COUPON DISCOUNT (-)

The Coupon Discount

(-)

Key is used

to

suotract a specific amount from an individual item. This function can

be performed in the middle of a transaction

or

by

itself in a

transaction.":

---

- .

..

. .

The programming

of

the Coupon Discount

(-)

Key consists

of

two

steps; seleCting a High Digit Lock Out (HDLO)

number and Tax Status.

1.

The

HIGH DIGIT LOCK

OUT

(HOLD) number is used

to

limit the number of digits that can be

rung

up

in a coupon

discount

This function is helpful in safeguarding against accidently subtracting

a large

amount

If

an excess number

of

digits Is entered an error tone sounds and the keypad locks

up. For example:

To

limit ringing

up

of

more than $99.99 on

the

Coupon Discount Key, set the HDLO

~~

. .

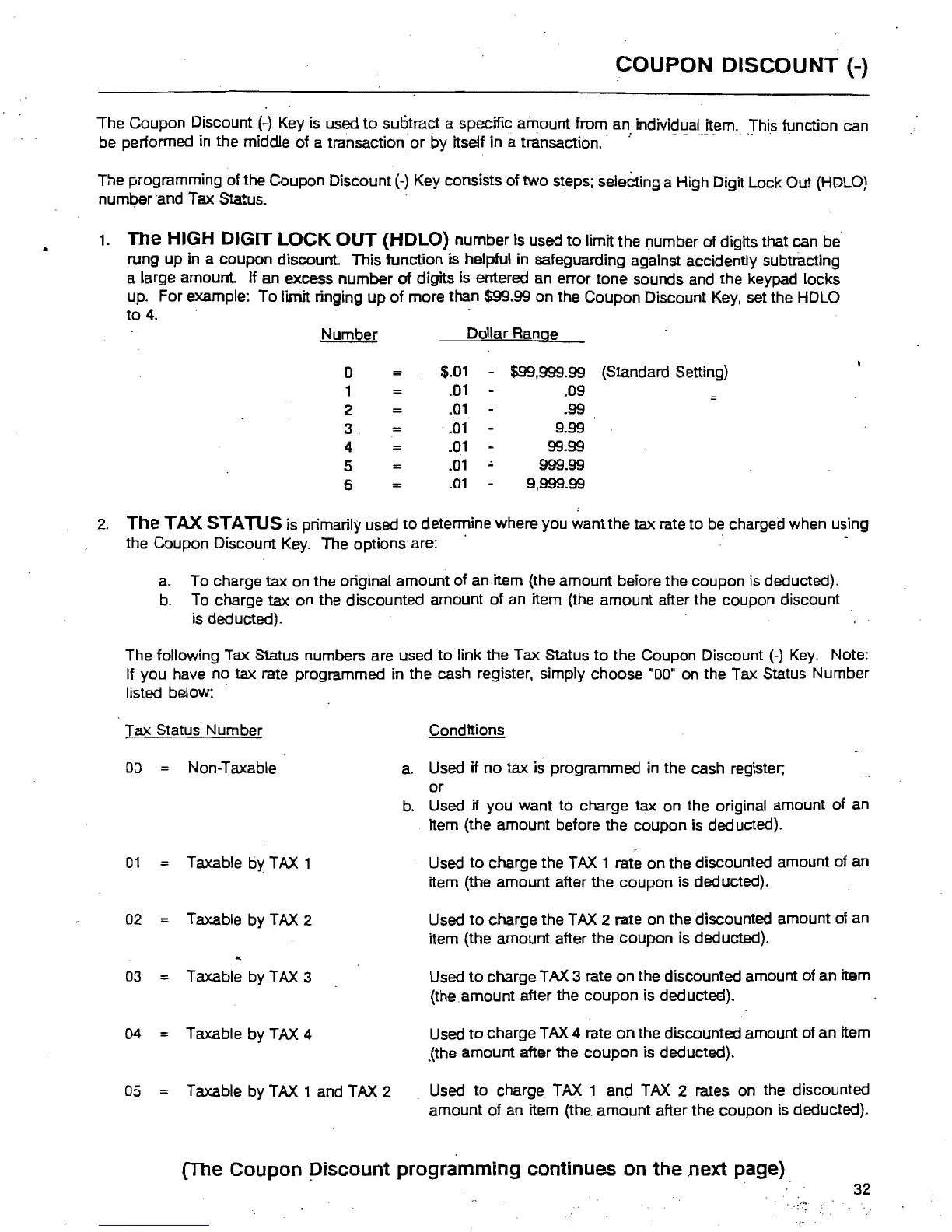

Number

Dollar Range

0

=

$.01

-

$99,999.99

(Standard Setting)

1

=

.01

.09

2

.01

.99

3

=

.01

9.99

4

=

.01

99.99

~

5

.01

999.99

6

.01

9,999.99

2.

The

TAX STATUS is primarily used

to

determine where you want the

tax

rate

to

be charged when using

the Coupon Discount Key. The options are: .

'.

a.

To

charge tax on the original amount of

anitem

(the amount before the coupon is deducted).

b.

To

charge tax on the discounted amount

of

an item (the amount after the coupon discount

is deducted).

