11. REGISTERING PROCEDURE AND PRINT FORMAT EO1-11154

11.23 Tax Exemption (for Add-on Tax Feature)

11-14

11.23 Tax Exemption (for Add-on Tax Feature)

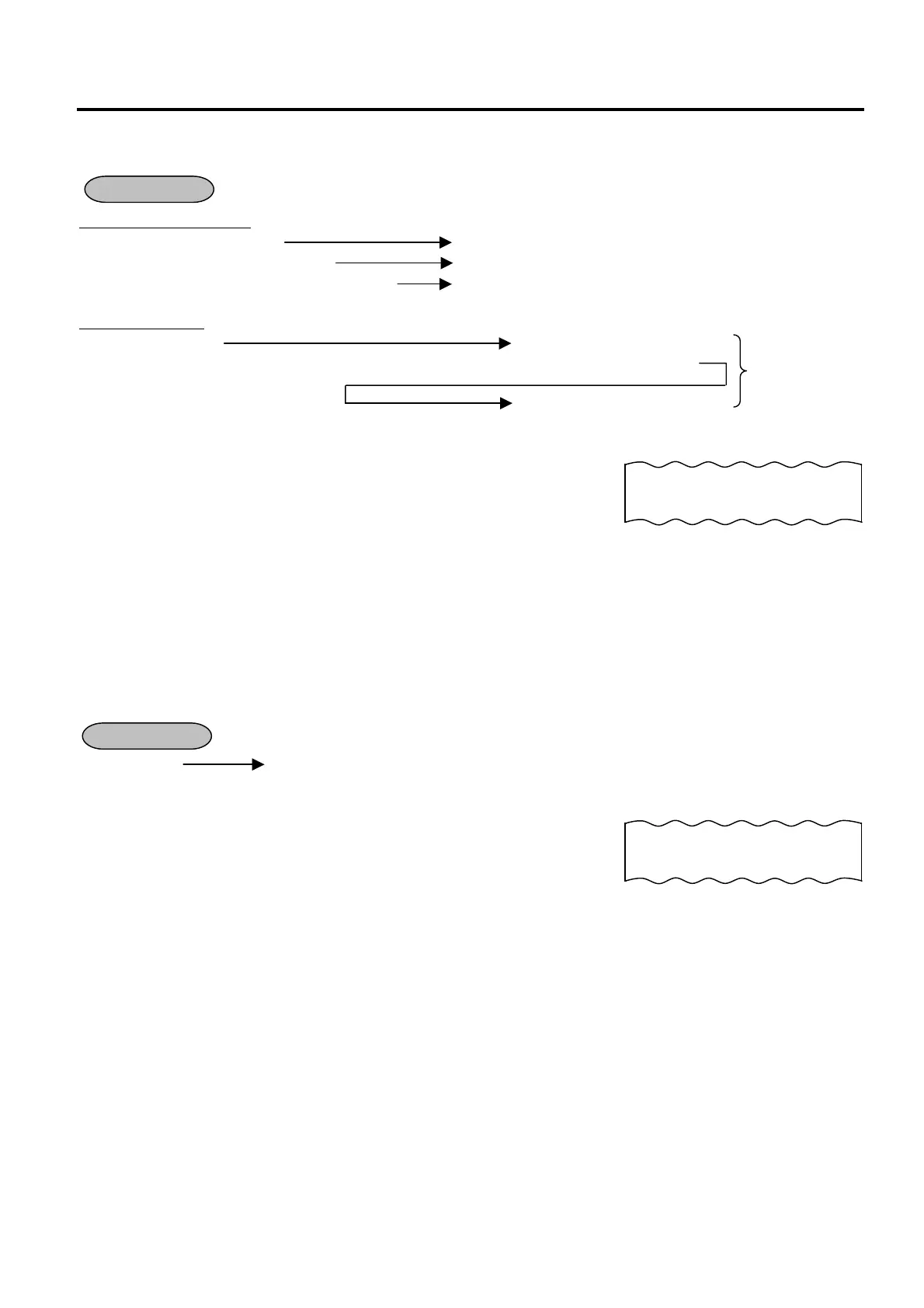

Selective Tax Exemption

Examples) [TX1/M] [EX] Sale Finalization ... to exempt from Tax 1 only

[TX1/M] [TX2/M] [EX] Sale Finalization ... to exempt from Tax 1 & Tax 2

[TX1/M] [TX2/M] [TX3/M] [EX] Sale Finalization ... to exempt from Tax 1, Tax 2, & Tax 3

All Tax Exemption

[EX] Sale Finalization

[TX1/M] [TX2/M] [TX3/M] [TX4/M] [TX5/M] [TX6/M] [TX7/M] [TX8/M] [EX]

Sale Finalization

NOTES:

1. On depressing [EX], the sale total including the exempted tax(es) is displayed and pre-taxed amount of the

sale portion subject to the tax exemption is printed.

