Chapter 7 Programming Complex Tax Rates

6 Press the Arrow Down key to select Table. Press the Amount Tend Total

<Enter> key.

7 Do the following:

• E nter the price ranges and the amount of tax for each range. A t the

start of the regular repeating break point, after you enter the fir st

value of the first regular breakpoint, press the #/NS <sym> key.

• C ontinue entering price ranges and the amount of tax for each range

until you completely enter an entire sequence of repeating regular

breakpoints. Press the #/NS <sym> key. You return to the Tax

selection screen.

8 R epeat for each tax you want to set.

Calculating Your Tax

T his section provides instructions for figuring your own tax code if your

specific state uses a tax table. Take the time to follow the E xample Tax

C hart on page 78. Familiarize yourself with the method of determining the

tax code.

T hen, using the worksheet on page 79, duplicate the method of calculating

your state tax code by the steps described in this section. To do this you

need to get a copy of your state's R etail Tax C hart from your local Tax

O ffice. A fter you are done, write down the tax code and save the

information for future reference.

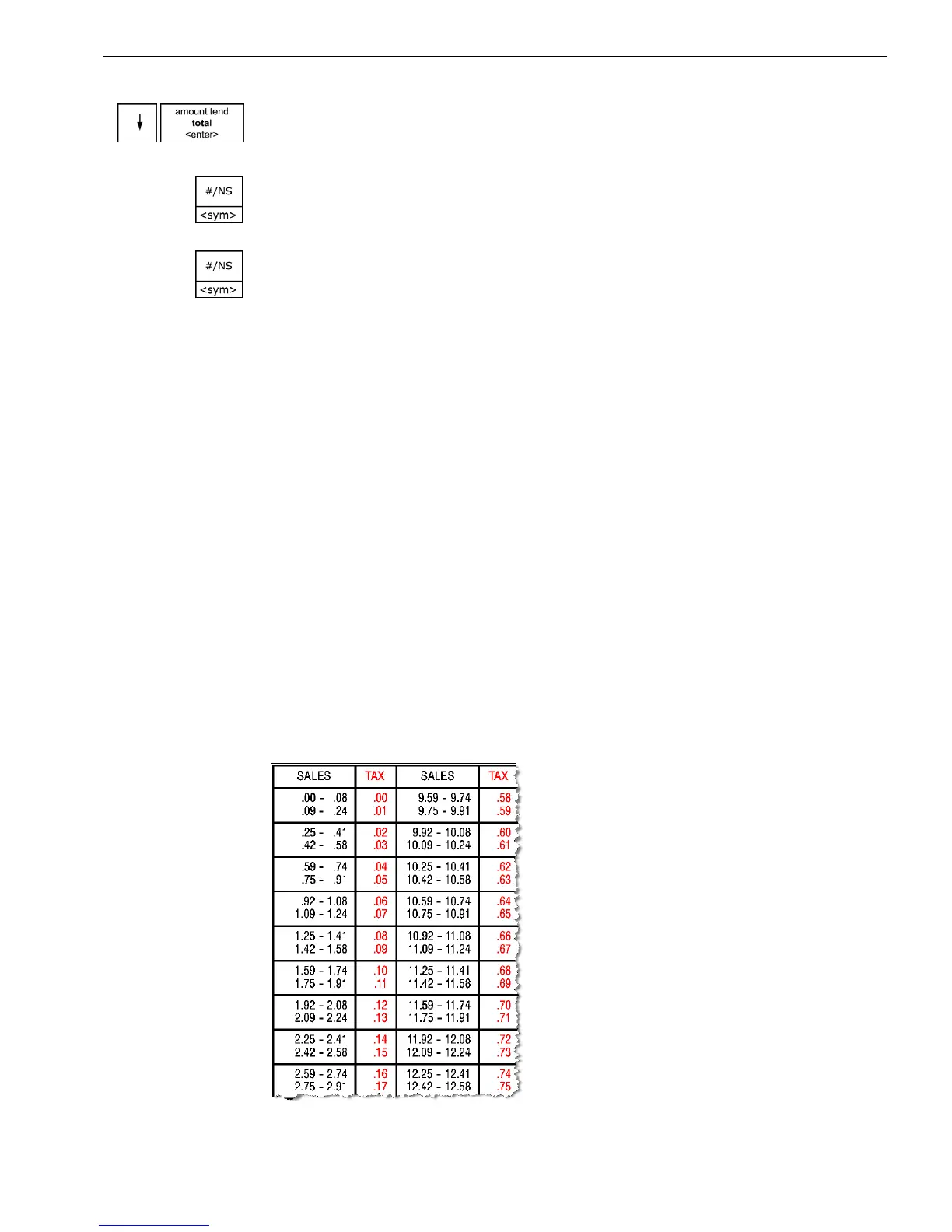

E very tax table consists of tax brackets. E ach consecutive tax bracket is

assigned a tax which is exactly one cent higher than that assigned to the

previous tax bracket. For example, part of a tax table might look like:

67 1000ML User's GuideahplA

Loading...

Loading...