- 12 -

EO3-11070

MA-1650-4 SERIES

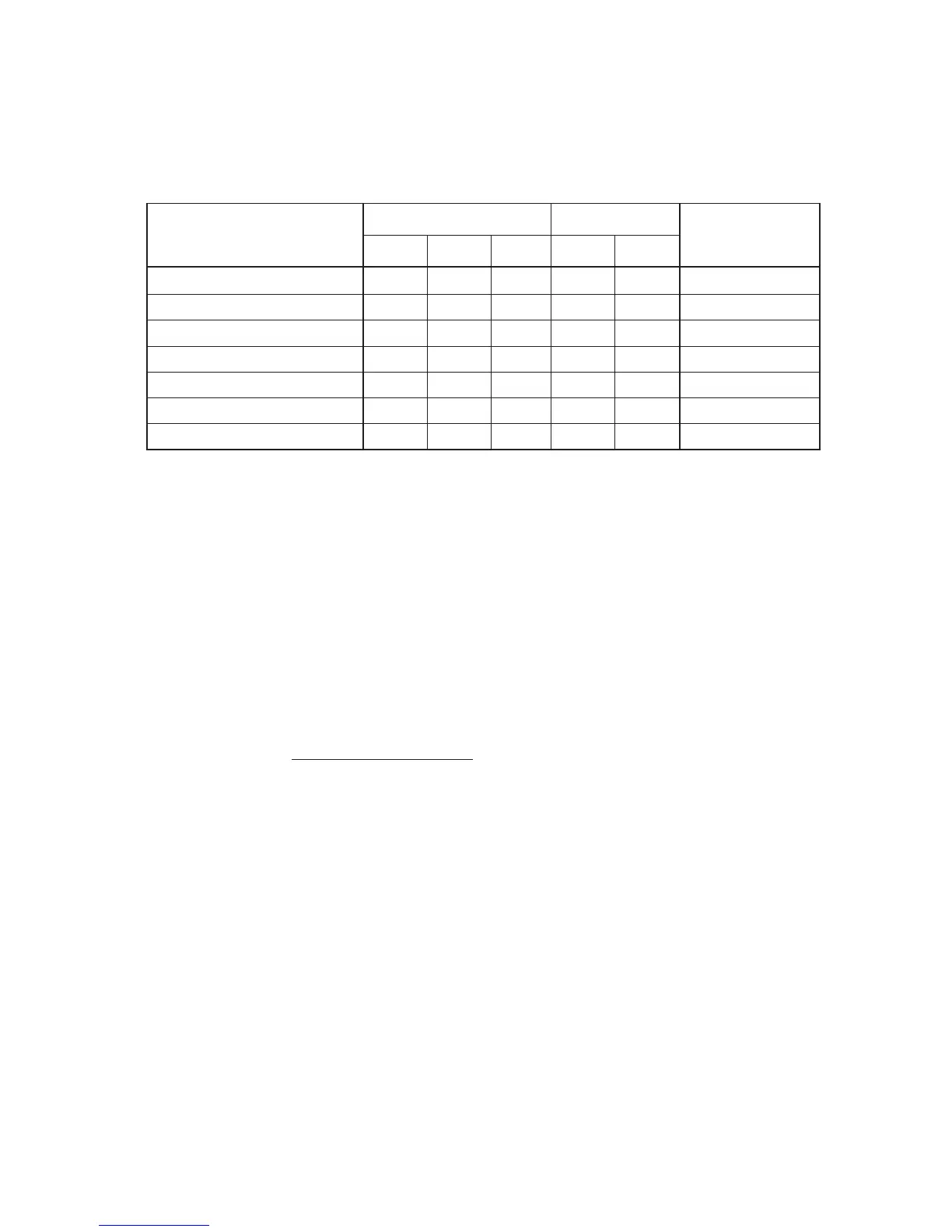

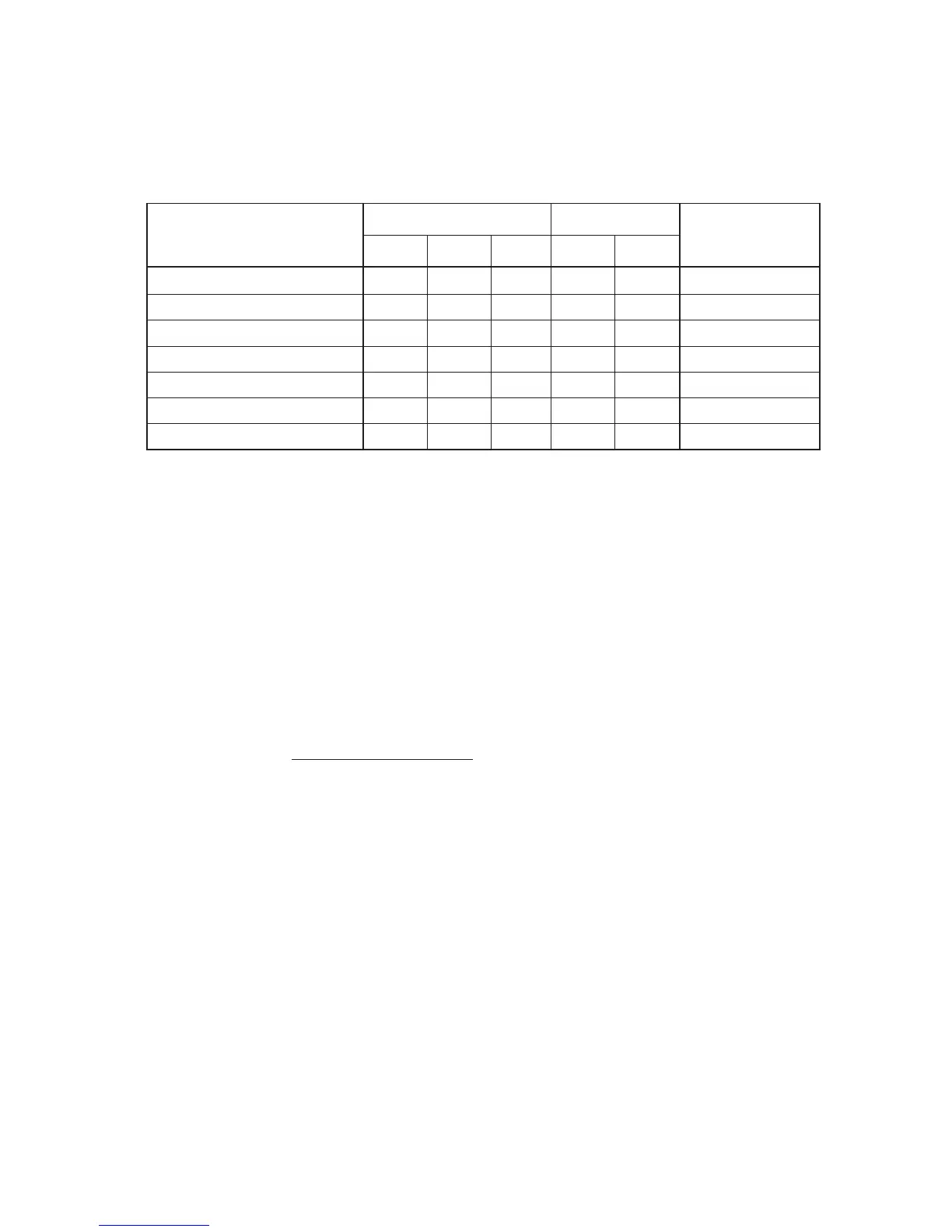

NAME OF TOTAL/COUNTER

DAILY

GT

REMARKS

COUNTER

DIGITS

COUNTER

TYPE

TOTAL

DIGITS

COUNTER

DIGITS

TOTAL

DIGITS

Hourly Range Reset Counter 4 ENTRY

PLU Reset Counter 4 ENTRY 4

Department Reset Counter 4 ENTRY 4

Financial Reset Counter 4 ENTRY 4

PLU Group Reset Counter 4 ENTRY 4

Salesperson Reset Counter 4 ENTRY

Credit Card Co. Reset Counter 4 ENTRY 4

Others

MEMORY BALANCE:

1. GT (Grand Total) = Sum of Daily GS (Gross Sale)

2. NET GT = Sum of Daily All-media Sales

3. GS (Gross Sale) = (Sum of Positive Depts) + (Sum of Taxes)*** + (%+) + (Item Correct) + (Void) +

(%- on Line Items) + (Dollar Discount on Line Items) + (Store Coupon) +

(Returned merchandise) + (Negative Tax)*** + (Negative Mode Total) + (All Void) +

(GST)

4. Net Sale With Tax = (Sum of All Depts)* + (Sum of Taxes)*** + (%+)+ (GST)

= (GS) - (Item Correct) - (Void) - (%- on Line Items) - (Dollar Discount on Line Items) -

(Store Coupon) - (Sum of Negative Depts) - (Returned Merchandise) -

(Negative Tax)*** - (Negative Mode Total) - (All Void)**

5. All-media Sales = (Net Sale With Tax) - (%- on Subtotal) - (Vendor Coupon) - (Dollar Discount ) -

(Bottle Return)

