49

VAT/tax assignment is printed at the fixed right position of the amount on the receipt and bill as

follows:

When the multiple VAT/tax is assigned to a department or a PLU, a smaller number of the

VAT/tax will be printed. For details, contact your authorized SHARP dealer.

■ VAT shift entries

This feature is intended to shift the tax status of a particular department (or PLU) programmed for taxable 1

or taxable 1 and taxable 3.

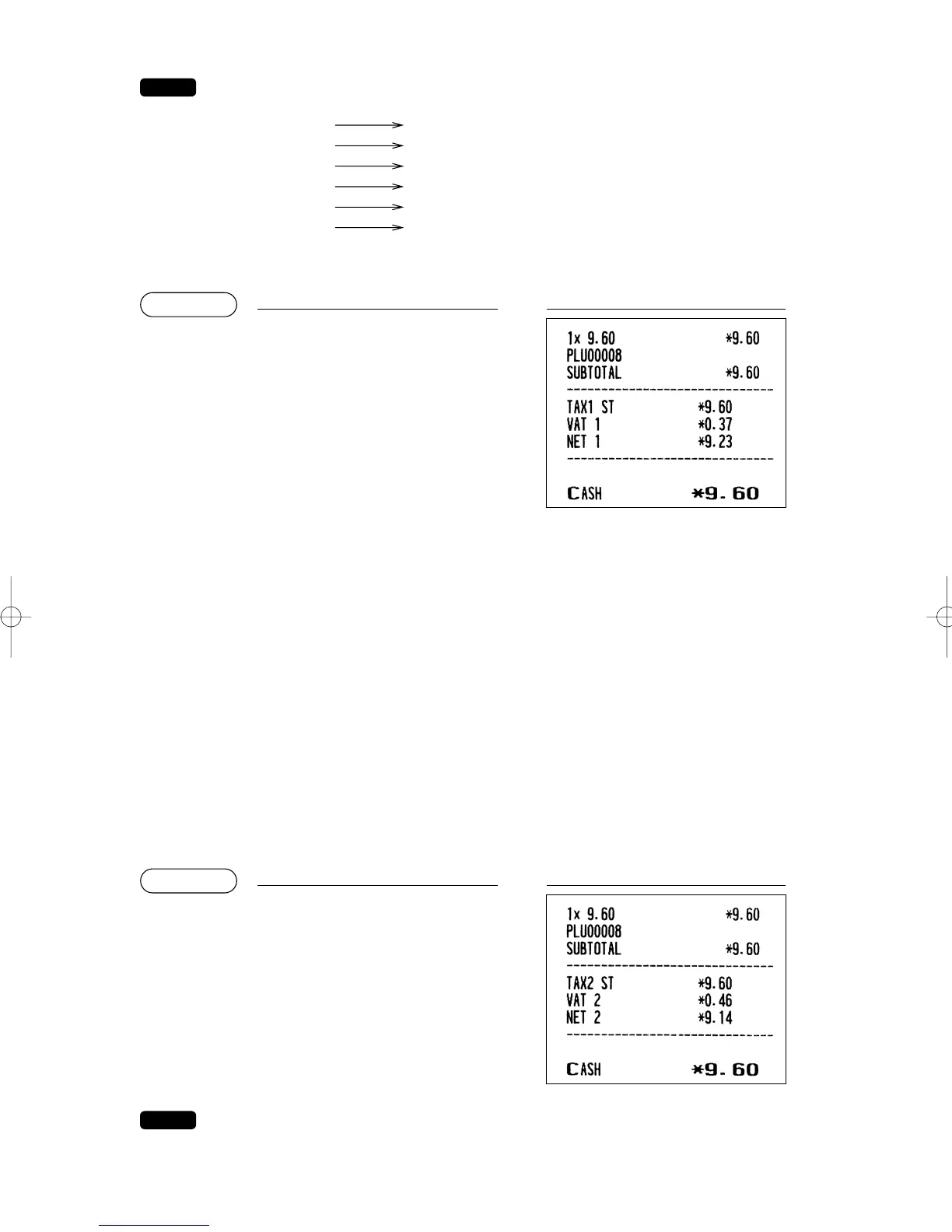

1. When the VAT shift entry is made for a particular department or PLU programmed for taxable 1, their tax

status shifts to taxable 2.

2. When this entry is made for a particular department (or PLU) programmed for taxable 1 and taxable 3, the

tax status “taxable 1” remains unchanged, but the other, “taxable 3” is ignored.

There are two types of VAT shift entries: VAT shift by transaction and by item.

VAT shift by transaction enables the VAT shift function to be in effect during a transaction. Press the

Z

(

w

) key to enter the VAT shift mode at the start of transaction. You can also perform this function by

assigning the clerk to operate in the VAT shift status (PERSONNEL-CLERK programming).

