APPENDIX

3:

GST/PST SYSTEM

FOR

CANADA

This electronic cash register includes

tho

following valuable functions lor taxation

in

Canada:

L

In

addition

to

G.S.T. (to

be

programmed

as

TAX1), 3 P.S.T. tax rates are programmable,

and

tax-an-tax calculation

is

available. (Tax

viii

I

be

printed

on

the

receipt.)

2.

Limit amounts

ot

non-tax (base

tax)

arc programmable

[or

TAX1 through TAX4.

3.

Two calculation modes

for

G.S.T. amounts are availabie.

For

example, tax-tax setting

of

G.S.T. 7%, PST-1

8%,

PST-2

8%

(trom$4.01)

and

PST-3

10% can

be

programmed

as

indicated below (lor Ontario).

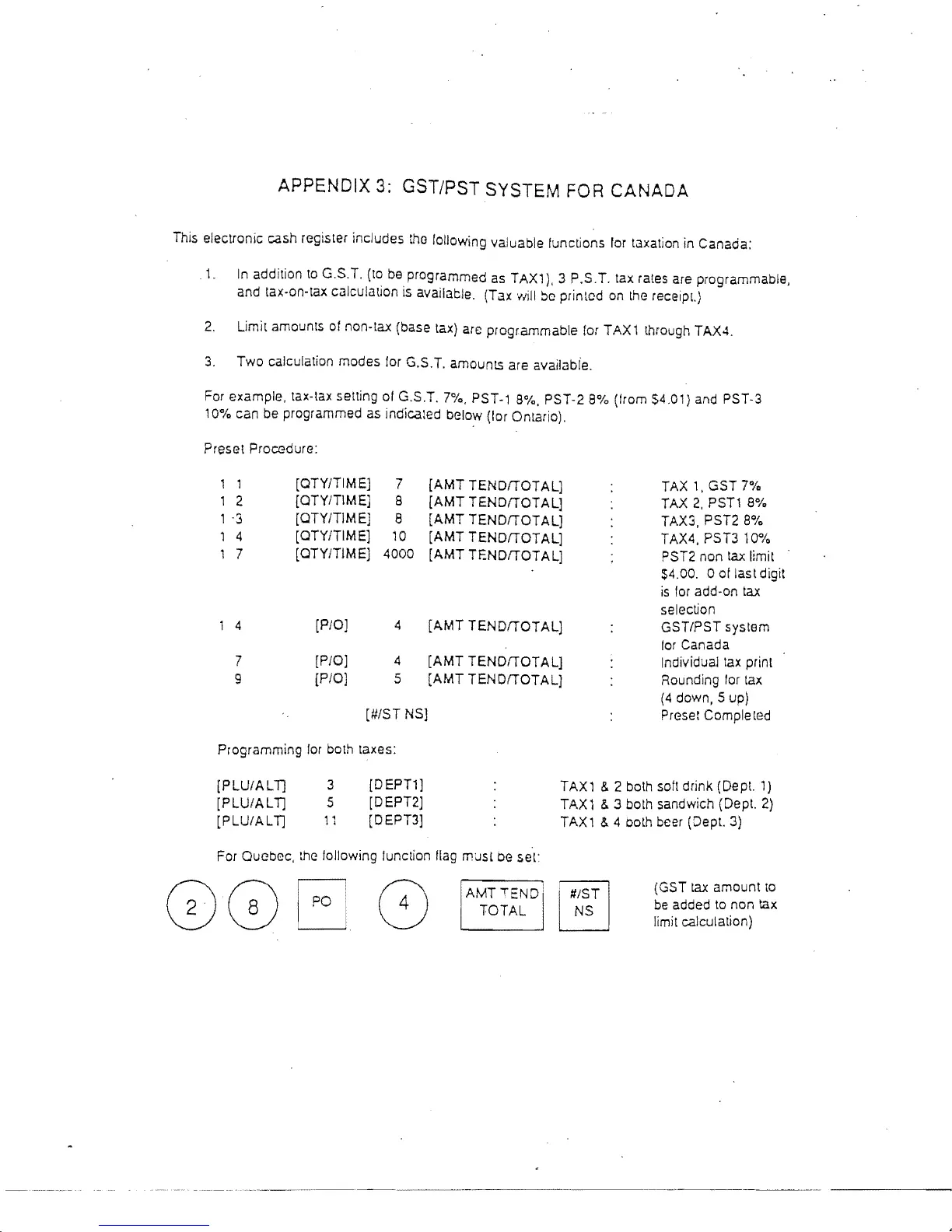

Preset Procedure:

1 1

1 2

1 ·3

1 4

1 7

1 4

7

9

[OTY/TIME] 7

[OTY/TIME] 8

[OTYITIME] 8

[OTYITIME)

10

[OTY/TIME] 4000

[AMT

TENDfTOTAL]

[AMT

TENDfTOTAL]

[AMT

TENDfTOTAL]

[AMT

TENDfTOTAL)

