Chapter 7 Programming Complex Tax Rates

71 Alpha 710ML User’s Guide

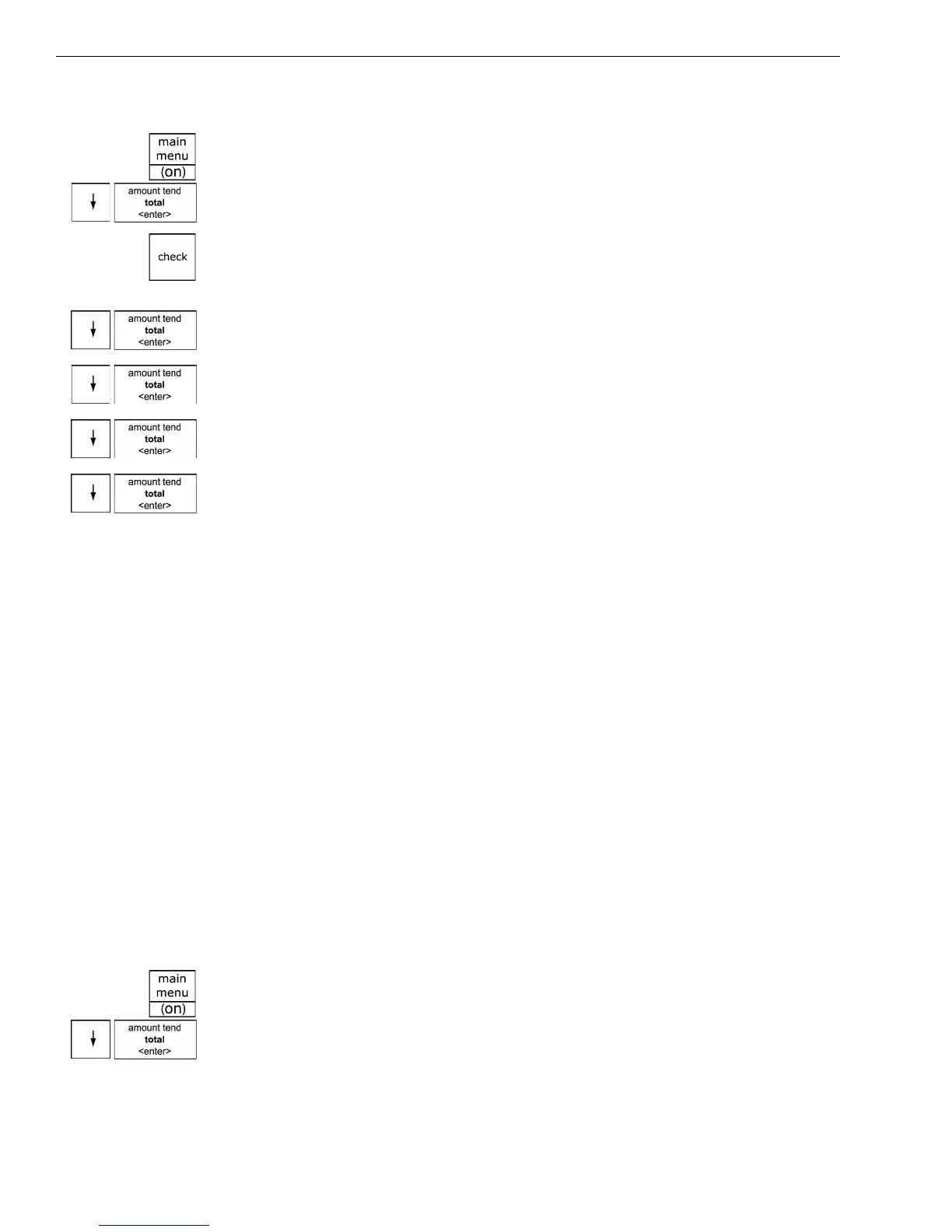

To select a tax system

ProgrammingMore OptionsConfigTax System

1 Press the Main menu (on) key.

2 Press the Arrow Down key to select Programming. Press the Amount

Tend Total <Enter> key.

3 If you are prompted for a Manager Passcode, type the passcode number

and then press the Check key. If you did not program a Manager

Passcode, go to the next step.

4 Press the Arrow Down key to select More Options. Press the Amount

Tend Total <Enter> key.

5 Press the Arrow Down key to select Config. Press the Amount Tend

Total <Enter> key.

6 Press the Arrow Down key to select Tax System. Press the Amount Tend

Total <Enter> key.

7 Select the tax system you want to use. Press the Amount Tend Total

<Enter> key.

