Appendix C

7. Price Basis 3=Gross Margin % Markup/

Markdown

Use this method if you wish to mark up or mark

down from List/Base using a gross margin

percentage. A change to List/Base will change the

calculated price levels accordingly. This option

works well in a “sticker-less” store. It allows a

minimum amount of maintenance and you always

get the margin you want.

Gross margin is calculated using this formula:

Total Selling Price - Total Cost

Total Selling Price

See Appendix B in the Inventory User Manual for

the Gross Margin % Conversion Table for a quick

reference on markup percentages. Here’s an

example of the calculations for this price basis. If

an item’s cost is $10.00 and you want to mark up

from cost, enter 10.00 or the cost of the item in

List/Base. Then enter the percentage of the gross

margin you want to make on the item or the

markup in Price Adjustments 1-9:

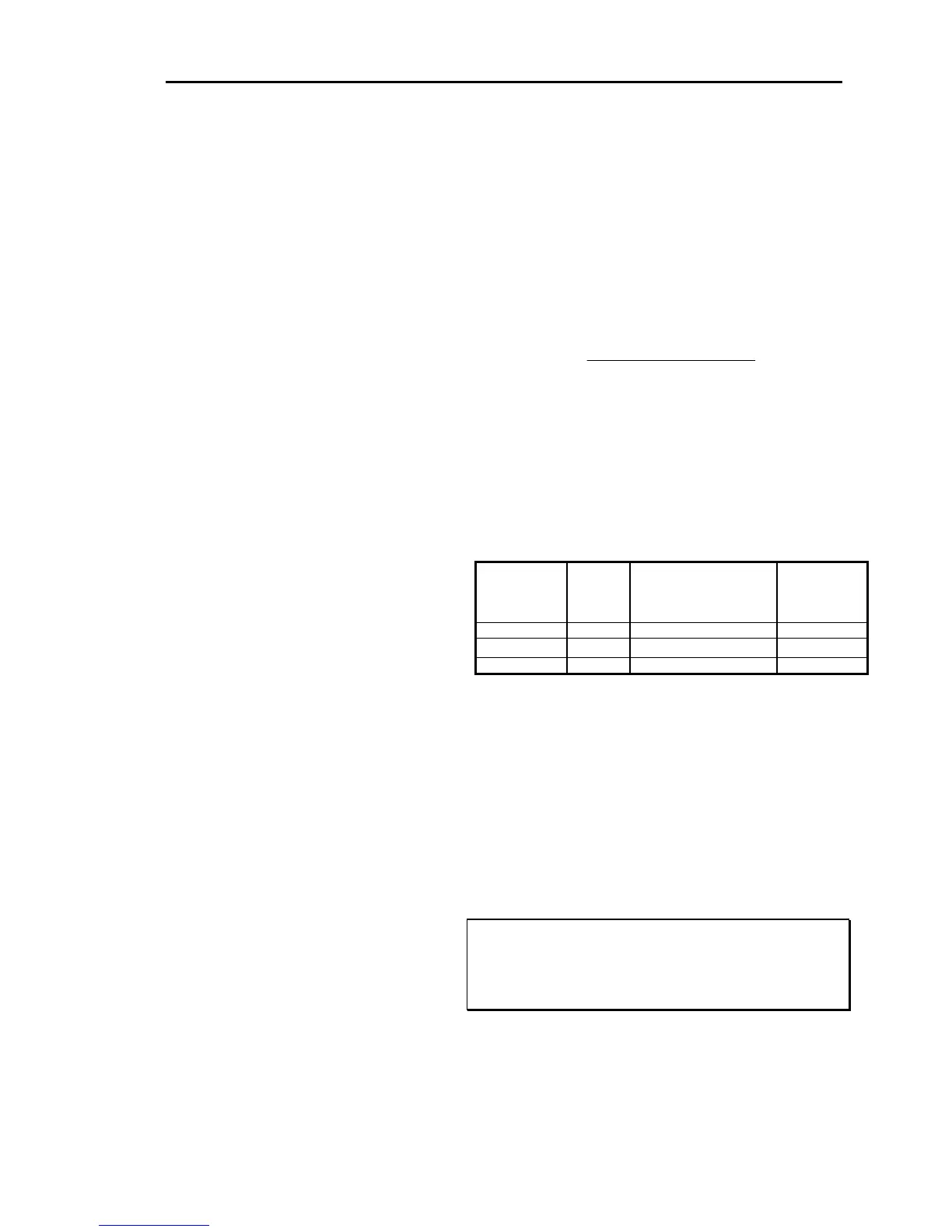

Price

Level

Adjustment

Gross

Margin

%

Calculation

(Selling Price – Total

Cost) / Total Selling

Price

Selling price

for:

Price Adj 1 33.34 (15.00 – 10.00) / 15.00 PL 1 = 15.00

Price Adj 2 25.93 (13.50 – 10.00) / 13.50 PL 2 = 13.50

Price Adj 3 16.67 (12.00 – 10.00) / 12.00 PL 3 = 12.00

8. Quantity test in relation to Price Basis:

This is an easy way to give better pricing for large

quantities sold. This basis of pricing allows the

price level to automatically drop the price when a

customer purchases large quantities of inventory.

This is useful on screws or nails where a customer

can buy a single pound but if they purchase a 50

lb. box, the price drops down. Price Bases 10-13

are similar to Price Bases 0-3 except that price

adjustment levels 6-9 contain quantity breaks

rather than percentages or dollar amounts.

) NOTE: DO NOT assign customers Price Levels 6-9 if you

have inventory items with a Price Basis of 10-13.

This is because Price Adjustments 6-9 will hold

quantity breaks rather than percentages or dollar

amounts.

Dimensions 14 417

Loading...

Loading...