– 44 –

EO1-11097

SELECTIVE ITEMIZER (SI) TOTAL READ

. [SI/TL] (for Single-SI Machine)

([SI1/TL] and/or [SI/2/TL] for Dual-SI machine)

The SI total is displayed and printed on the journal

(and printed on receipt if so programmed.)

NOTE: The fraction process method is fixed to Round OFF.

TAX CALCULATION AND PRINT

Your register has been programmed with proper tax tables (tax breaks and/or tax rates). Each department

or PLU has been programmed with proper tax status, i.e. taxable or non-taxable status of each Tax (of

maximum 4 taxes of Tax 1 to Tax 4, and GST).

On finalizing a sale, the taxes due are automatically calculated and printed on the receipt, and thus added

to the sale.

Whether all taxes (Tax 1 to Tax 4, and GST) are consolidated into one line print or individually printed in

separate lines is a program option.

TAX EXEMPTION

Exemption from Selective Taxes

Examples)

[TX1/M] [EX] Sale Finalization ... to exempt from Tax 1 only

[GST/M] Sale Finalization ... to exempt from GST only

[TX1/M] [TX2/M] [EX] Sale Finalization ... to exempt from Tax 1 & Tax 2

[TX1/M] [TX2/M] [TX3/M] [EX] Sale Finalization ... to exempt from Tax 1, Tax 2, & Tax 3

Exemption from All Taxes

[EX] Sale Finalization

[TX1/M] [TX2/M] [TX3/M] [TX4/M] [EX]

Sale Finalization

NOTE: On depressing [EX], the sale total including the exempted tax(es) is displayed and pre-taxed

amount of the sale portion subject to the tax exemption is printed.

OPERATION

---

---

.......