± (Selective Itemizer Totals) + (Positive Other Income Depts)

| - (Negative Other Income Dept)

(when the option “SI/TL Add to or Subtract from sale” is selected)

= (Cash Sales) + (Check Sales) + (Charge Sales) + (Misc. Sales) + (Media-Coupon Sales)

+ (Food Stamp Sales) + (Previous Balance Sales) + (Credit 1 to 4 Sales)

6. Sum of Hourly Range Sales = Net Sale With Tax (US Balance)

... if Financial Reset Report and Hourly Range Reset Report are taken at the same time

7. Sum of Hourly Range Sales = Net Sale Without Tax (Canada Balance)

... if Financial Reset Report and Hourly Range Reset Report are taken at the same time

8. Negative Mode Total = GS in the Negative Mode

9. Net Sale Item Count per Customer = (Item Count of Net Sale with Tax)

÷ (Customer Count of All-media Sales )

Net Sale per Customer = (Amount of Net Sale without Tax)

÷ (Customer Count of All-media Sales)

(Sum of All Depts)* = (Sum of Positive Depts) + (Sum of Negative Depts) but excluding Other Income Depts

(All Void)** = (Sum of the amount processed into the GS memory by the time of All Voiding)

(Sum of Taxes)***, (Negative Tax)*** = (Amount of exclusive taxes only, inclusive taxes are excluded.)

Inclusive tax feature is applicable for V1.9 or after.

Loading...

Loading...