Chapter 6. Accounts Payable

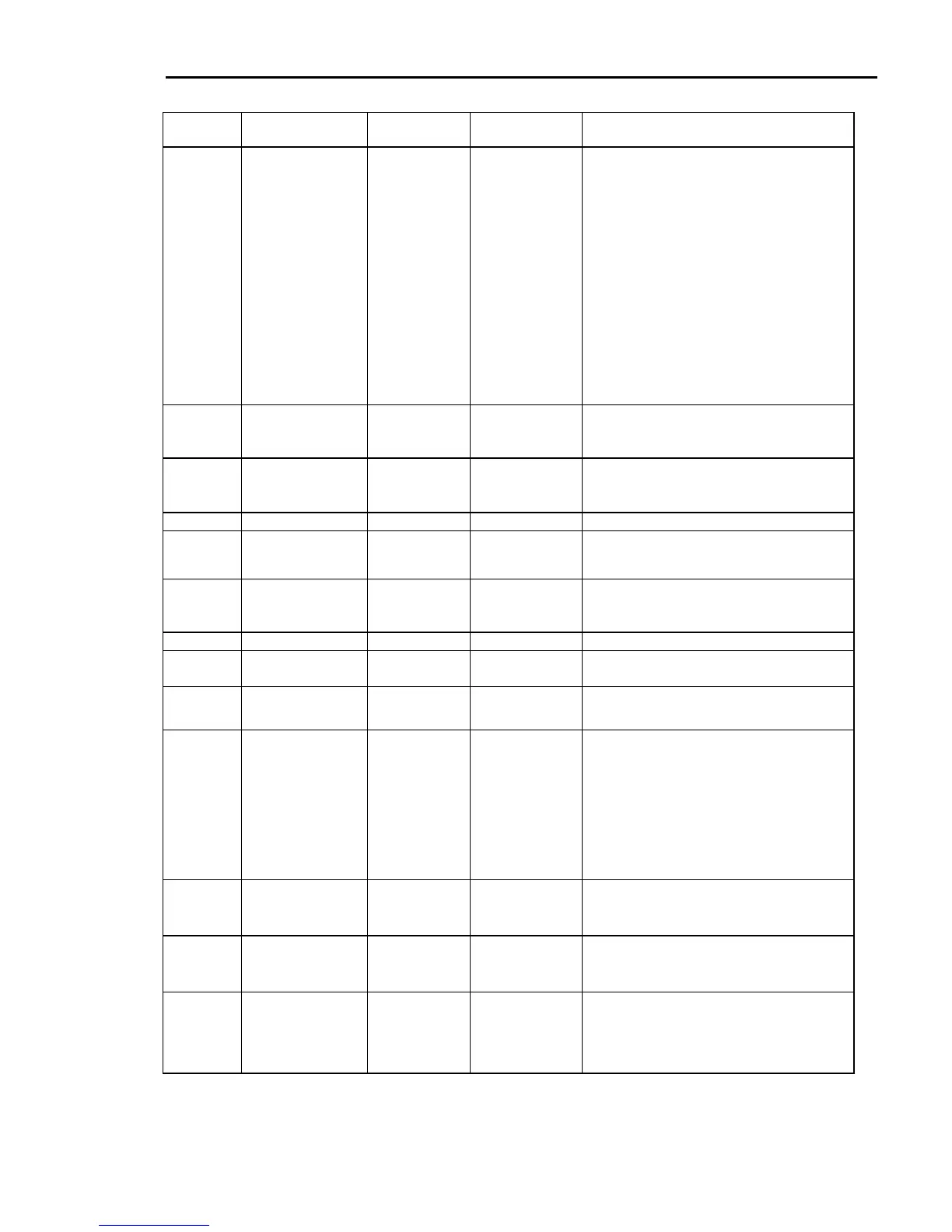

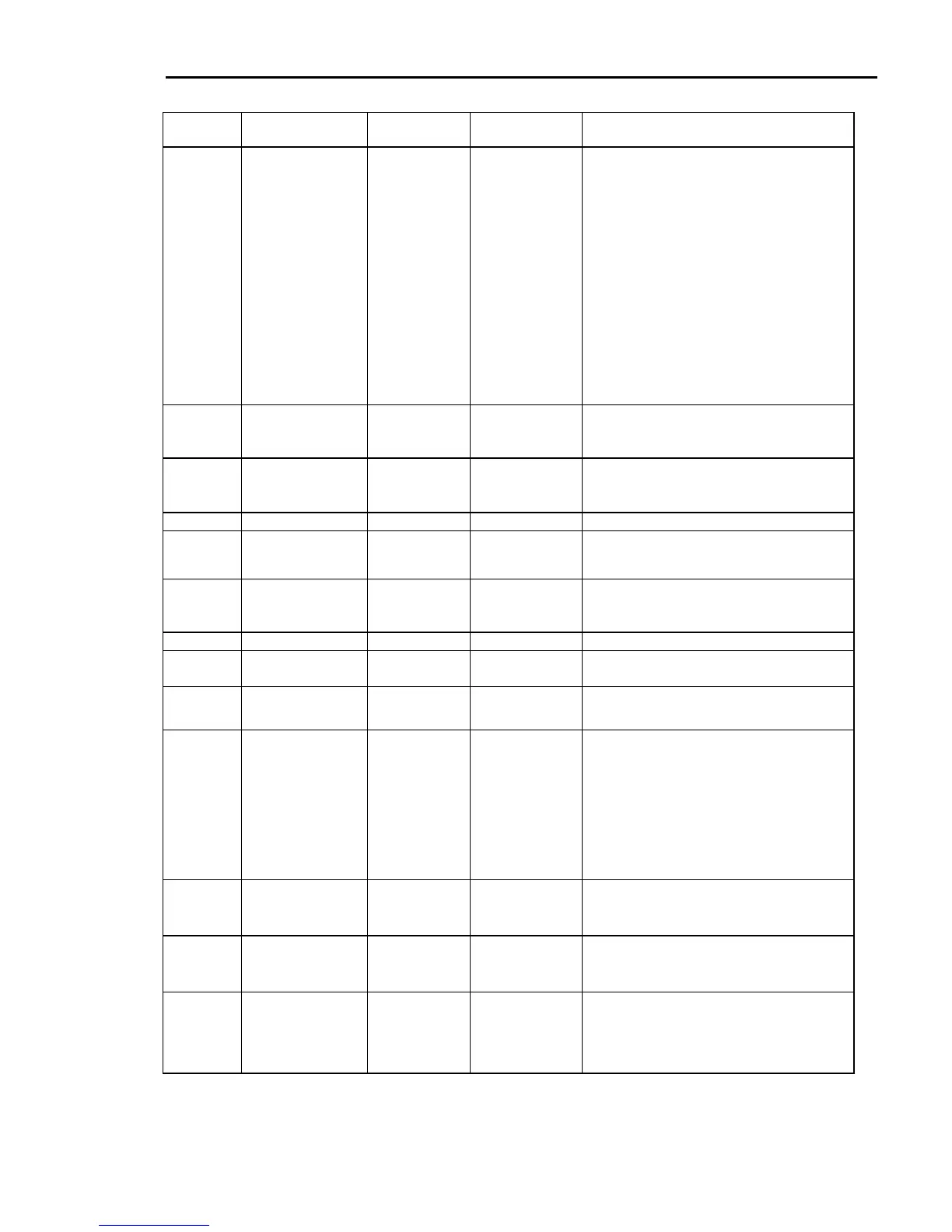

FIELD WHAT HOW LONG FOR EXAMPLE MORE...

VENDOR

NO

Vendor Number Up to 7 digits 1234567 1. Vendor numbers 100 and higher are used for

accounts where the transactions (invoices and

checks) are tracked through the A/P system.

2. Vendor numbers less than 100 (1-99) are one-

time or miscellaneous vendors. Set up a

different miscellaneous vendor for each type of

vendor terms you may encounter. All

miscellaneous vendors must have SEPARATE

CHECKS=Y.

3. At the time you enter an invoice for a

miscellaneous vendor, you will enter the vendor

name and address. The computer will also ask if

you want to save invoice information for 1099’s.

At the end of the year you will need to sort

through the saved information and determine

which miscellaneous vendors will require a 1099

form.

4. If you suspect that a miscellaneous vendor will

exceed the 1099 limits for the year, use a regular

vendor number (over 100).

NAME Vendor Name 30 characters

INTERMOUNTAIN

SUPPLIERS or

SMITH/DOUG

This controls how the account is alphabetized. See

Step 2 on page 72 for more explanation of how to

format the vendor name.

ADDR 1 P.O. Box or Attn

information

25 characters P.O. BOX 888 or

ATTN: Accounts

Receivable

ADDR 2 Street address 25 characters This can be the actual mailing address.

ADDR 3 City, state & zip

code

25 characters Newtown, CO

87101

1. Separate the city and state with a comma.

2. If the vendor has both a PO box and a street

address, use the zip code of the PO box.

PHONE Phone number 12 characters 800/222-3333

800-222-3333

222-3333 x123

Enter the phone number exactly how you wish it to

print on report and inquiry screens.

FAX NO Fax number 12 characters 702-222-4444

CONTACT Contact person 20 characters Bill W. or

