Chapter 11: Financial Application 192

Cost/Sell/Margin

CST = SEL

100

MRG

1 –

SEL =

100

MRG

1 –

CST

MRG(%) =

SEL

CST

1 –

× 100

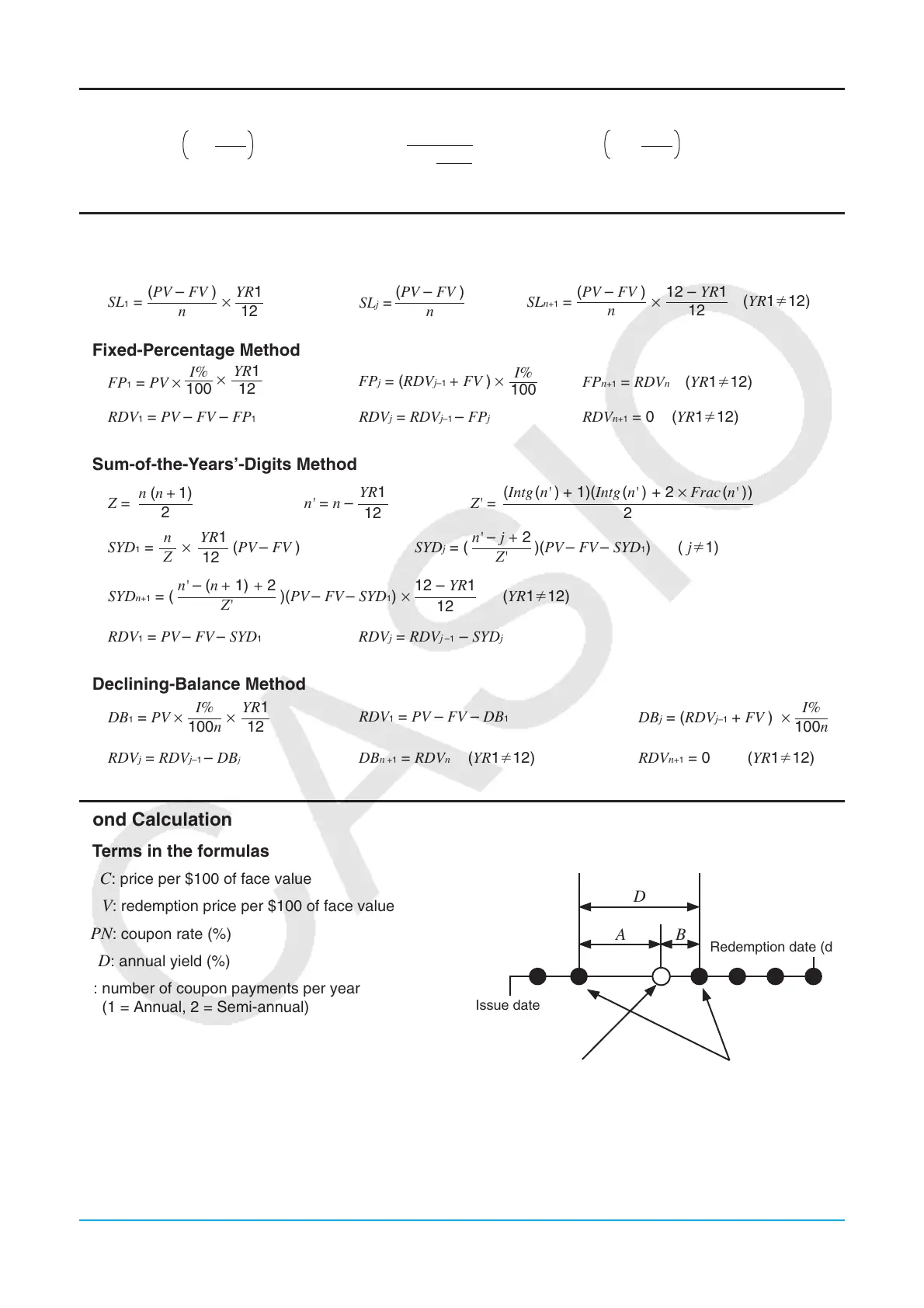

Depreciation

u Straight-Line Method

YR1(PV – FV )

SL

1 =

n 12

×

(PV – FV )

SL

j =

n

12 – YR1

(YR112)

(PV – FV )

n 12

×

SLn+1 =

u Fixed-Percentage Method

100

YR1

I%

FP

1 = PV ×

12

×

100

I%

FP

j = (RDVj–1 + FV ) ×

FP

n+1 = RDVn (YR112)

RDV1 = PV – FV – FP1

RDV

j = RDVj–1 – FPj

RDV

n+1 = 0 (YR112)

u Sum-of-the-Years’-Digits Method

n (n + 1)

Z =

2

2

(Intg(n' ) + 1)(Intg(n' ) + 2 × Frac(n' ) )

Z' =

SYD

1 =

YR1

12

n

Z

× (PV

– FV )

n' – j + 2

Z'

)(PV

– FV – SYD1)( j1)SYDj = (

RDV1 = PV – FV – SYD1

RDVj = RDVj –1 – SYDj

n' – (n + 1) + 2

Z'

