VICTOR TECHNOLOGY

29

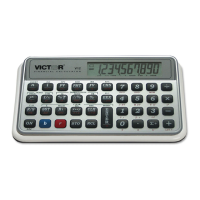

9.172009 ENTER

9.17

Enters purchase date

11.022017 b PRICE

89.14

Enters maturity date and

calculates bond price (as a % of Par)

.+.

90.98

Calculates total bond price including accrued

interest

To Calculate Bond Yield to Maturity (.b YTM )

¾ Enter quoted Bond price (as a % of Par); touch PV

¾ Enter coupon rate; touch PMT

¾ Enter purchase date; touch ENTER

¾ Enter redemption date; touch .b YTM

Example

Using the Bond described above, what is the Yield to Maturity if the market

quote for the Bond is 91.42?

ENTRIES DISPLAY

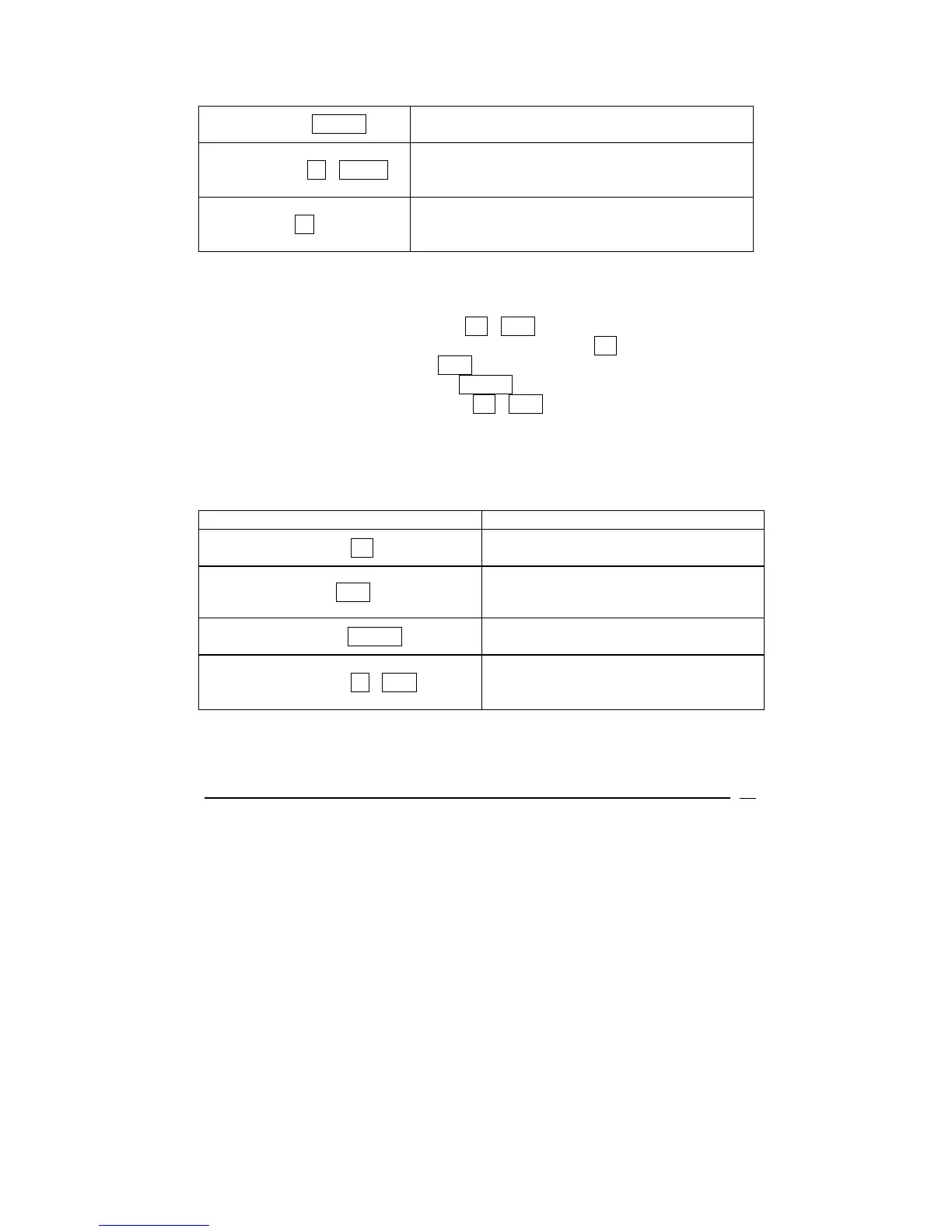

91.42 PV

91.42

Enters market quote

4.9 PMT

4.90

Enters coupon rate

9.172009 ENTER

9.17

Enters purchase date

11.022017 b YTM

6.26

Enters Maturity Date and calculates

yield to maturity

To Calculate Bond Price and Yield for 30/360 Day Basis Bonds with a

semiannual coupon, please reference V12 programming guide at

www.VictorV12.com

.

Loading...

Loading...