Mrs. Johnson

Enter the name of the contact person for this

vendor. This is optional.

TERMS

DESC.

Terms Description 13 characters 1% NET 10

NET 30th

Enter the description of the terms for this vendor to

be displayed when selecting vendors at invoice

entry.

DISCOUNT

TERMS

(DAYS/

DATE)

Discount Terms 1 character 1=# days

2=date of month

1 = calculate the number of days from the invoice

date for due date. Then enter the number of days in

the DISCOUNT: DAYS field. For example, if

TERMS equals 1 and DAYS equals 10, the invoice

would be due 10 days past the date of the invoice.

1 = use date of month for the due date rather than a

number of days from the invoice date. For example

if TERMS equals 2 and DAYS equals 10, then

invoices would be due on the 10

th

day of the next

month. Enter the day of month in the next field,

DISCOUNT: DAYS.

DISCOUNT:

DAYS/DAT

E

Determines the

discount date if paid

within terms.

2 characters 10=10 days after

invoice date or 10

th

of the month

1. If TERMS equals 1, enter the number of days to

calculate the due date from the date of invoice.

2. If TERMS equals 2, enter the day of month for

the due date.

DISCOUNT:

PERCENT

Determines the

percent of discount

available if paid within

terms.

2 characters 1 = 1% discount

2 = 2% discount

If there is an allowable discount if paid on or before

the due date, enter the percentage next to

PERCENT. For example, take a 2% discount if paid

within 10 days from invoice date.

G/L DEBIT

ACCOUNT

General Ledger debit

account number

Up to 7 digits Standard G/L chart

of accounts–store

1

1312.01=Inventory

purchases

6020.01=Utilities

Enter the G/L account number for the debit entry

when an invoice is entered for this vendor. It can be

overridden at the time of invoice entry.

Dimensions 14 233

Loading...

Loading...