TRANSACTION EXAMPLES FOR OPERATING

THE

CASH REGISTER

1----

---._,----

NOTE:

Tum

the key

the

"REG" (REGISTER)

position

for

registering sales transactions.

--rMPORTANT: It

is

not necessary

to

press the Decimal Point when ringing- upll. pnce.

--

REMINDER: If Clerk Numbers are programmed.

be

sure

to

TYPE the (CLERK

#).

then PRESS

the (CLERK) Key before ringing up a sale.

-

In

the examples below. Department 1 is programmed

as

taxable with a

5%

(TAX

')

rate and Department 2 is

programmed

for

no

tax and Clerk

#1

is used.

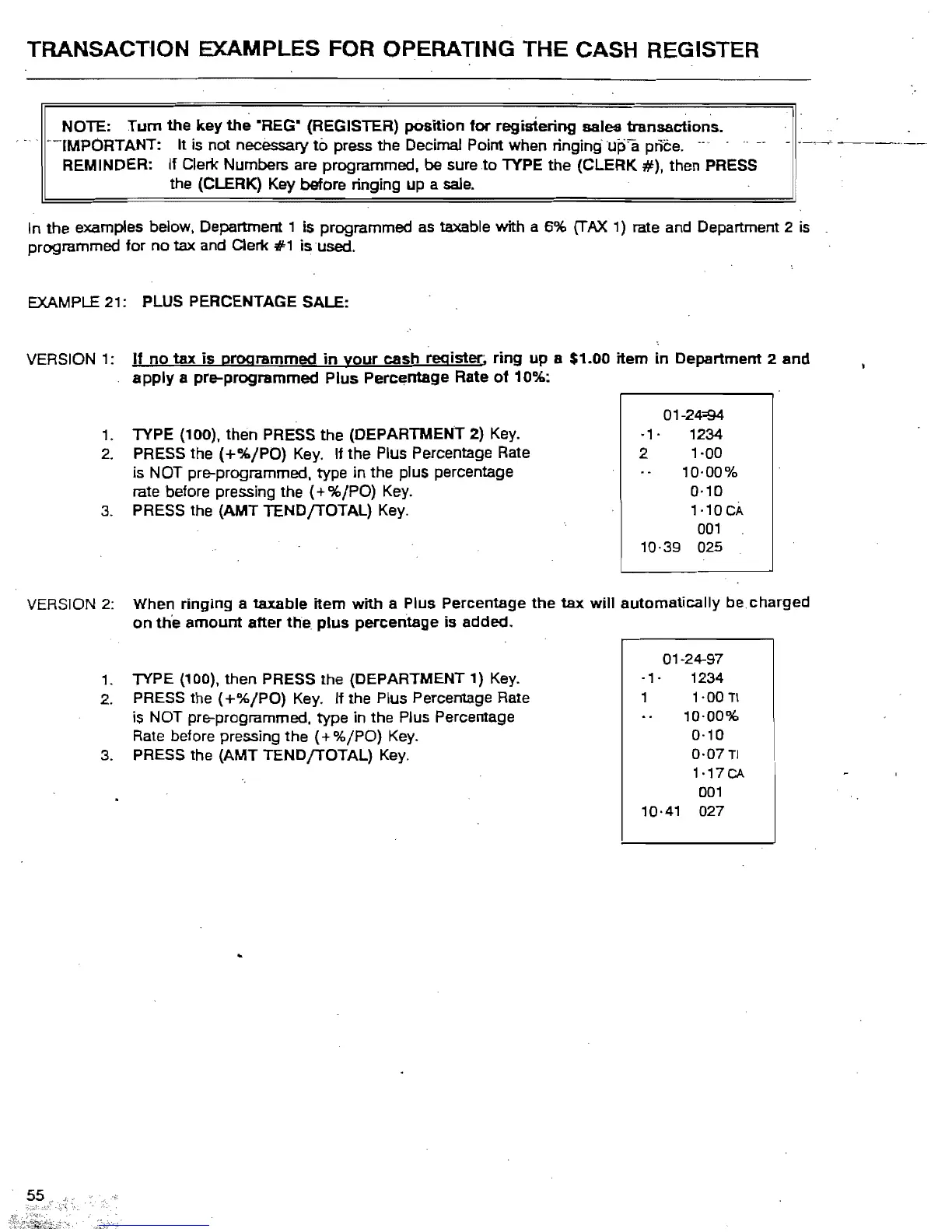

EXAMPLE 21: PLUS PERCENTAGE SALE:

VERSION 1:

If

no

tax

is

programmed

in

your

cash register; ring

up

a $1.00 item

in

Department 2

and

apply

a pre-programmed

Plus

Percentage Rate

of

10%:

01

-24"'94-

.,.

1234

1. TYPE (100), then PRESS the (DEPARTMENT 2)

Key.

