RECORD

KEEPER

FUNCT IO NS

Whe

n t he Rec

or

d Keepe r

Mai

nMenu appears ( Figure4

-1

). de

cid

e w

hat

subf

unc-

tio

n yo u wa nt to per for m, type th e

keywo

rd fo r t hat fu

nctio

n, and press i;ijiii;iti.

Then ref er to th eappro pria t e d ire

ct

i on s on t he fo

llo

wi ng pages

of

th is sect io n.

ENTER

Format

Toente r

inf

orm

ati on into the co mp

ute

r and onto th e Data D isk

ett

e. yo u mu st

t yp e th eappro priate d at a and th en pr ess t he 'fiiii;lt' key. Pressing the i;liilli;lfi key

tell s t he p rogra m toente r t he d ata i

nto

th e system .

All

in fo r

matio

n mu st beentered in t he pr op er ti me seq uence. That means

you

canno t enter da ta

for

Ma

rc h and then go back to ent er

data

for

January. Plan

you

rwor k sessio n eac h ti me

befo

re

you

begin .

1. Type t he keyword a nd press ';Ijiii -it'.

2.

After

th e message INSERT THE DAT A DI SK ET T E, p ress ' ·Ijiwli' to co n-

ti nue .

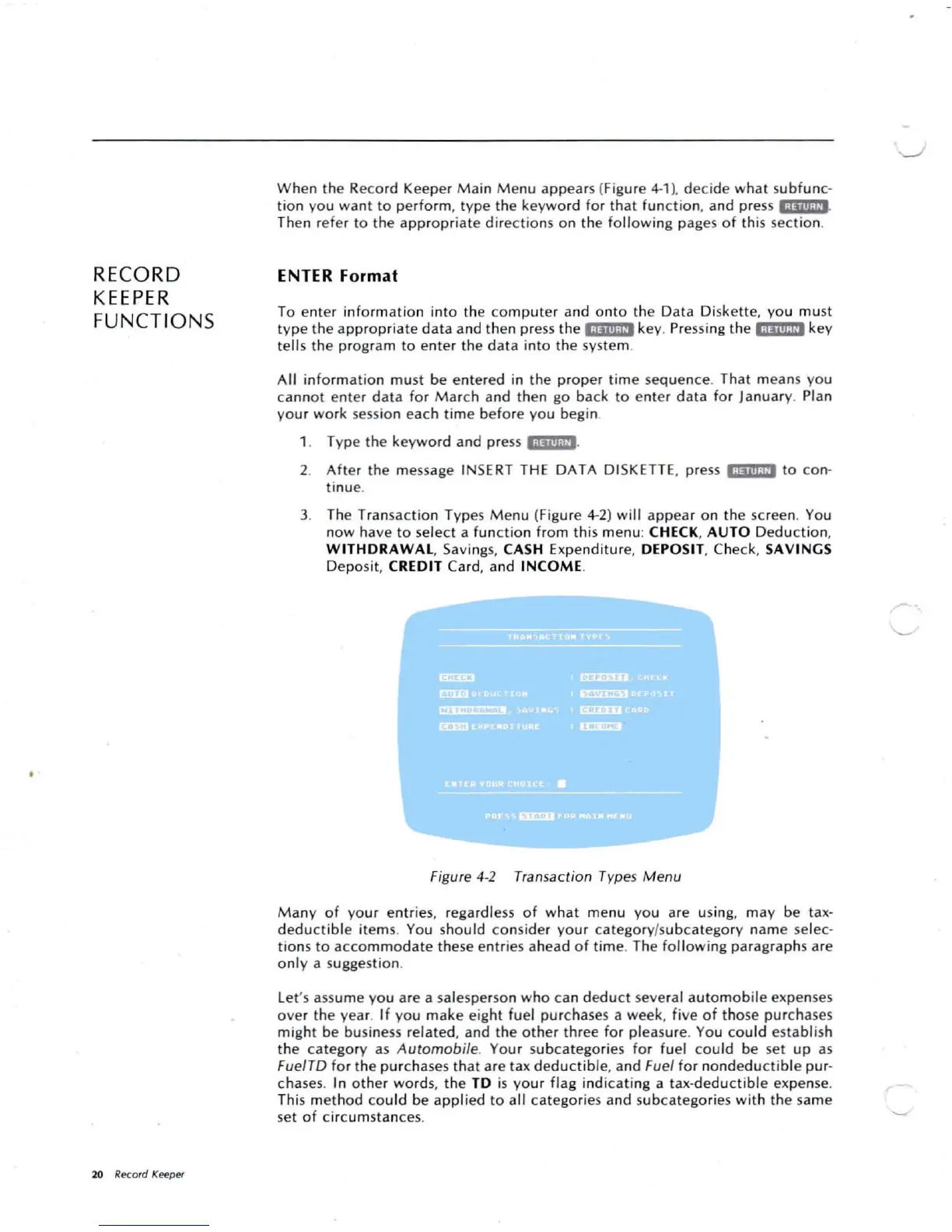

3. The Transact ion Typ es M enu (Figure 4-2) wi ll app ear o n th e scree n. You

n

ow

have to se

lec

t a fun

cti

on

fro

m this menu : CHECK.

AUTO

Dedu

cti

o n.

WITHDRAWAL

, Sa vi ngs. CASH Expen

ditu

re. DEPOSIT . Chec k. SAVINGS

Deposit . CREDIT Card. and

INCOME

.

T

20 Reco rd Keeper

Fi

gur

e 4-2 Transact ion Types M enu

Man

y

of

yo ur entries. regardless of w hat m enu yo u are using. may be tax-

d edu

ctibl

e

it

em s. You sho ul d co nside r y our

catego

ry/subca tego ry nam e selec-

t ion s toa

cco

m

mo

da te th ese entries ahea d o f time. The f

oll

owin

g paragraph s are

o

nly

asugges

tio

n.

Let's ass ume yo u a re a sa lesperson who can

de

d

uct

seve

ral a uto

mobile

expe nses

ove

r the yea r. If yo uma ke eig

ht

fuel purchases a week ,

five

of

th ose purch ases

mi ght be business rela ted . and th eother

thr

ee fo r p lea sure. You co uld esta blish

th e ca tego ry as A

uto

mo

bile

. You r su bc ategories fo r f ue l

cou

ld be set up as

FuelTO f

or

the

pur

ch ases th at are tax dedu ct ib le, and Fuel fo rno ndeduct iblepur-

chases. In ot her

wo

rd s, t he TO is yo ur f lag ind ic at ing a tax-dedu

ct

ibl

e expense.

Th is m

eth

od could be

app

li ed to all cate go ri es and subc ate go r ies w

ith

th e same

se t o f circ umsta nces.

Loading...

Loading...