[AMT

TENDfTOTAL]

[P/O]

[P/O]

[P/O]

4

[AMT

TENDfTOTAL]

4

[AMT

TENDfTOTAL]

5

[AMT

TENDfTOTAL)

[#/ST NS]

TAX

1,

GST 7%

TAX

2,

PST1

8%

TAX3, PST2

8%

TAX4, PST3 10%

PST2

non

tax

limit

$4.00. 0

01

last digit

is

for

add-on

tax

selection

GST/PST

system

for

Canada

Individual

tax

print

Rounding lor

tax

(4

down, 5 up)

Preset Completed

Programming

for

both taxes:

[PLU/ALn

[PLU/ALn

[PLU/AL

n

3

5

11

[0

EPT']

[OEPT2]

[DEPT3]

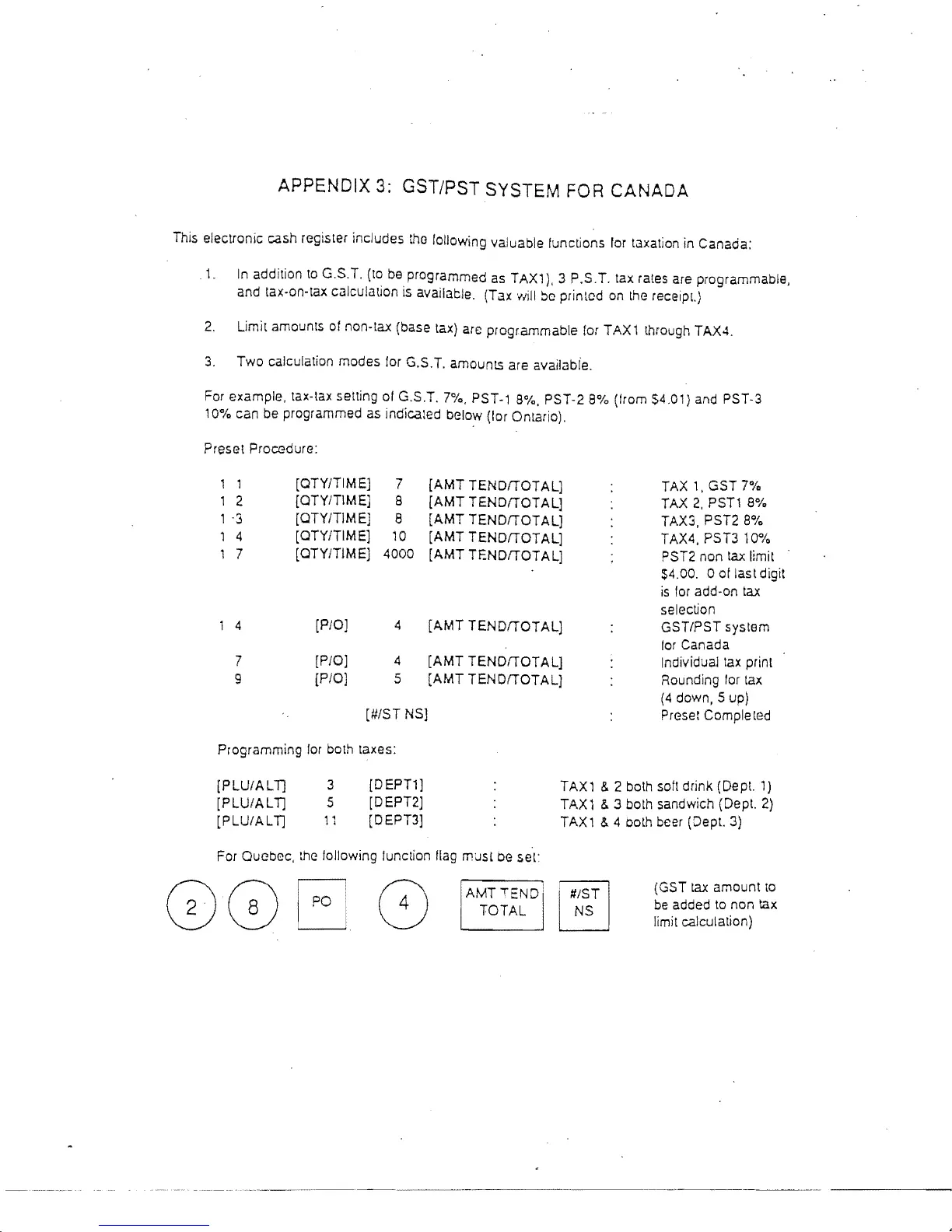

For Quebec,

the

following function

flag

m'Jsl

be

sel:

AMT

Ti:ND

I

TOTAL

TAX1 & 2 both soft drink (Dept.

1)

TAXi

& 3 both sandwich (Dept. 2)

TAX1

&.

4

Doth

beer

(Dept. 3)

I

#1ST

I

NS

(GST

tax

amount

to

be

added

to

non

\ax

limit calculation)

Loading...

Loading...