86

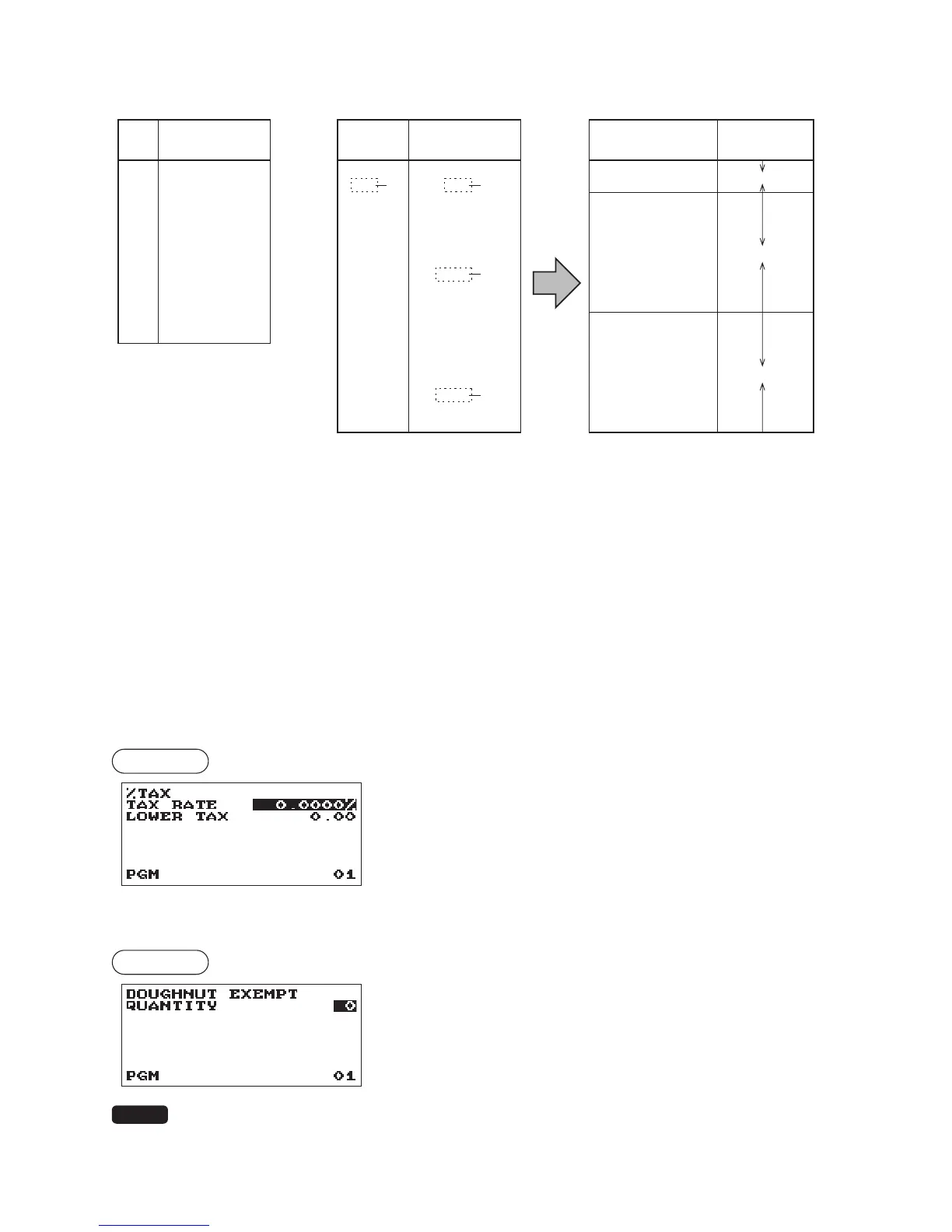

Exampledataofabovetaxtable(8%)

TAXRATE: 8.0000 (enter 8)

CYCLE: 1.00 (enter 100)

INITIALTAX: 0.01 (enter 1)

LOWERTAX: 0.11 (enter 11)

BREAKPOINT1: 0.26 (enter 26)

BREAKPOINT2: 0.47 (enter 47)

BREAKPOINT3: 0.68 (enter 68)

BREAKPOINT4: 0.89 (enter 89)

BREAKPOINT5: 0.89 (enter 89)

BREAKPOINT6:1.11 (enter 111)

BREAKPOINT7:1.11 (enter 111)

BREAKPOINT8: 1.11 (enter 111)