2. After the Tax Exemption operation, only the Sale Finalization is possible.

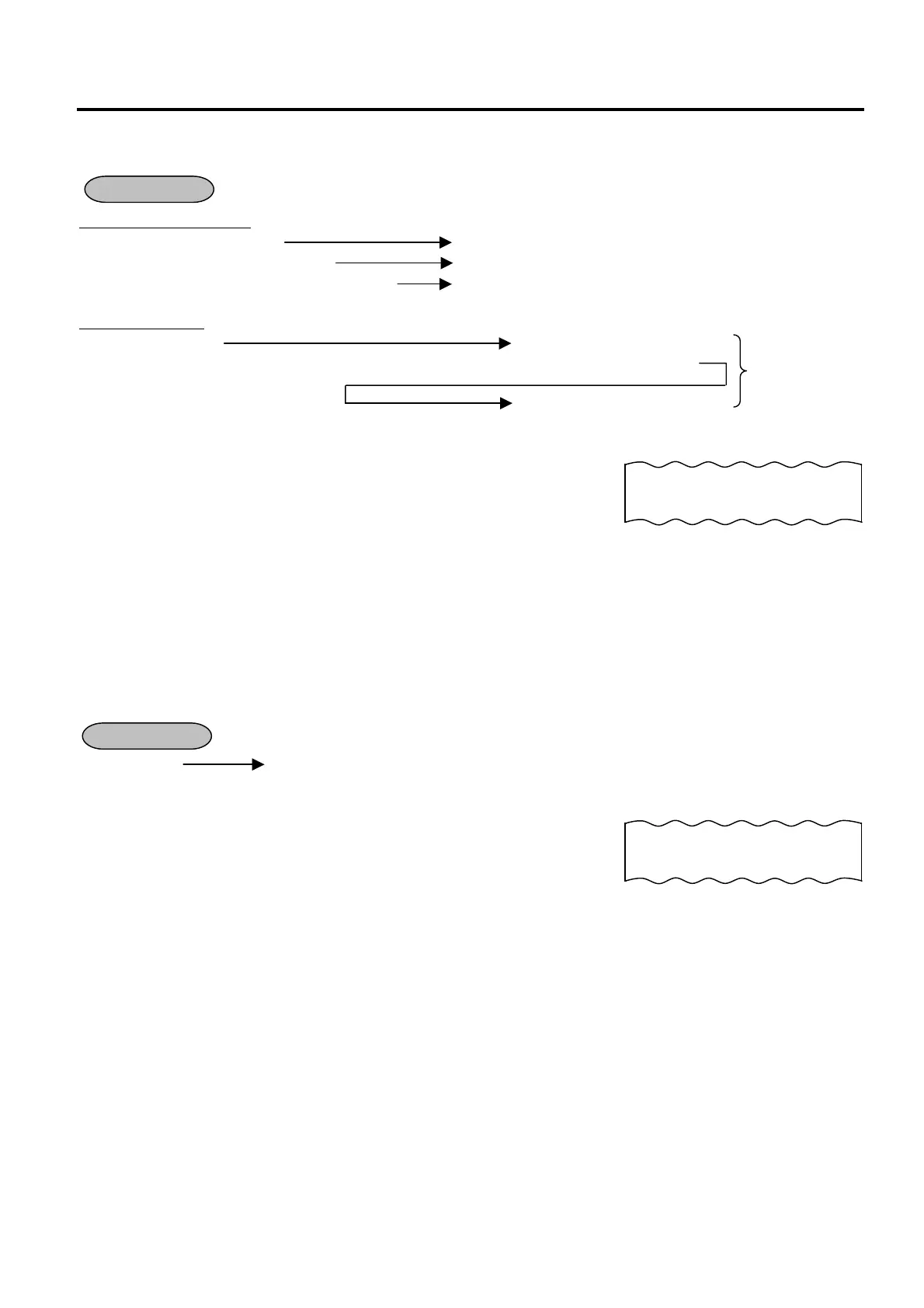

11.24 VAT Exemption (for VAT Feature)

The amount of VAT is exempted at the Department and PLU entries.

[EX] Sale Finalization ….. to exempt from all VATs

NOTES:

1. On depressing [EX], the sale total excluding the exempted VAT(s) is

displayed and the amount of the exempted VAT(s) is printed.

2. After the VAT Exemption operation, only the Sale Finalization is possible.

3. None of the [ITEM CORR], [VOID], and [ALL VOID] operations are

possible after the VAT Exemption operation.

OPERATION

to exempt from

all taxes

-- Receipt Print Format --

Pre-taxed amount of the sale portion subject to Tax1

Pre-taxed amount of the sale portion subject to Tax2

TAX1EX €1,50

TAX2EX €6,00

OPERATION

-- Receipt Print Format --

VAT1EX -0,14

VAT2EX -0,78

Loading...

Loading...