)(PV

– FV – SYD1)(YR112)

12 – YR1

12

×SYD

n+1 = (

12

YR1

n' = n –

u Declining-Balance Method

100n

YR1I%

B1 = PV ×

12

×

RDV

1 = PV – FV – DB1

100n

I%

×

DB

j = (RDVj–1 + FV )

RDV

j = RDVj–1 – DB

(YR112)

DB

n +1 = RDVn

(YR112)

RDV

n+1 = 0

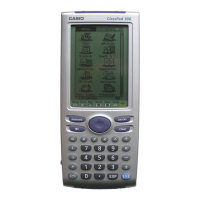

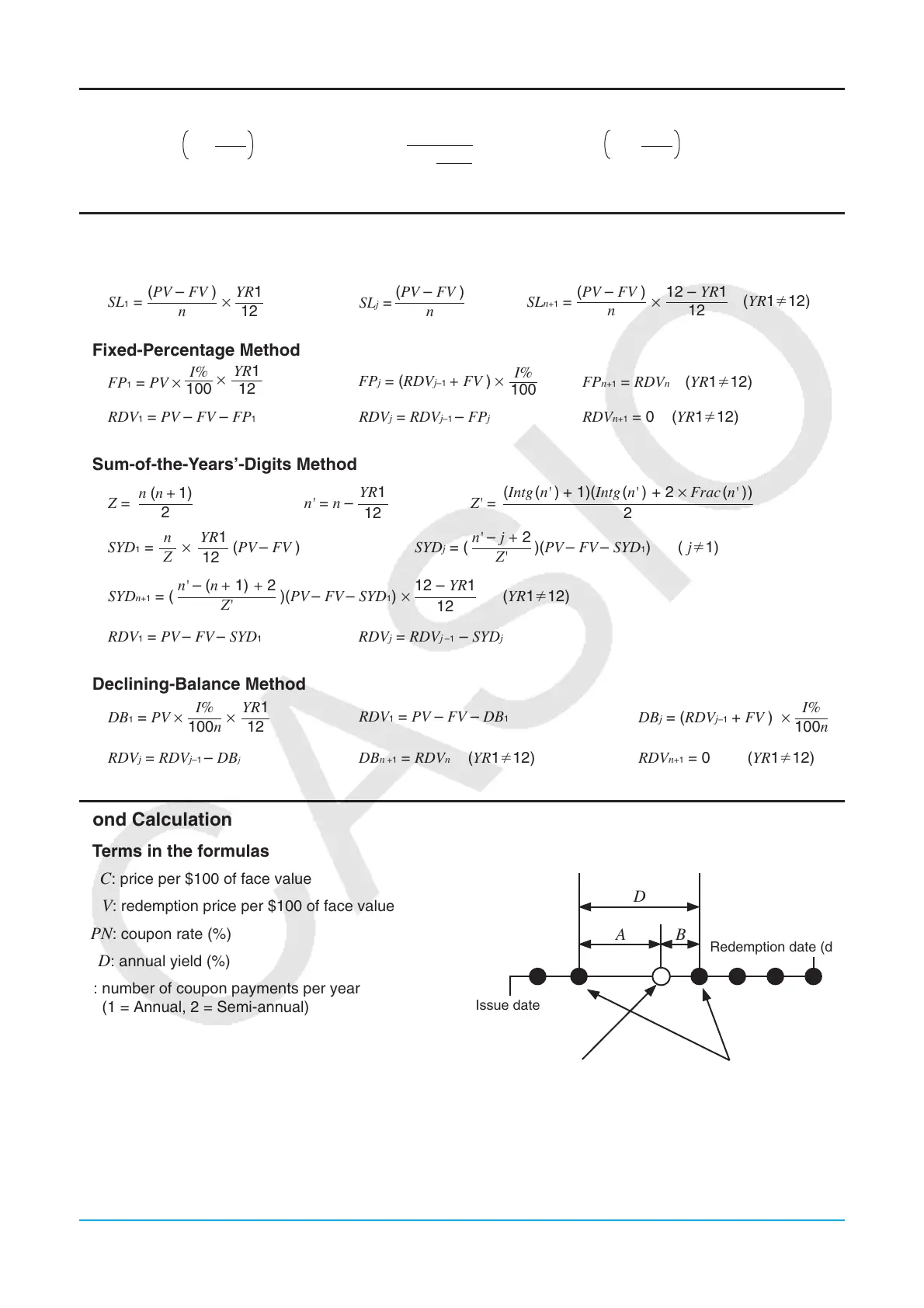

Bond Calculation

u Terms in the formulas

PRC

: price per $100 of face value

RDV: redemption price per $100 of face value

CPN: coupon rate (%)

YLD: annual yield (%)

M: number of coupon payments per year

(1 = Annual, 2 = Semi-annual)

N: number of coupon payments until maturity (n is

used when “Term” is specified for “Bond Interval”.)

INT: accrued interest

CST: price including interest

A: accrued days

D: number of days in coupon period where settlement occurs

B: number of days from purchase date until next coupon payment date = D – A

D

Issue date

Redemption date (d2)

Purchase date (d1) Coupon payment dates

AB

Loading...

Loading...