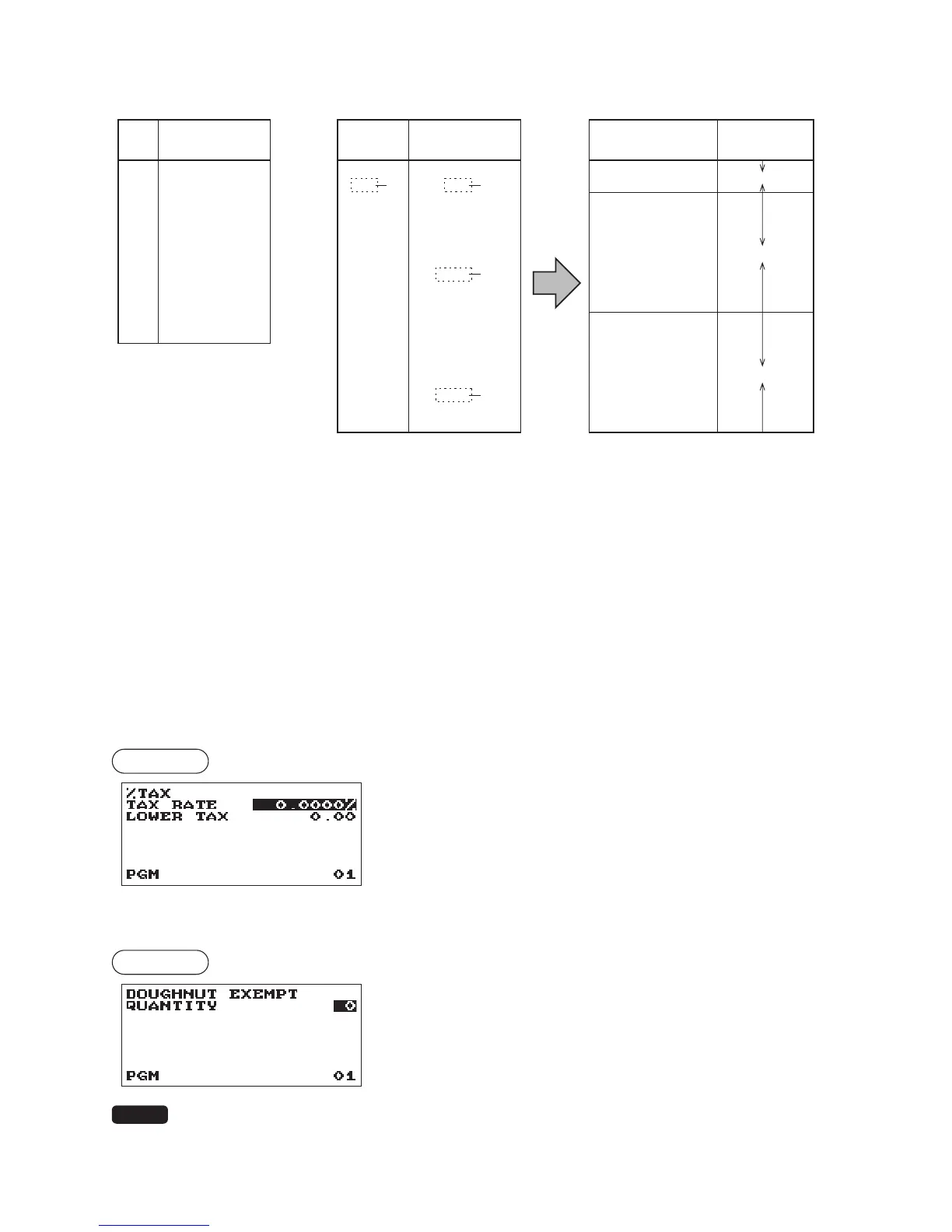

•%Tax

Procedure

Program each item as follows:

•TAXRATE(Usethenumericentry)

Tax rate (max. 7 digits: 0.0000 to 999.9999%).

•LOWERTAX(Usethenumericentry)

Lowest taxable amount (max. 5 digits: 0.00 to 999.99).

■

Doughnutexempt

Procedure

Program each item as follows:

•QUANTITY(Usethenumericentry)

Quantity for doughnut tax exempt (2 digits: 1 to 99/0).

NOTE

The programming is effective for “taxable 1 & taxable 3” items on Canadian tax (CANADA TAX

01 or CANADA TAX 10).

Loading...

Loading...