The following Tax Status numbers are used

to

link the Tax Status

to

the Coupon Discount

(-)

Key.

Note:

If you have no tax rate programmed in the cash register, simply choose ·00" on the Tax Status Number

listed below: .

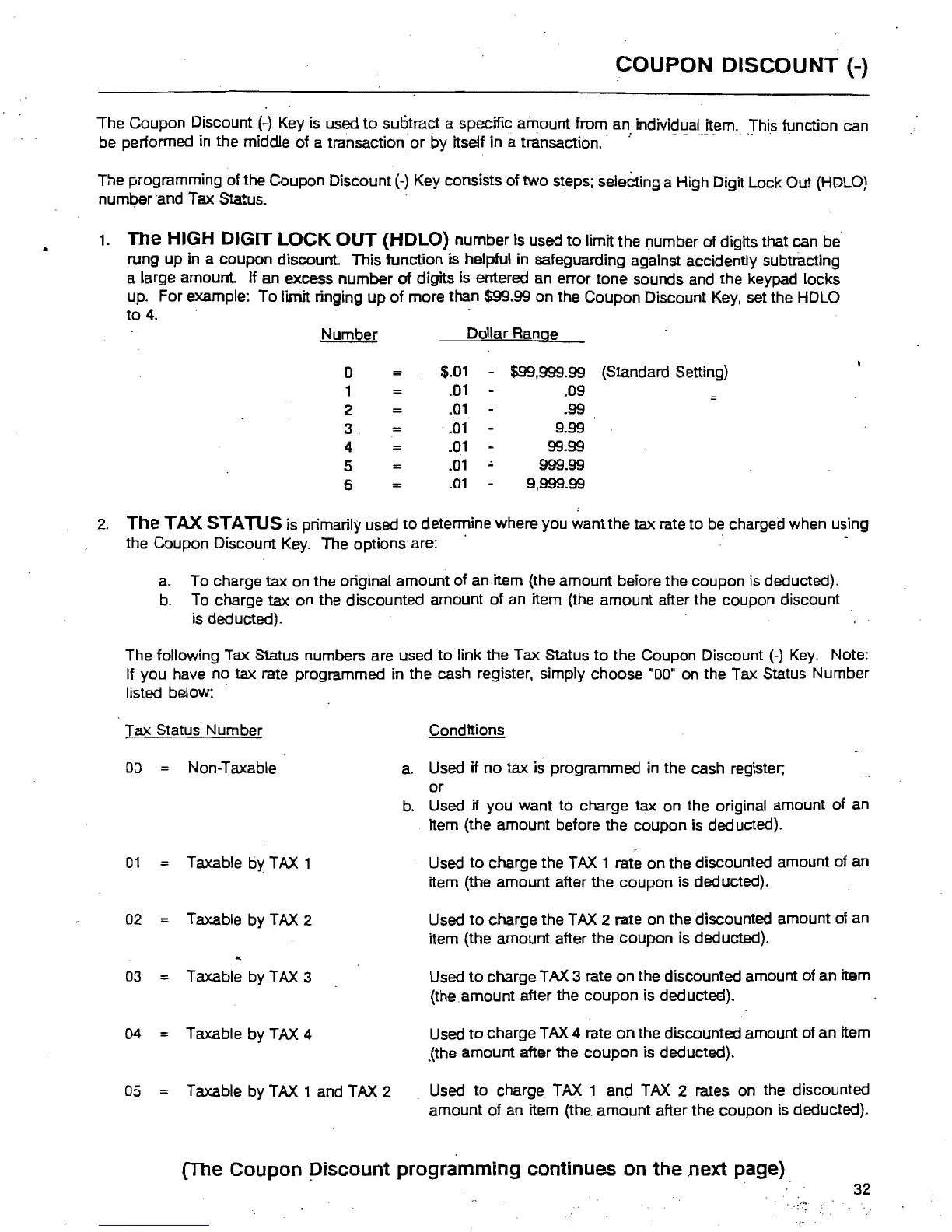

Tax Status Number

Conditions

00

==

Non-Taxable

a.

Used if

no

tax is programmed in the cash register;

or

b .

Used if you want

to

charge

tax

on the original amount of an

. item (the amount before the coupon is deducted).

01

==

Taxable

by

TAX 1 Used

to

charge the TAX 1 rate on the discounted amount of an

item (the amount after the coupon is deducted).

02

Taxable by TAX 2 Used

to

charge the TAX 2 rate on the discounted amount of an

item (the amount after the coupon is deducted).

03

==

Taxable

by

TAX 3 Used

to

charge TAX 3 rate

on

the discounted amount of an item

(the amount after the coupon is deducted).

04

==

Taxable

by

TAX 4 Used

to

charge TAX 4 rate

on

the discounted amount of

an

item

.(the amount after the

coupon

is deducted).

05

==

Taxable by TAX 1 and TAX 2 Used

to

charge TAX 1 ano TAX 2 rates on the discounted

amount of an item {the amount after the coupon is deducted}.

(The Coupon piscount programming continues

on

the next page)

32

Loading...

Loading...