7-16

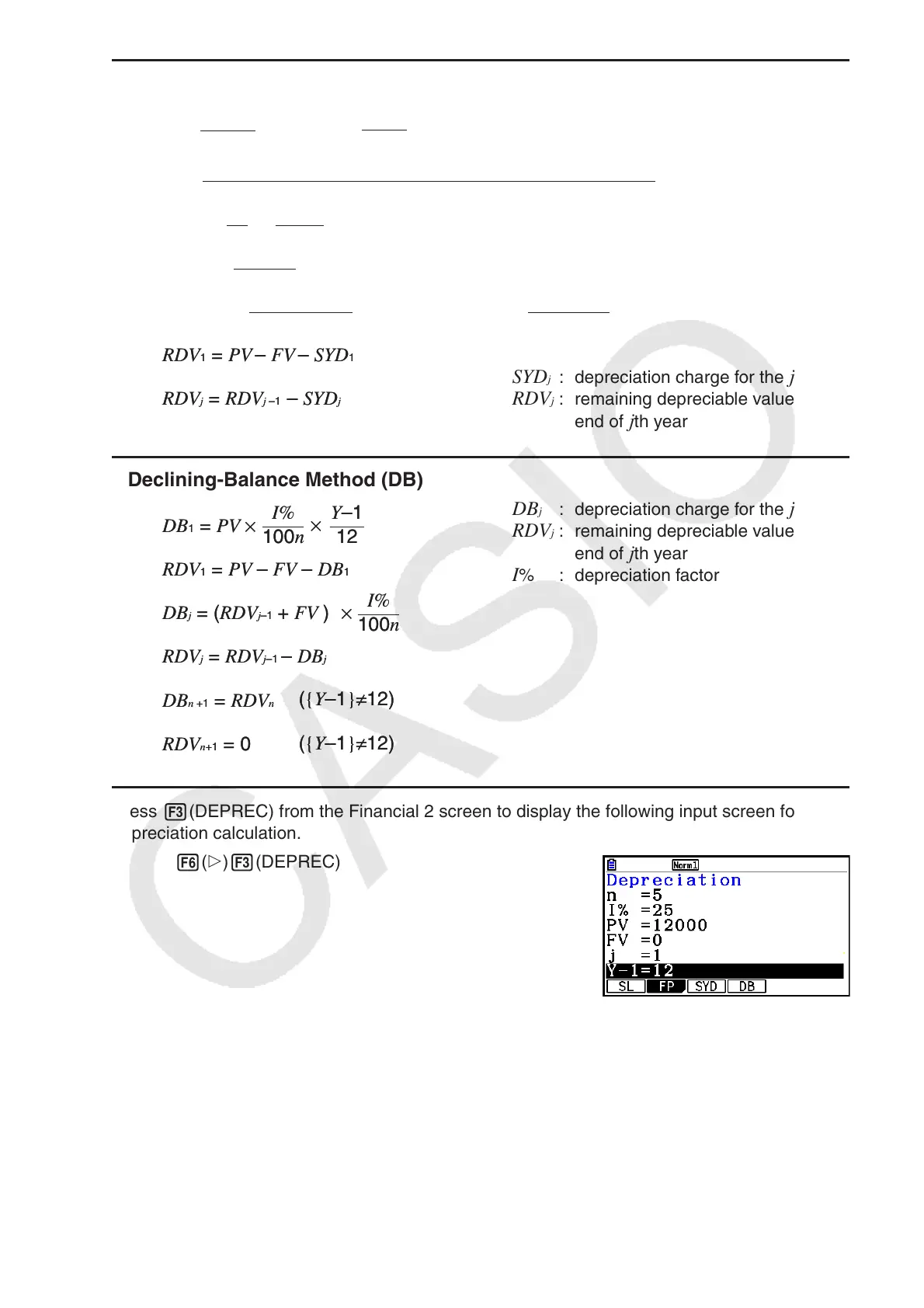

u Sum-of-the-Years’-Digits Method (SYD)

SYD j : depreciation charge for the j th year

RDV j : remaining depreciable value at the

end of

j th year

u Declining-Balance Method (DB)