2 1

-DO

is NOT pre-programmed. type in the plus percentage

2.

PRESS the

(+%/PO)

Key.

If the Plus Percentage Rate

10·00%

rate before pressing the

(+%/PO)

Key.

0·10

3.

PRESS the (AMT TENDfTOTAL)

Key_

1·10CA

001

10-39 025

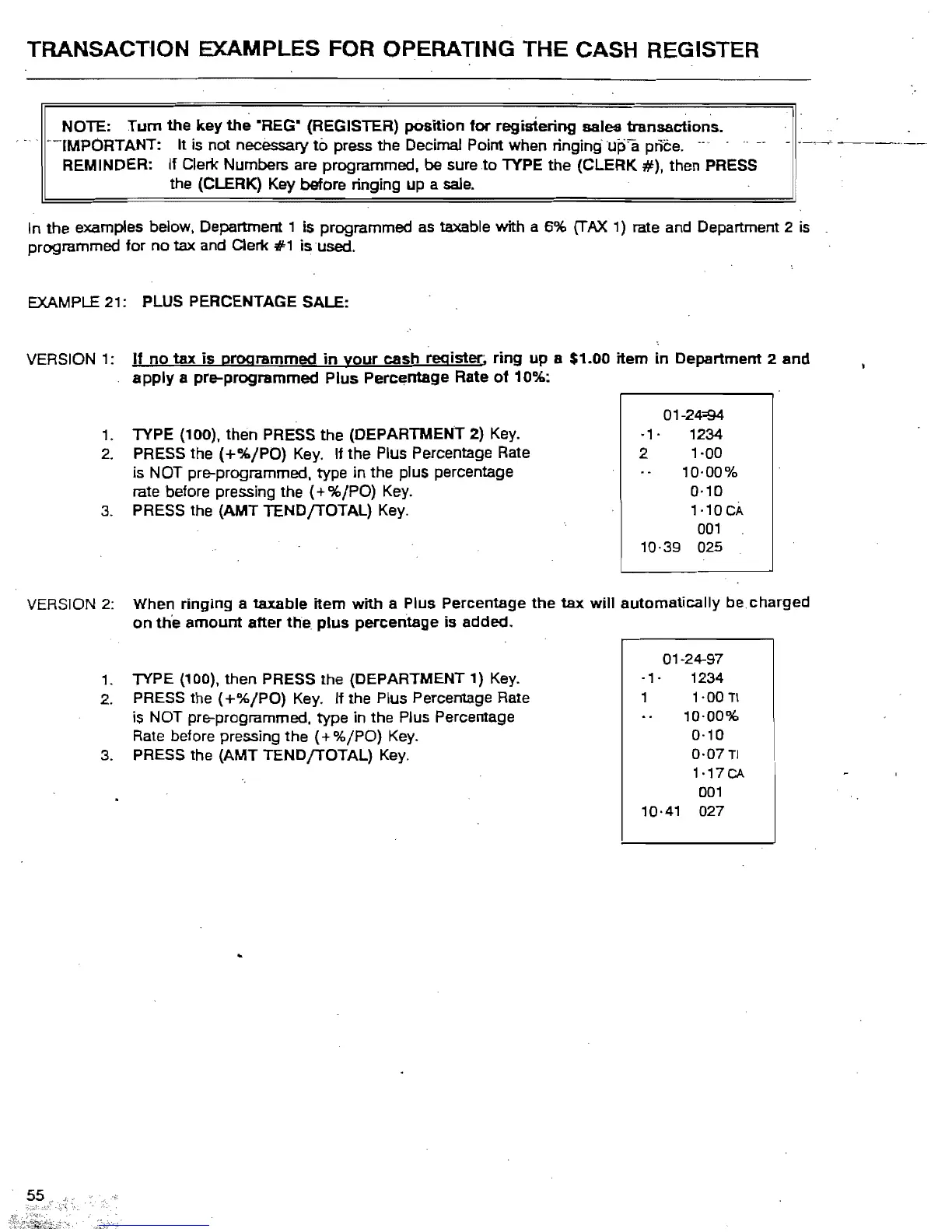

VERSION

2:

When ringing a taxable item

with

a Plus Percentage

the

tax

will

automatically be charged

on

th'e

amount

after

the

plus

percentage

is

added.

01-24-97

,_

TYPE (100), then PRESS the (DEPARTMENT 1)

Key.

-1'

1234

1-00

TI

is NOT pre-programmed. type in the Plus Percentage

2.

PRESS the

(+%/PO)

Key. If the Plus Percentage

Rate

10-00%

Rate

before

preSSing

the

(+

'Yo/PO)

Key.

0-10

0-07

TI

1-17CA

3.

PRESS the (AMT TENDfTOTAL)

Key.

001

10·41 027

Loading...

Loading...