38

3-6. Tax

You can print the Tax in receipt mode at the bottom of each receipt;

You should enter the percentage of tax. Additionally, If you wish to print

the Tax at the bottom of receipt, you should set P1-11 PLU Tax.

To program the Tax:

1. Enter ‘Main menu’, and follow 2 steps below.

2. Press

.

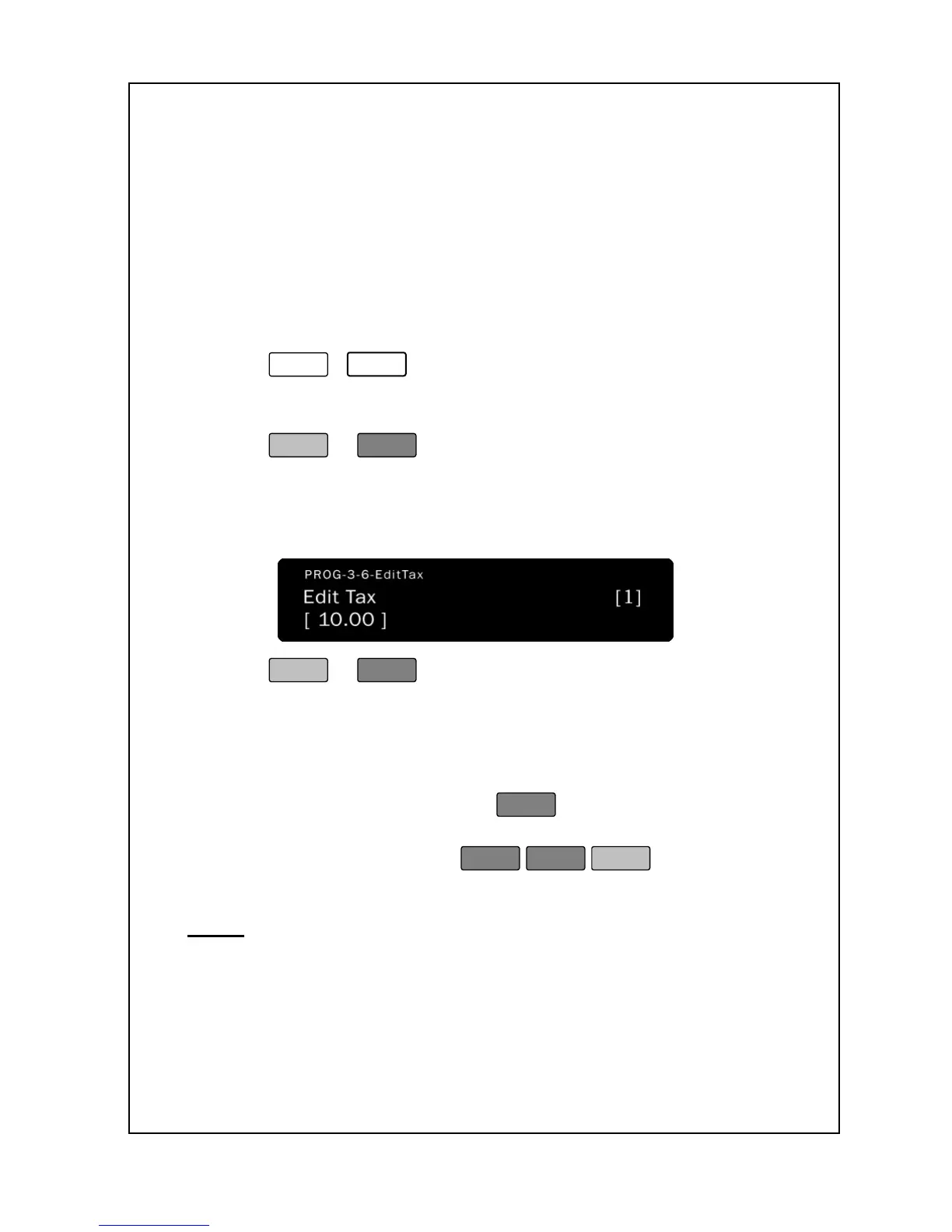

3. Enter the tax number you wish to edit. This number must be from

1 to 10. You will see the tax number in the Total Price Display.

4. Press

.

5. Type a percentage of tax that you wish to use for this tax. The tax

percentage must be from 0 to 99.99. As you type the percentage

of tax, you will see it displayed in the Alpha Display.

6. Press

.

7. The tax name was stored and the scale automatically moves on

to the next sale message number which is displayed in the Total

Price display.

8. If you wish to program the next tax name, then you can go

back to step 5; otherwise, press

.

9. You can go back to step 3 to specify another tax number you may

wish to edit or you can press

to finish.

10. You are back in the Initial State.

Note

1

:

If the PLUs data, account, Store name, Group, Operator, Sale

message, and Tax in the master scale is changed, the master scale

sends the changed data to the slave scale. If the PLUs data and

account in the slave scale is changed, the slave scale sends the

changed data to the master scale. If Store name, Group, Operator,

Sale message, and Tax in slave scale is changed, the slave scale

dose not send it to master.

Loading...

Loading...