DB

j : depreciation charge for the j th year

RDV j : remaining depreciable value at the

end of j th year

I % : depreciation factor

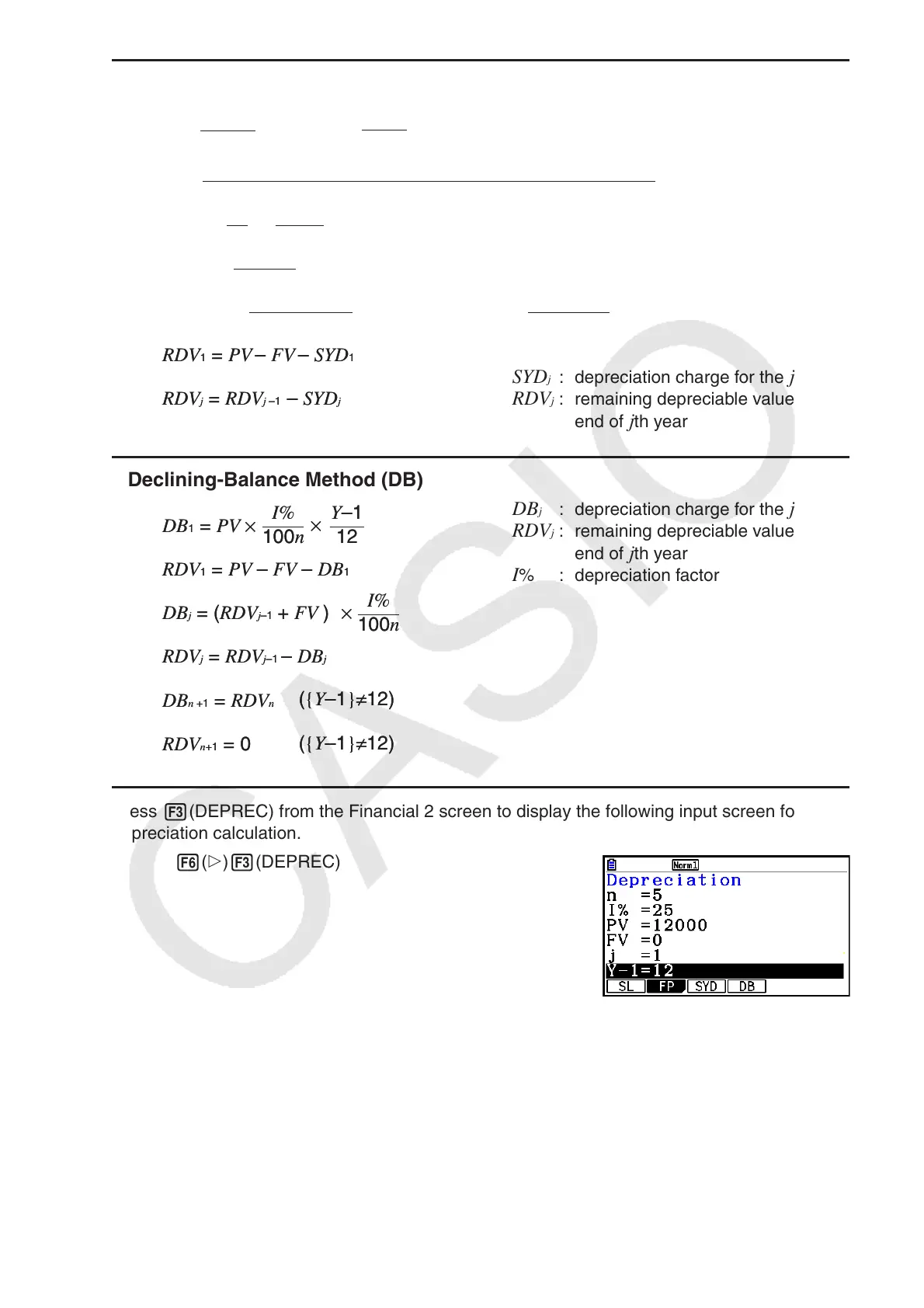

Press 3(DEPREC) from the Financial 2 screen to display the following input screen for

depreciation calculation.

6( g) 3(DEPREC)

n ............ useful life

I % ......... depreciation ratio in the case of the fixed percent (FP) method, depreciation factor in

the case of the declining balance (DB) method

P V ......... original cost (basis)

F V ......... residual book value

j ............. year for calculation of depreciation cost

Y −1 ........ number of months in the first year of depreciation

n (n +1)

Z =

2

2

(n' integer part +1)(n' integer part + 2*n' fraction part

)

Z' =

SYD

1 =

{Y–1}

12

n

Z

× (PV

– FV )

n'– j+2

Z'

)(PV

– FV – SYD1)( j≠1)SYDj = (

RDV1 = PV – FV – SYD1

RDVj = RDVj –1 – SYDj

n'– (n +1)+2

Z'

)(PV

– FV – SYD1)({Y–1}≠12)

12–{Y–1}

12

×SYD

n+1 = (

12

{Y–1}

n' = n –

n (n +1)

Z =

2

2

(n' integer part +1)(n' integer part + 2*n' fraction part

)

Z' =

SYD

1 =

{Y–1}

12

n

Z

× (PV

– FV )

n'– j+2

Z'

)(PV

– FV – SYD1)( j≠1)SYDj = (

RDV1 = PV – FV – SYD1

RDVj = RDVj –1 – SYDj

n'– (n +1)+2

Z'

)(PV

– FV – SYD1)({Y–1}≠12)

12–{Y–1}

12

×SYD

n+1 = (

12

{Y–1}

n' = n –

RDV1 = PV – FV – DB1

({Y–1}≠12)

({Y–1}≠12)

100n

Y–1I%

DB

1 = PV ×

100n

I%

12

×

×

DB

j = (RDVj–1 + FV )

RDVj = RDVj–1 – DBj

DBn +1 = RDVn

RDVn+1 = 0

RDV

1 = PV – FV – DB1

({Y–1}≠12)

({Y–1}≠12)

100n

Y–1I%

DB

1 = PV ×

100n

I%

12

×

×

DB

j = (RDVj–1 + FV )

RDVj = RDVj–1 – DBj

DBn +1 = RDVn

RDVn+1 = 0

Loading...

Loading...