I

ADVANCED PROGRAMMING

=

==============~==============~~

...,

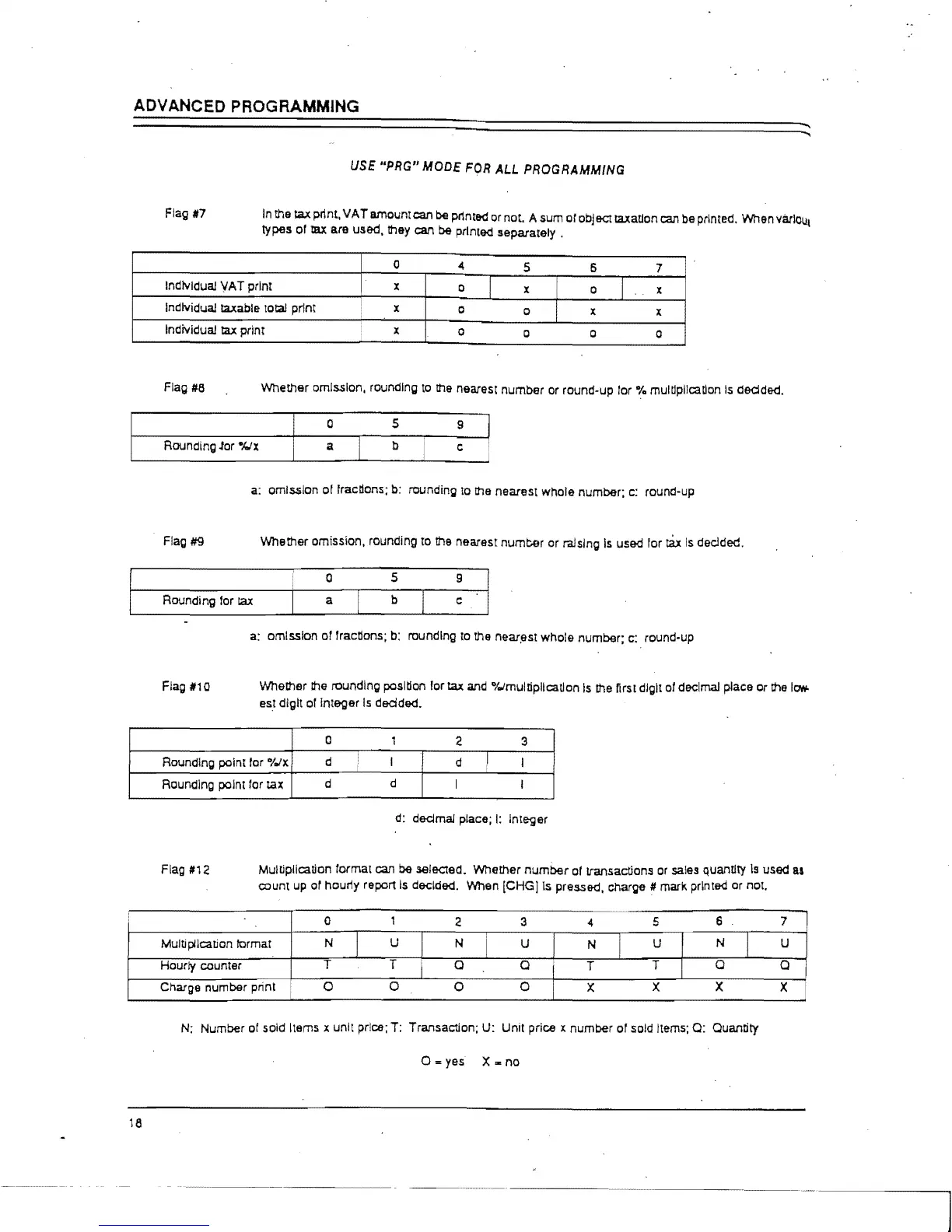

Flag #7

USE

"PRG"

MODE

FOR

ALL

PROGRAMMING

In

the tax plint.

VAT

amount can be plinted

or

not. A sum

01

obj

&C!

taxatlon can be printed. When varlou,

types

01

tax are used, they can be printed

separately.

7

Individual

VAT

print

x

Individual taxable total

Individual

tax

print

x

o

Flag #8

Whether

omission. rounding

to

the nearest

number

or round-up lor % multiplication

Is

dedded.

o 5

9

Rounding .tor

-klx

a

b

c

a: omission

of

fractions;

b:

rounding to the nearest

whole

number;

c:

round-up

Flag #9

Whether

omission. rounding to !he nearest

number

or ra.!slngls used

lor

tax

Is

declded.

o

5

Rounding for

laX

a

b

a; omission

or

fractions;

b:

rounding to the neari:lst

whole

number; c: round-up

Flag

#10

Whether the rounding position

lor

tax and "to/multiplication

Is

!he nrs! digit

01

decimal place

or

!he

It'T1\Io

esl digit of Integer

Is

dOOded.

