20060301

k

Example 2

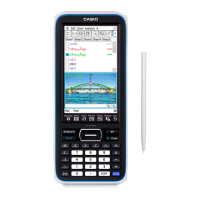

Now calculate the depreciation amount ([SYD]) for the second year (

j

= 2).

Note

• You can also tap [SL] to calculate depreciation using straight-line method, [FP] using fixed-

percentage method, or [DB] using declining-balance method.

• Each depreciation method will produce a different residual value after depreciation (RDV)

for the applicable year (

j

).

Calculation Formulas

k

Straight-Line Method

YR1

(PV–FV )

SL1 =

n

12

×

(PV–FV )

SLj =

n

12– YR1

(YR1G12)

(PV–FV )

n 12

×

SLn+1 =

15-9-3

Depreciation

Loading...

Loading...