(Continued) TAX RATE

ADD~ON

TAX TABLE RATE (an alternative t()

using

the

Fix~d

Rate Procedure)

Re!er

to

Appendix I

to

locate

the

tax

table

codes

listed

for

your

particular

state. If your state's tax rate

is

not listed

in

Appendix

1,-

refer to Appendix

II

for instructions

on

calculating your own state's tax table codes.

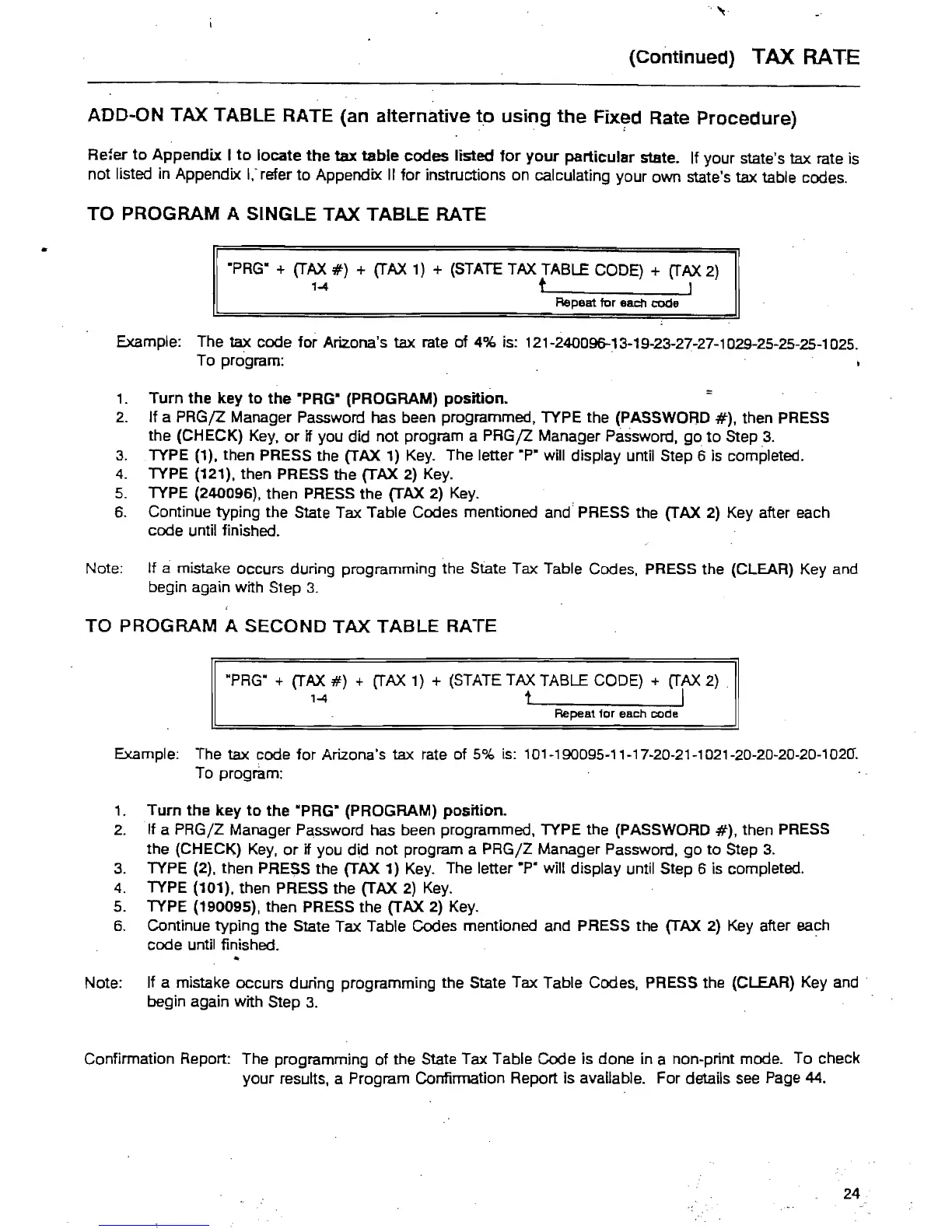

TO PROGRAM A SINGLE TAX TABLE RATE

"PRG"

+

(TAX

#)

+

(TAX

1) + (STATE TAX TABLE CODE) +

(TAX

2)

1-4

t I

Repeat tor each code

Example: The tax code for Arizona's tax rate of 4% is: 121-24009&13-19-23-27-27-1029-25-25-25-1025.

To program: .

1.

Turn

the

key

to

the

"PRG" (PROGRAM)

position.

2.

If a

PRGjZ

Manager Password has been programmed, TYPE the (PASSWORD

#),

then PRESS

the (CHECK)

Key,

or

if you did not program a

PRGjZ

Manager Password,

go

to

Step

.3.

3.

TYPE (1), then PRESS the (TAX

1)

Key.

The letter ·P" will display until Step 6 is completed.

4.

TYPE (121). then PRESS the (TAX 2)

Key.

5.

TYPE (240096), then PRESS the (TAX 2)

Key.

6.

Continue typing the State Tax Table Codes mentioned and' PRESS the (TAX

2)

Key after each

code until finished.