0

1

<!

3

I Rounding point lor

"to/x

d I

d

I

I

I

18

Rounding point lor tax

d

d

I I

d:

dedmal

place;

I:

Integer

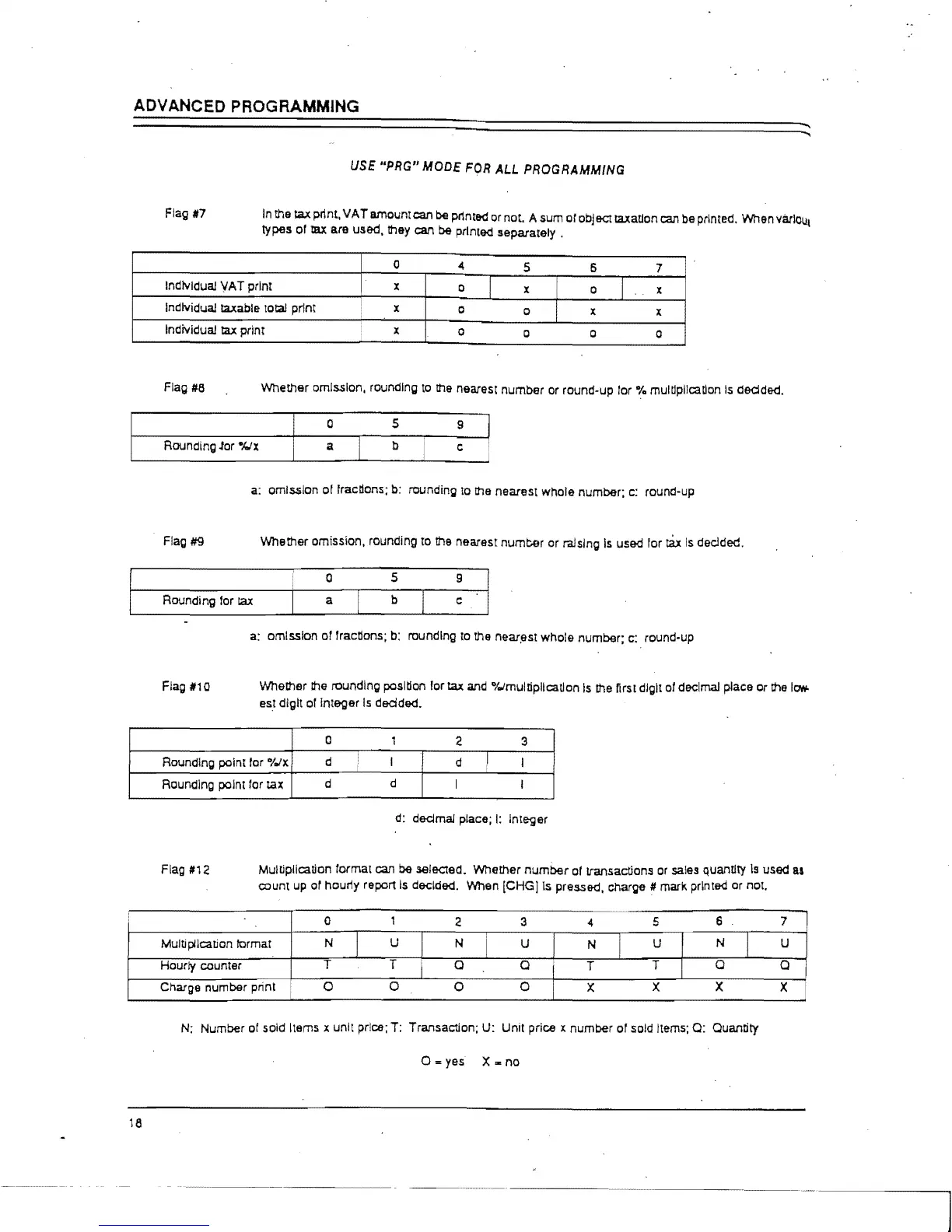

Flag

#1<!

MuWplication format can be sei&C!ed. Whether

number

01

transactions

or

sales quantity

Is

used

II

count up or hour1y report

Is

decided. When

[CHG]Is

pressed. charge # mark printed or not.

5

6 7

U

N

U

T

Q

Q

x x

x

N: Number of sold Items x unit price; T: Transaction; U: Unit price x

number

or sold Items; Q: Quantity

0=

yes X m

no

Loading...

Loading...