SNACK $10.00TS

SI1 TL -0.70

TAX $0.60

CASH $ 9 . 9 0

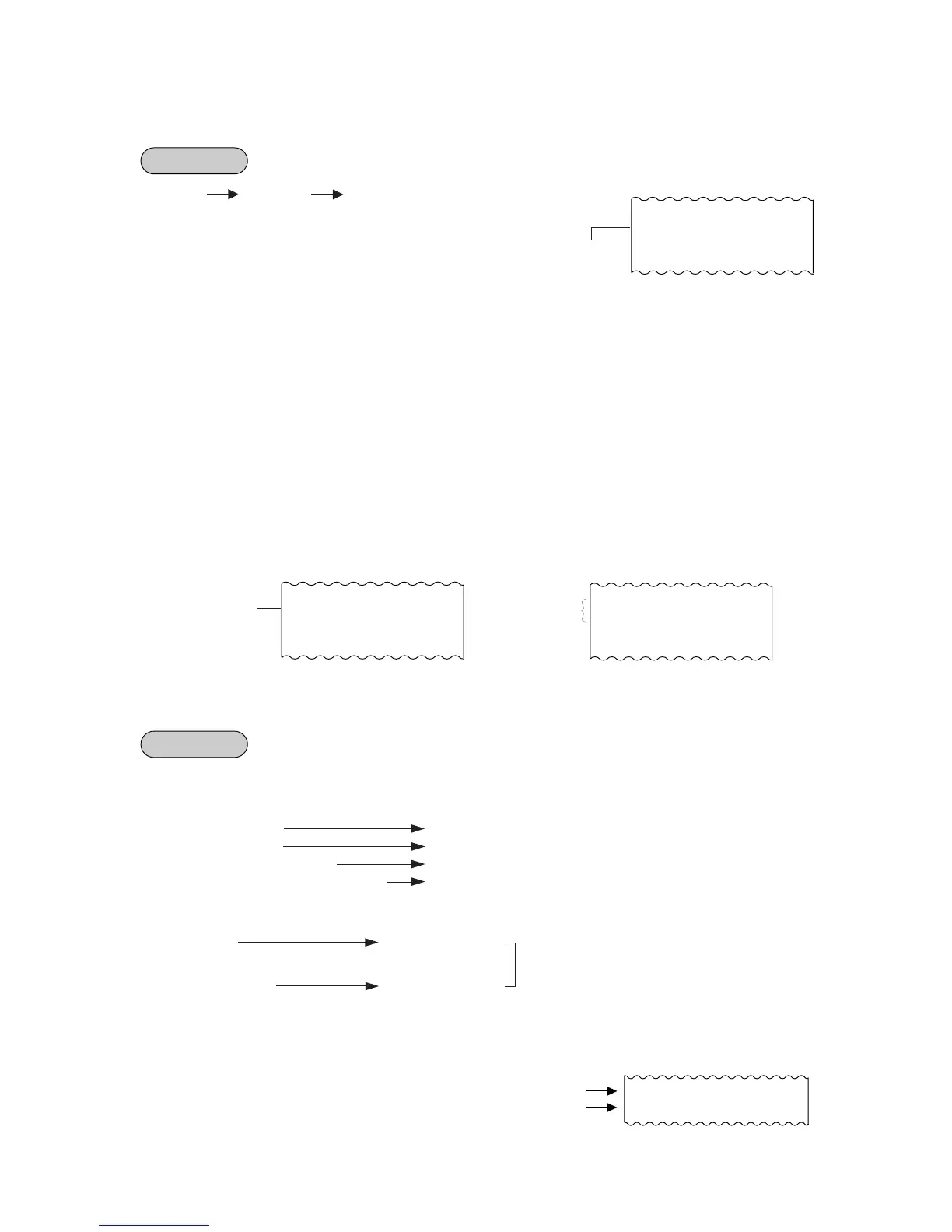

-- Journal Print Format --

SI Total Calculated

TAX1 $2.48

TAX2 $0.66

CASH $ 1 6 . 3 4

TAX $3.14

CASH $ 1 6 . 3 4

-- Receipt Print Format --

Example of

Consolidated

Print Line

Example of

Separate Print

Lines

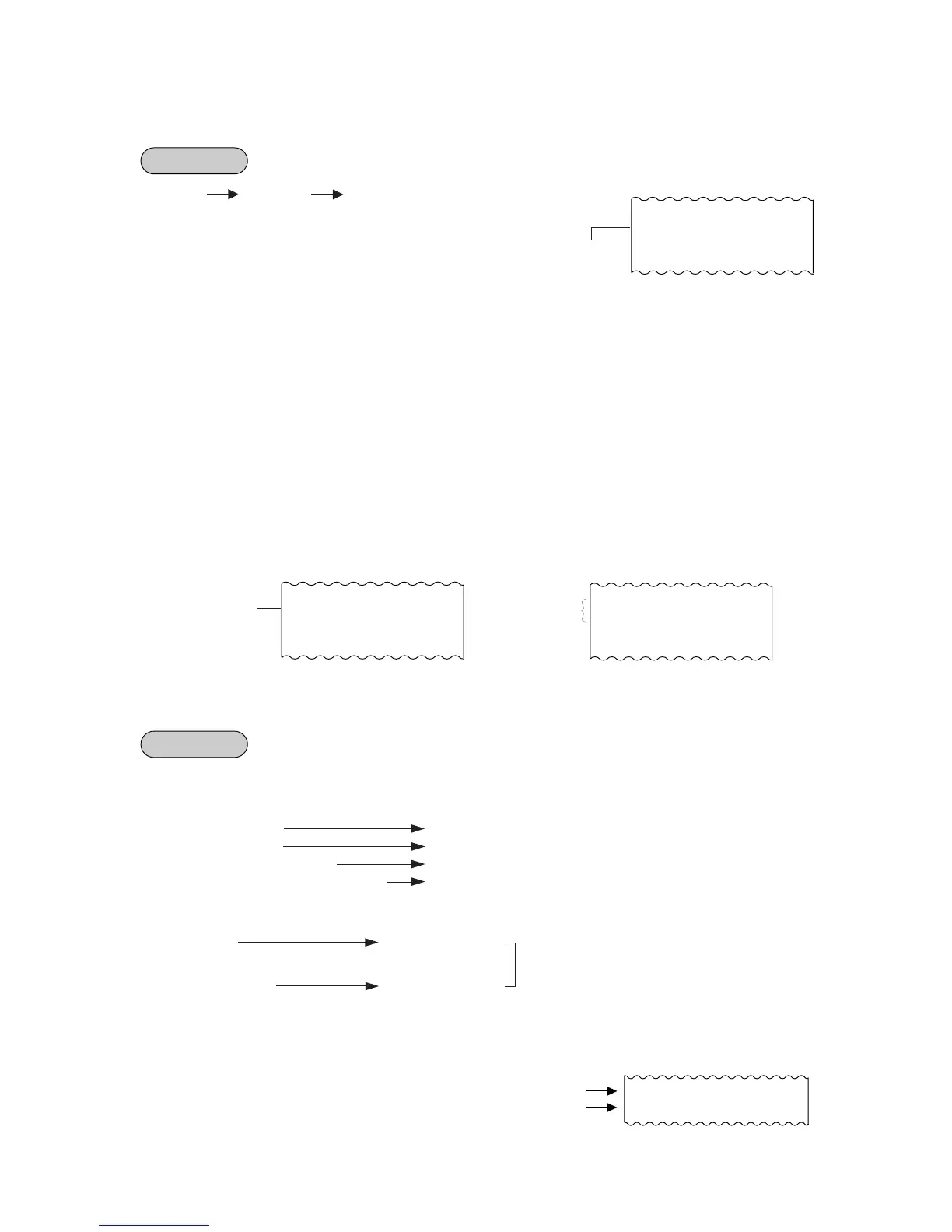

to exempt from all taxes.

TAX1EX $9.90

TAX2EX $3.30

OPERATION

-- Receipt Print Format --

Pre-taxed amount of the sale portion subject to Tax1 Exemption

Pre-taxed amount of the sale portion subject to Tax2 Exemption

Loading...

Loading...