Chapter 11: Financial Application 195

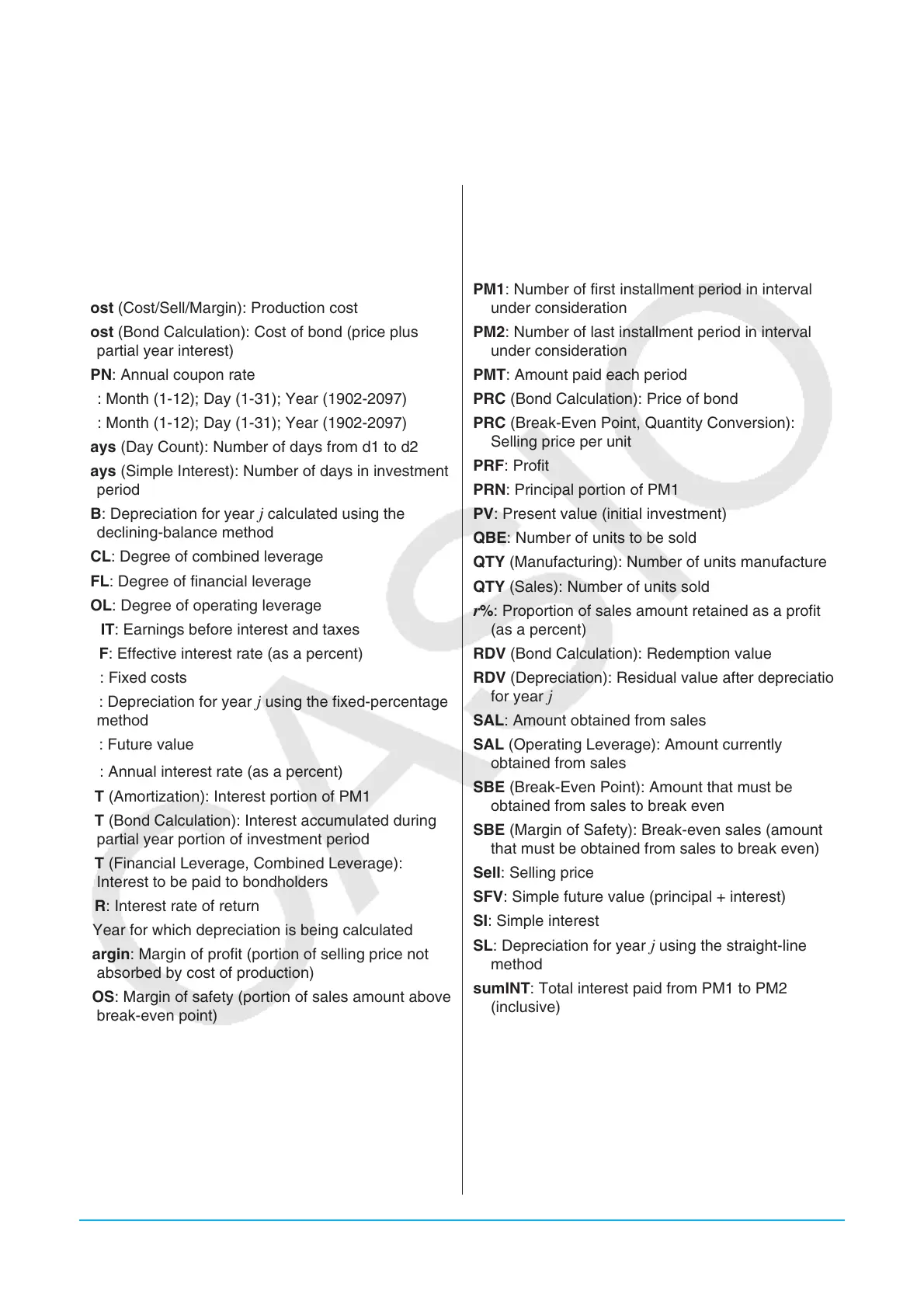

11-5 Input and Output Field Names

The list below shows the names of the input and output fields displayed on the various Financial application

pages. When performing a calculation on your ClassPad, you can also get information using the [Help] tab.

APR: Nominal interest rate (as a percent)

BAL: Balance of principal after PM2

C/Y: Number of times interest is compounded per

year

Cash: List of income or expenses (up to 80 entries)

Cost (Cost/Sell/Margin): Production cost

Cost (Bond Calculation): Cost of bond (price plus

partial year interest)

CPN: Annual coupon rate

d1: Month (1-12); Day (1-31); Year (1902-2097)

d2: Month (1-12); Day (1-31); Year (1902-2097)

Days (Day Count): Number of days from d1 to d2

Days (Simple Interest): Number of days in investment

period

DB: Depreciation for year

j calculated using the

declining-balance method

DCL: Degree of combined leverage

DFL: Degree of financial leverage

DOL: Degree of operating leverage

EBIT: Earnings before interest and taxes

EFF: Effective interest rate (as a percent)

FC: Fixed costs

FP: Depreciation for year

j using the fixed-percentage

method

FV: Future value

NFV: Net future value

NPV: Net present value

P/Y: Number of installment periods per year

PBP: Payback period

PM1: Number of first installment period in interval

under consideration

PM2: Number of last installment period in interval

under consideration

PMT: Amount paid each period

PRC (Bond Calculation): Price of bond

PRC (Break-Even Point, Quantity Conversion):

Selling price per unit

PRF: Profit

PRN: Principal portion of PM1

PV: Present value (initial investment)

QBE: Number of units to be sold

QTY (Manufacturing): Number of units manufactured

QTY (Sales): Number of units sold

r%: Proportion of sales amount retained as a profit

(as a percent)

RDV (Bond Calculation): Redemption value

RDV (Depreciation): Residual value after depreciation

for year

j

SAL: Amount obtained from sales

SAL (Operating Leverage): Amount currently

obtained from sales

SBE (Break-Even Point): Amount that must be

obtained from sales to break even

SBE (Margin of Safety): Break-even sales (amount

that must be obtained from sales to break even)

Sell: Selling price

SFV: Simple future value (principal + interest)

SI: Simple interest

SL: Depreciation for year

j using the straight-line

method

sumINT: Total interest paid from PM1 to PM2

(inclusive)

sumPRN: Total principal paid from PM1 to PM2

(inclusive)

SYD: Depreciation for year

j using the sum-of-the-

years’-digits method

VC: Variable cost for a certain level of production

VCU: Variable cost per unit

YLD: Yield to maturity (as a percent)

YR1: Number of depreciable months in first year

I%: Annual interest rate (as a percent)

INT (Amortization): Interest portion of PM1

INT (Bond Calculation): Interest accumulated during

partial year portion of investment period

INT (Financial Leverage, Combined Leverage):

Interest to be paid to bondholders

IRR: Interest rate of return

j: Year for which depreciation is being calculated

Margin: Margin of profit (portion of selling price not

absorbed by cost of production)

MOS: Margin of safety (portion of sales amount above

break-even point)

N (Bond Calculation): Number of periods

N (Compound Interest): Number of installment

periods

N (Depreciation): Number of years over which

depreciation occurs

N (Interest Conversion): Number of times interest is

compounded per year

Loading...

Loading...