Note: If

amistake occurs during programming the State Tax Table Codes, PRESS the (CLEAR) Key and

begin again with Step

3.

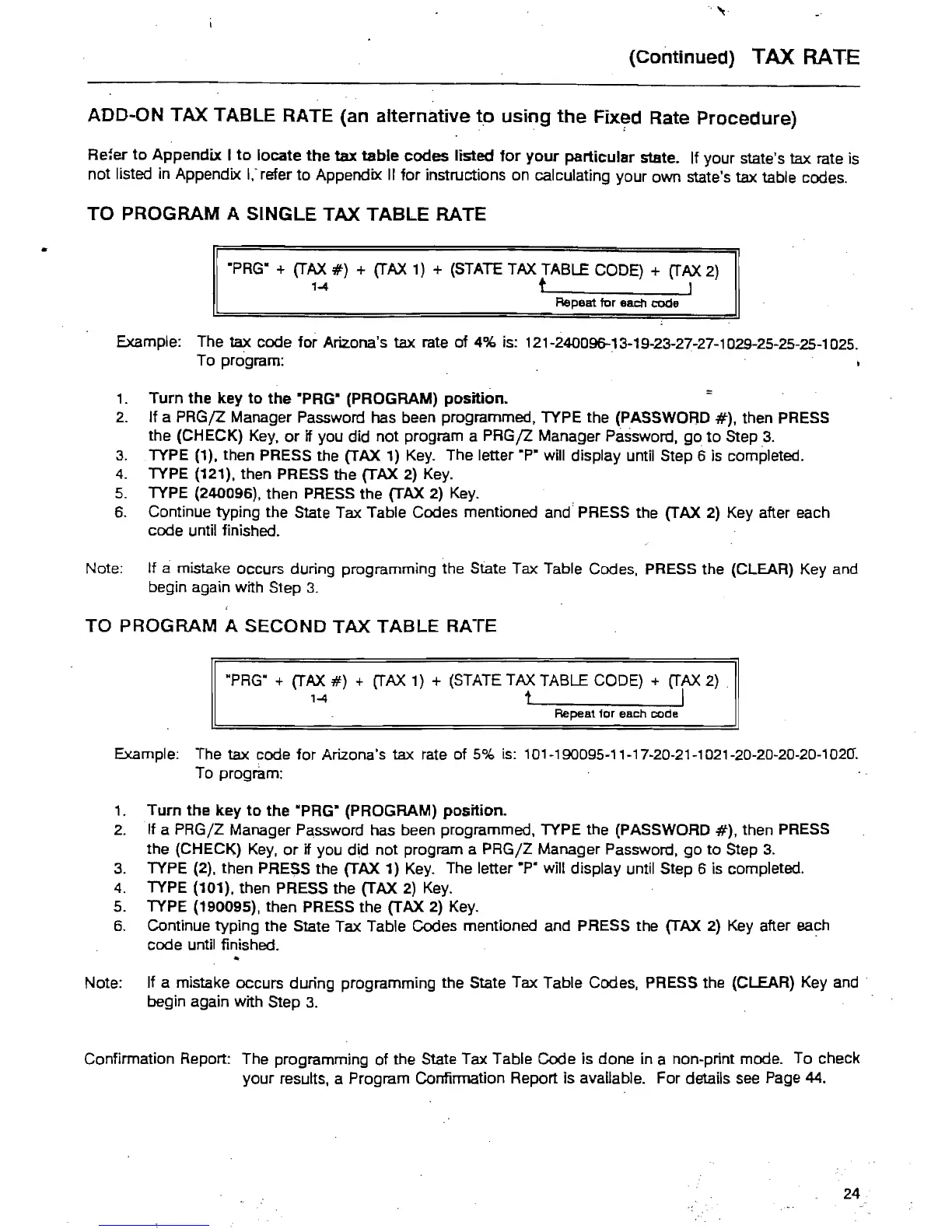

TO

PROGRAM

A

SECOND

TAX

TABLE

RATE

RPRG"

+

(TAX

#)

+

(TAX

1) + (STATE TAX TABLE CODE) +

(TAX

2)

1-4

1 I

Repeat for each code

Example: The tax code for Arizona's tax rate of

5%

is: 101-190095-11-17-20·21-1021-20-20-20-20-1020".

To program:

1.

Turn

the

key

to

the

·PRG" (PROGRAM)

position.

2.

If a PRG/Z Manager Password has been programmed, TYPE the (PASSWORD

#),

then PRESS

the (CHECK)

Key,

or

if you did not program a PRG/Z Manager Password.

go

to

Step 3.

3.

TYPE (2), then PRESS the (TAX 1)

Key.

The letter

.p.

will display until Step 6 is completed.

4.

TYPE (101), then PRESS the (TAX

2)

Key.

5.

TYPE (190095). then PRESS the (TAX 2)

Key.

6.

Continue typing the State Tax Table Codes mentioned and PRESS the (TAX

2)

Key after each

code until finished.

Note: If a mistake occurs during programming the State Tax Table Codes. PRESS the (CLEAR) Key

and·

begin again with Step

3.

Confirmation Report: The programming

of

the State Tax Table Code is done in a non-print mode. To check

your results, a Program Confirmation Report is available. For details

see

Page 44.

24

Loading...

Loading...