VAT shift by item is valid only for one item. Press the

v

key just before the item entry.

In case of VAT shift by transaction

ER-A280F

• If you want to achieve the VAT shift per item, contact your authorized SHARP dealer.

ER-A280N

• If you need the VAT shift function, contact your authorized SHARP dealer.

Z

8

s

z

A

(When the manual

VAT 1 through 6 system

is selected)

PrintKey operation

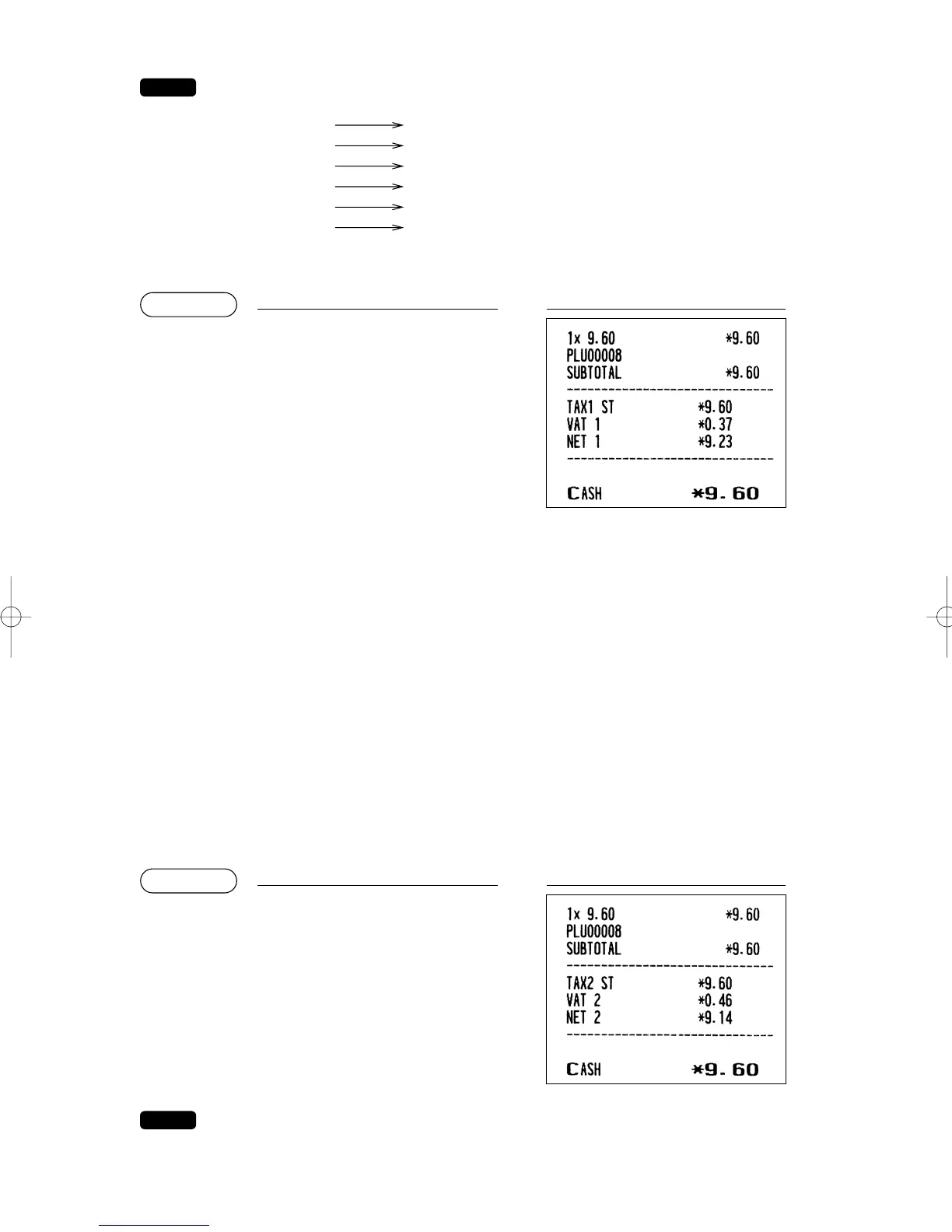

8

s

z

A

(When the manual

VAT 1 through 6

system is selected)

PrintKey operation

VAT1/tax1

VAT2/tax2

VAT3/tax3

VAT4/tax4

VAT5/tax5

VAT6/tax6

A

B

C

D

E

F

ER-A280F_N(SEEG)(E)-2 09.6.18 6:50 AM Page 49

Loading...

Loading...