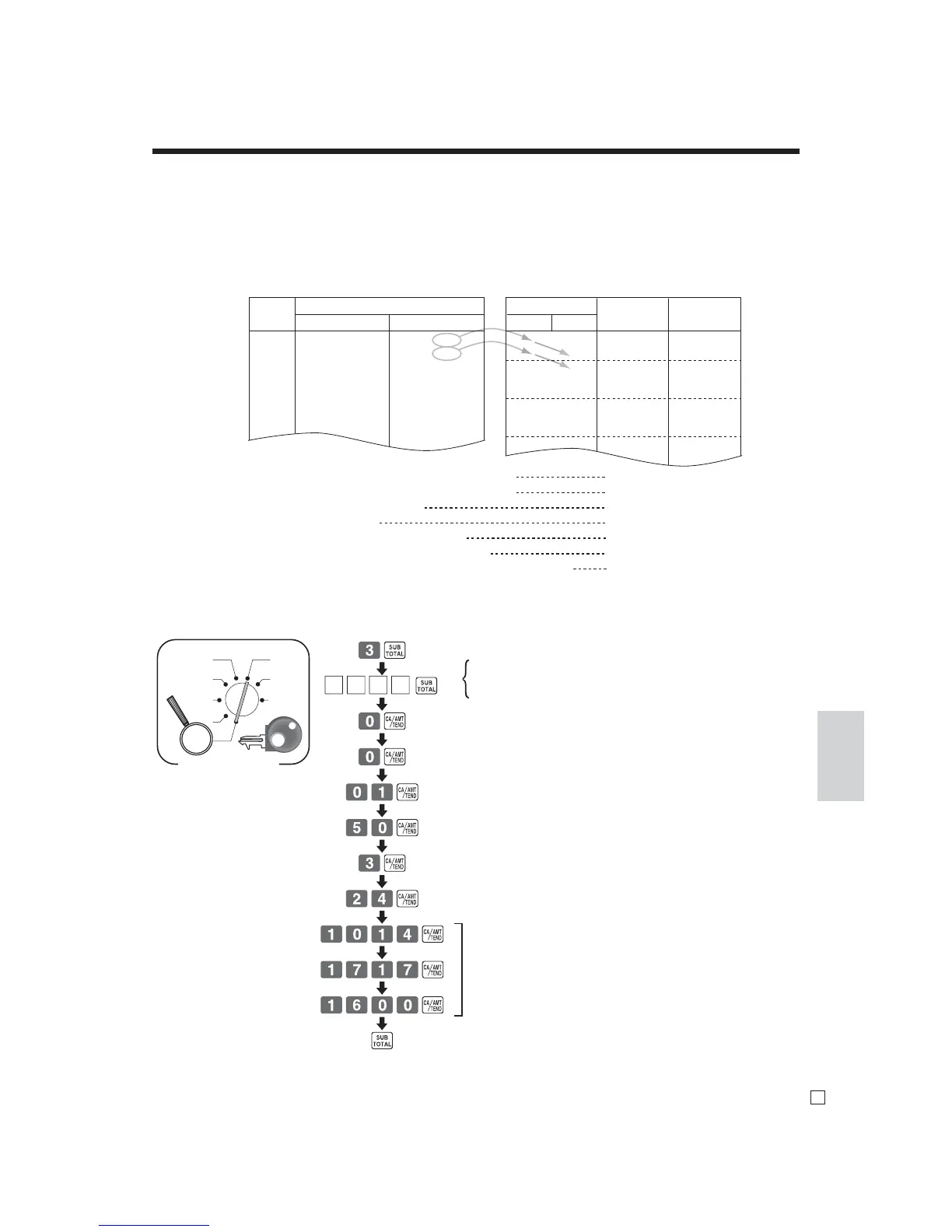

TAX

(6%)

