Chapter 8 Programming Complex Tax Rates

79 TS4240 User’s Guide

Using Canadian Tax Rates

If you are in Canada, this cash register can be set for Canadian tax rates.

If you are using Canadian tax rates, you see the following 4 tax rate

options:

For each tax rate (GST, and each PST), in addition to setting the tax

percentage rate, you can also set a “tax limit”. Set this amount when

setting the tax percentage amount. Just follow the instructions on the

screen.

You can also set Tax-On-Tax or Piggy Back Tax.

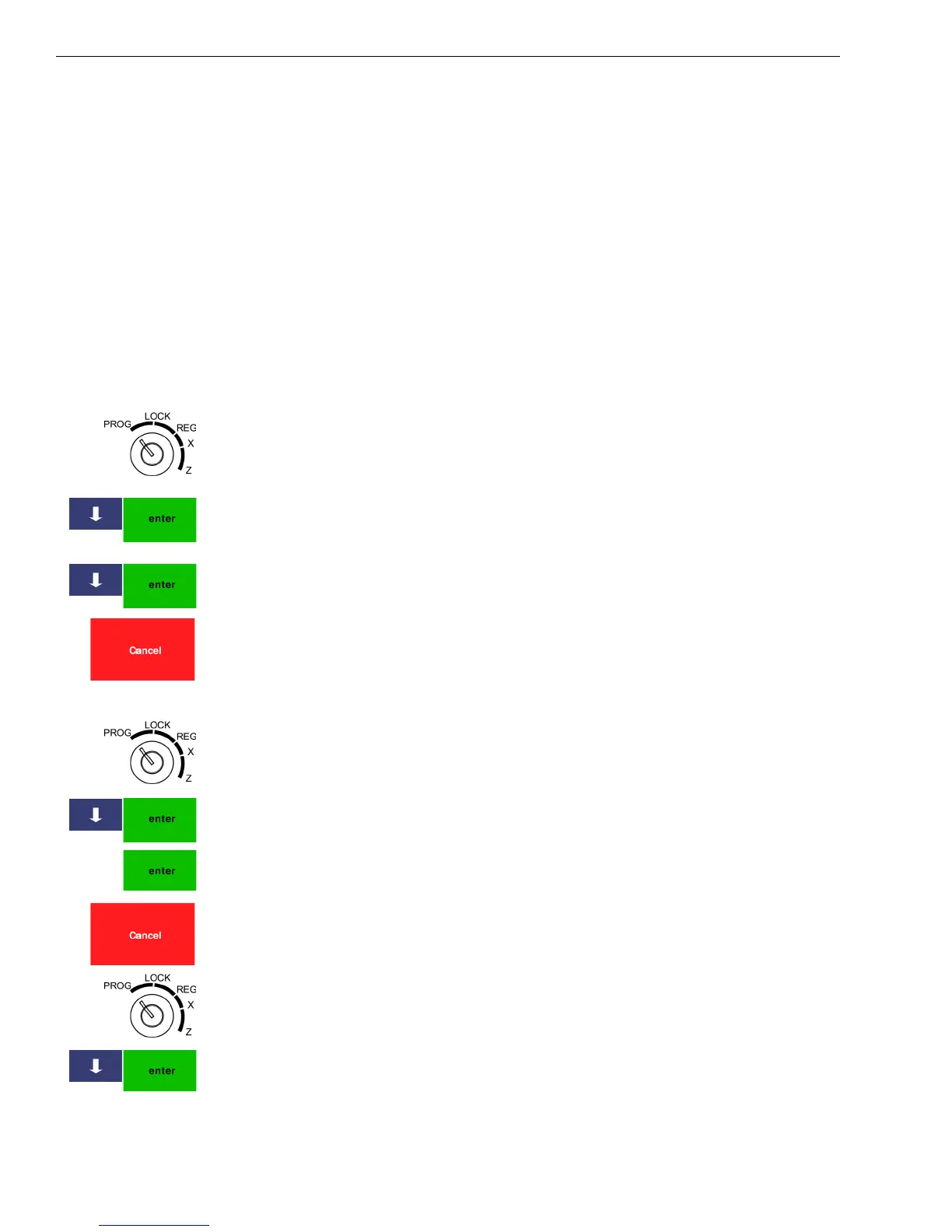

To set the cash register to GST/PST (Canadian tax) format

406 -- OptionsSystem Configuration SettingTax System

1 Put the MGR key in the Mode key slot and turn it to the PROG

position. If prompted, enter the Manager passcode and press Enter.

2 Press the Arrow Down key to select 406 -- Options. Press Enter.

3 Press the Arrow Down key to select System Configuration Setting. Press

Enter.