8 Now you need to specify the values for the tax rate(s):

• Straight tax values for Tax 1 and, optionally, Tax 2 through 4. See the

next section.

• Table tax values. See Programming Table Tax in the United States on

page 72.

• Canadian tax rates. Using Canadian Tax Rates on page 76.

• VAT tax rates. See Using VAT Tax Rates on page 78.

Programming Straight Add-on Tax in the United States

After you select the tax system to use, you must specify values. This

section explains how to specify straight add-on tax rates for the United

States. Straight add-on tax is the most common in the United States. You

must specify at least 1 tax rate and, optionally, you can specify up to 3

others.

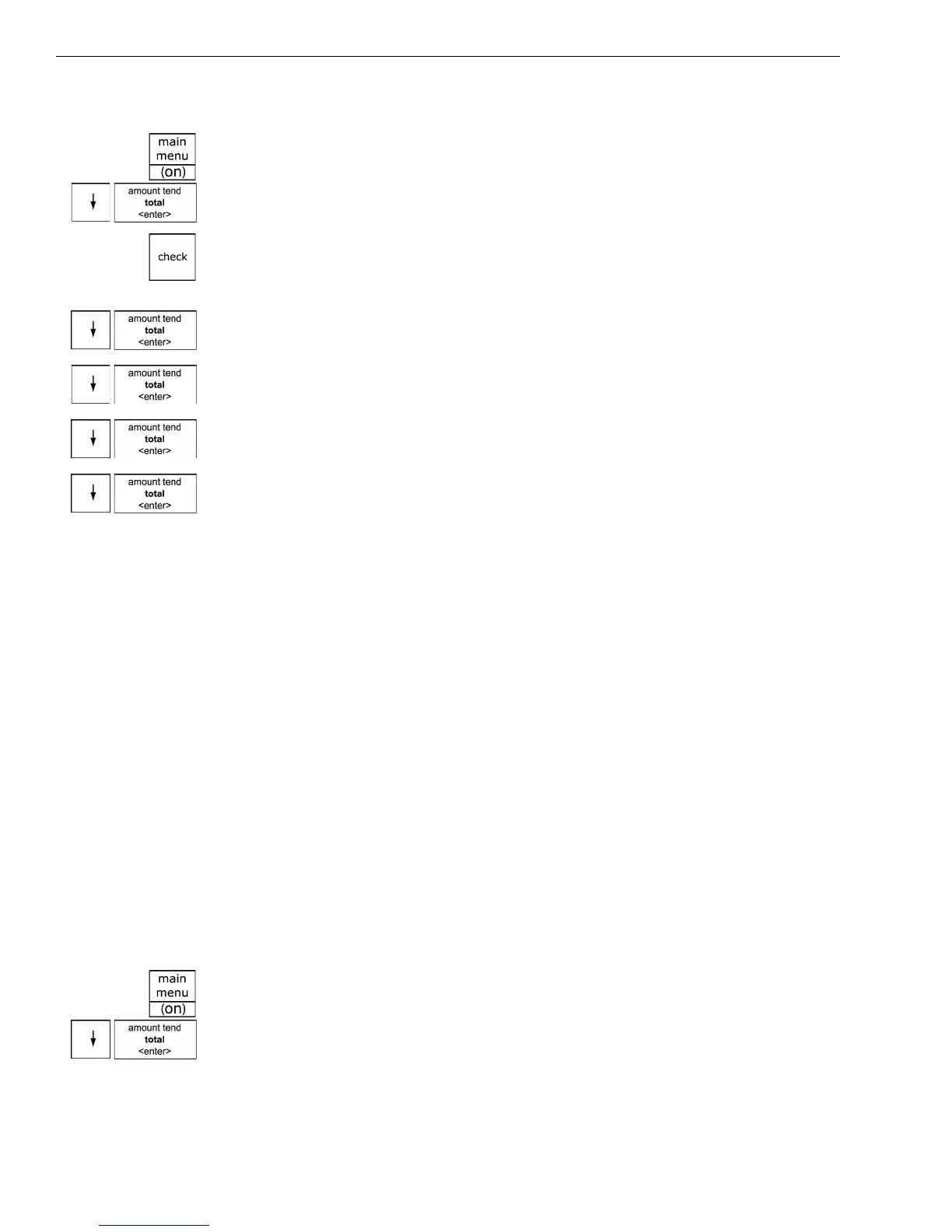

To program straight Add-on tax rates for the United States

ProgrammingTax Set Up

1 Press the Main menu (on) key.

2 Press the Arrow Down key to select Programming. Press the Amount

Tend Total <Enter> key.

Loading...

Loading...