Price range

Min. break point Max. break point

$ .00

.01

.02

.03

.04

.05

.06

.07

$ .01

.11

.25

.42

.59

.75

.92

1.09

$ .10

.24

.41

.58

.74

.91

1.08

1.24

Max. break point

10

24

41

58

74

91

108

124

0

10

24

41

58

74

91

108

124

10

14

17

17

16

17

17

16

17

17

Upper Lower

Difference

Pattern

Non-cyclic

Cyclic

Cyclic

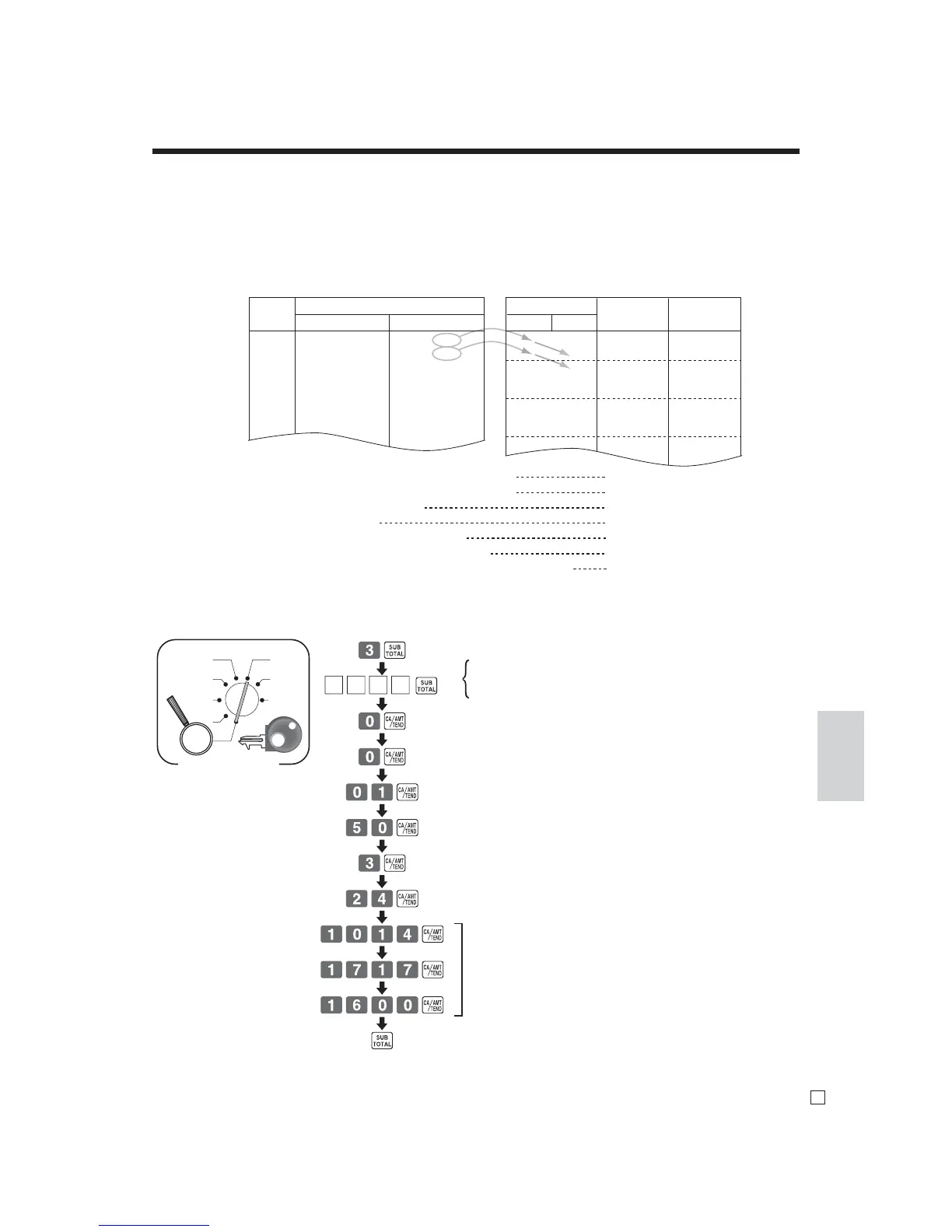

Tax rate (2-digit for integer + 4- digit for decimal)

Tax table maximum value ("0" means unlimited).

Rounding/tax table system code

Sum of a cyclic pattern

Number of values in each cyclic pattern

Number of values in each non-cyclic pattern

Actual value of difference of the non-cyclic and cyclic values

0% (Table only)

0 (Table only)

01 (Table only)

50 (17 + 17 + 16)

3

24 (10 + 14)

10, 14, 17, 17, 16

Tax table programming (for US tax table)

Example 1, Without rate tax:

Preparation

X1

Z1

X2/Z2

REG2

REG1

OFF

RF

PGM

Mode Switch

0125

0225

0325

Tax table 1 =

Tax table 2 =

Tax table 3 =

Tax rate (2-digit for integer + 4-digit for decimal)

Tax table maximum value (“0” means unlimited).

Rounding/tax table system code

Sum of a cyclic pattern

Number of values in each cyclic pattern

Number of values in each non-cyclic pattern

Actual value of difference of the non-cyclic and cyclic values

You must enter these values in 4-digit block. If the last block

comes out to be only two digits, add two zeros.

PGM

Programming procedure:

Loading...

Loading...