4 Press the Arrow Down key to select Tax System. Press Enter.

5 Select G ST-P ST.

6 When you are done, press Cancel.

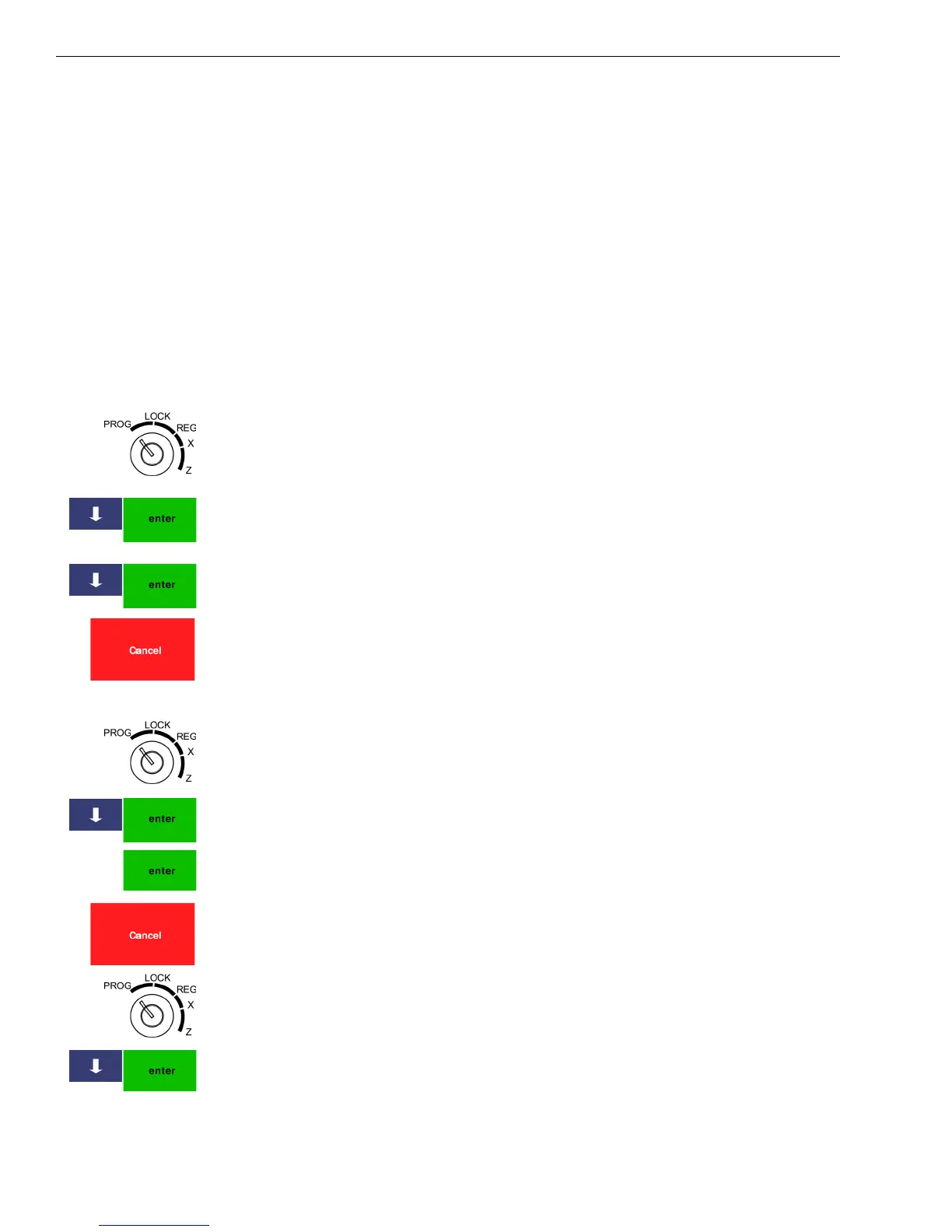

To set Canadian tax rates

404 -- Tax Setting

1 Put the MGR key in the Mode key slot and turn it to the PROG

position. If prompted, enter the Manager passcode and press Enter.

2 Press the Arrow Down key to select 404 -- Tax Setting. Press Enter.

3 Select the item you want to program. Press Enter.

4 Select the rate or limit amount to be changed and press Enter.

5 Follow the instructions on the screen.

6 When you are done, press the Cancel key.

To set Tax-on-Tax

1 Put the MGR key in the Mode key slot and turn it to the PROG

position. If prompted, enter the Manager passcode and press Enter.

2 Press the Arrow Down key to select 404 -- Tax Setting. Press Enter.

3

Press the Arrow Down key to select Tax Limit. Press Enter.

• GST • PST1

• PST2 • PST3

Loading...

Loading...