GST

/PST

SYSTEM FOR CANADA

Appendix

III

STEP

1:

To select the Canadian Tax System, you must first pragram Rag 20 as follows:

1.

Tum

the key

to

the 'PRG" (program) position.

2. If a PRGjZ Manager Password has been programmed, TYPE the {PASSWORD

#),then

PRESS the (CHECK)

Key,

or

If

you did not program a

PRGjZ

Manager Password, go

to

~a

.'

3. TYPE (20){1). then PRESS the (VOID)

Key.

STEP 2: This cash register includes the following functions for taxation in Canada.

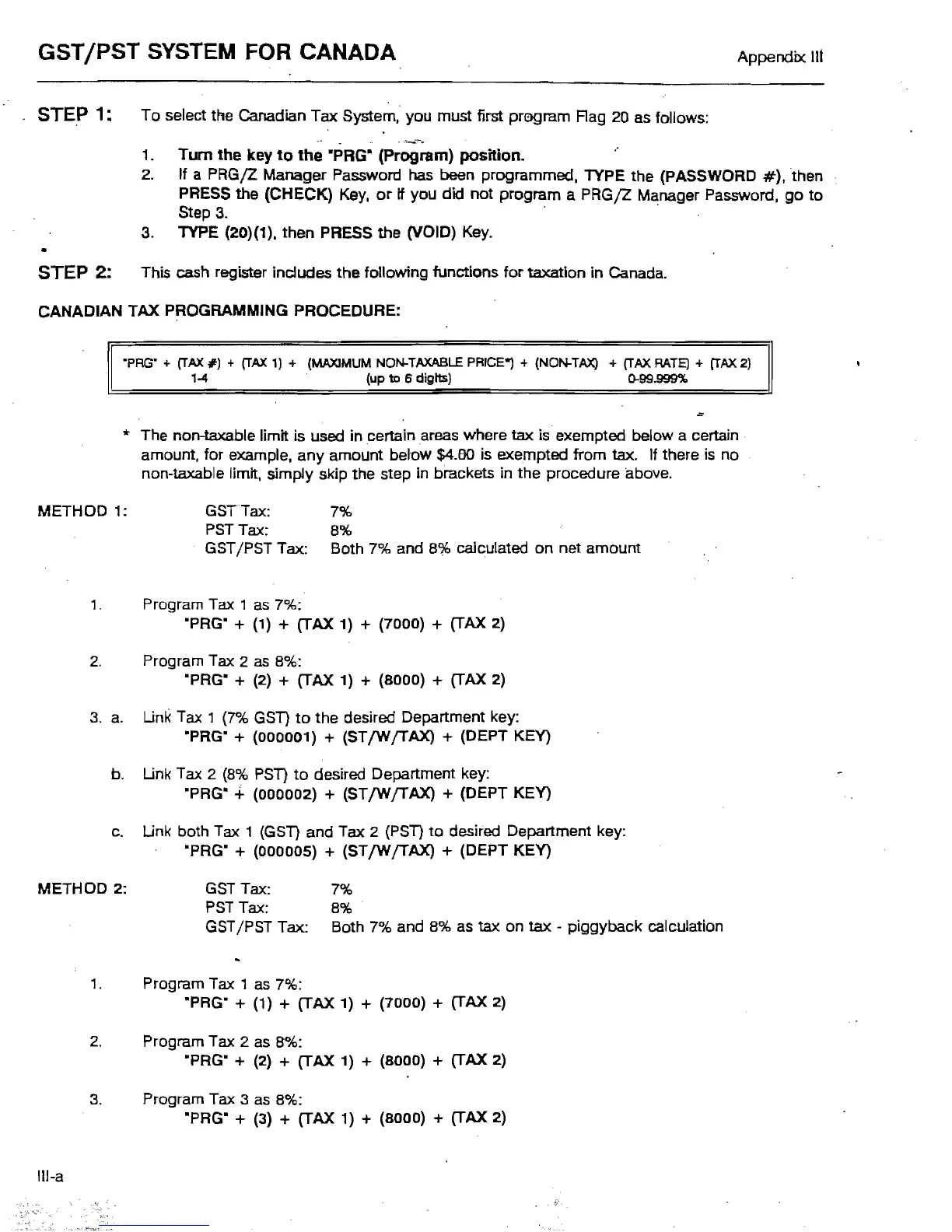

CANADIAN TAX PROGRAMMING PROCEDURE:

"PRG" +

(TAX#)

+

(TAX

1) + (MAXIMUM NON-TAXABLE PRICE*) + (NON-TAX) + (TAX

RATE)

+ (TAX2)

1-4 (up

to

6 digits)

0-99.~

* The non-taxable limit is used in certain areas where tax is exempted below a certain .

amount, for example. any amount below

$4.00

is

exempted from tax. If there

is

no

non-taxable limit, simply skip the step in brackets in the procedure above.

METHOD

1:

GSTTax: 7%

PST

Tax:

B%

GSTjPST Tax:

Both

7% and

B%

calculated on net amount

1. Program Tax ,

as

7%:

"PRG" + (1) + (TAX 1) + (7000) + (TAX 2)

2.

Program Tax 2

as

B%:

'PRG" + (2) + (TAX 1) + (8000) + (TAX 2)

3.

a.

Unk Tax , (7%

GST)

to

the desired Department key:

"PRG"

+ (000001) + (STfWJTAX) + (DEPT KEY)

b.

Unk Tax 2 (8%

PST)

to

desired Department key:

"PRG"

-+-

(000002) + (STfWJTAX) + (DEPT KEY)

c.

Unk both Tax 1

(GST)

and Tax 2

(PST)

to

desired Department key:

'PRG"

+ (000005) + (ST

fW

JTAX) + (DEPT KEY)

METHOD

2:

GST

Tax:

7%

PST

Tax:

8% .

GST

JPST

Tax:

Both

7% and 8% as tax on

tax

- piggyback calculation

,.

Program Tax 1

as

7%:

"PRG" + (1) + (TAX 1) + (7000) + (TAX 2)

2. Program Tax 2 as 8%:

'PRG" + (2) + (TAX 1) + (8000) + (TAX 2)

3. Program Tax 3 as 8%:

'PRG" + (3) + (TAX 1) + (8000) + (TAX 2)

III-a

Loading...

Loading...