.'~

(

COUPON

DIS~OUNT

(-)

(Continued)

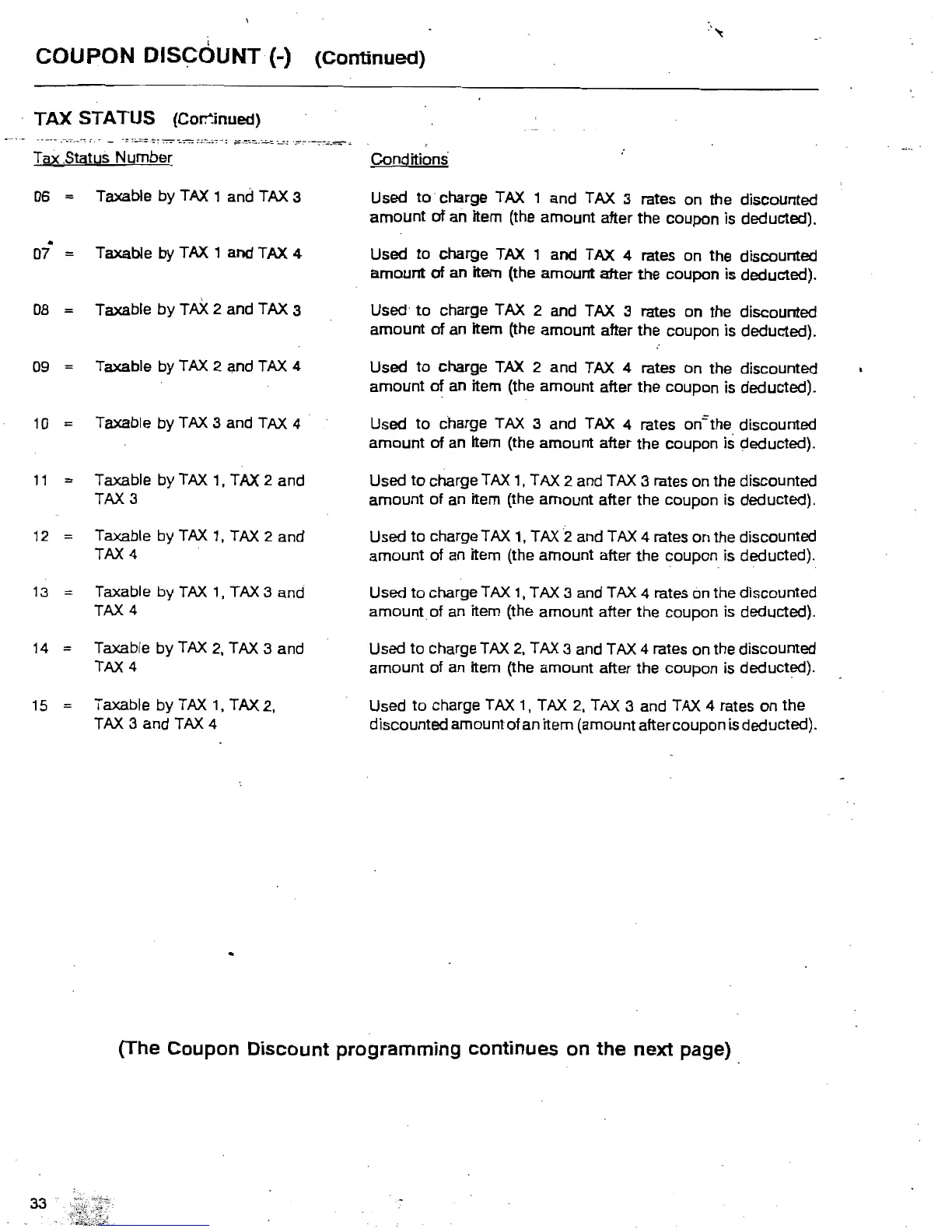

TAX

STATUS (Corr.inued)

TaxStatys

Number

06

::

Taxable by

TAX

1 and

TAX

3

..

07

Taxable by

TAX

1 and TAX 4

=

08

=

Taxable by

TAX

2 and TAX 3

09

=

Taxable by

TAX

2 and

TAX

4

10

Taxable by

TAX

3 and

TAX

4

11

Taxable by

TAX

1,

TAX

2 and

TAX 3

12

Taxable by

TAX

1,

TAX

2 and

TAX

4

13

Taxable by

TAX

1,

TAX 3 and

TAX

4

14

=

Taxable by

TAX

2,

TAX

3 and

TAX 4

15

=

Taxable by

TAX

1.

TAX

2,

TAX

3 and

TAX

4

Conditions

Used

to·

charge

TAX

1 and TAX 3 rates on the discounted

amount

of

an

item (the amount after the coupon is deducted) .

Used

to

charge TAX 1 and TAX 4 rates on the discounted

amount

of an item (the amount after the coupon is deducted).

Used

to

charge TAX 2 and TAX 3 rates on the discounted

amount

of an item (the amount after the coupon is deducted).

Used

to

charge TAX 2 and TAX 4 rates on the discounted

amount

of an item (the amount after the coupon

is

deducted).

Used

to

charge

TAX

3 and TAX 4 rates on=the discounted

amount

of an Item (the amount after the coupon

is

deducted).

Used

to

charge

TAX

1 , TAX 2 and TAX 3 rates

on

the discounted

amount of an item (the amount after the coupon is deducted).

U sed

to

charge

TAX

1,

T

AX2

and TAX 4 rates on the discounted

amount of

an

item (the amount after the coupon is deducted).

Used

to

charge

TAX

1,

TAX 3 and TAX 4 rates

on

the discounted

amount

of

an

item (the amount after the coupon

is

deducted).

Used

to

charge TAX

2,

TAX 3 and TAX 4 rates on the discounted

amount of an item (the amount after the coupon

is

deducted).

Used

to

charge TAX 1 , TAX

2,

TAX 3 and

TAX

4 rates on the

discounted amount of an item (amount after coupon is deducted).

(The

Coupon

Discount

programming

continues

on

the

next

page)

33

Loading...

Loading...