Appendix:

II

CALCULATING STATE TAX TABLE CODES

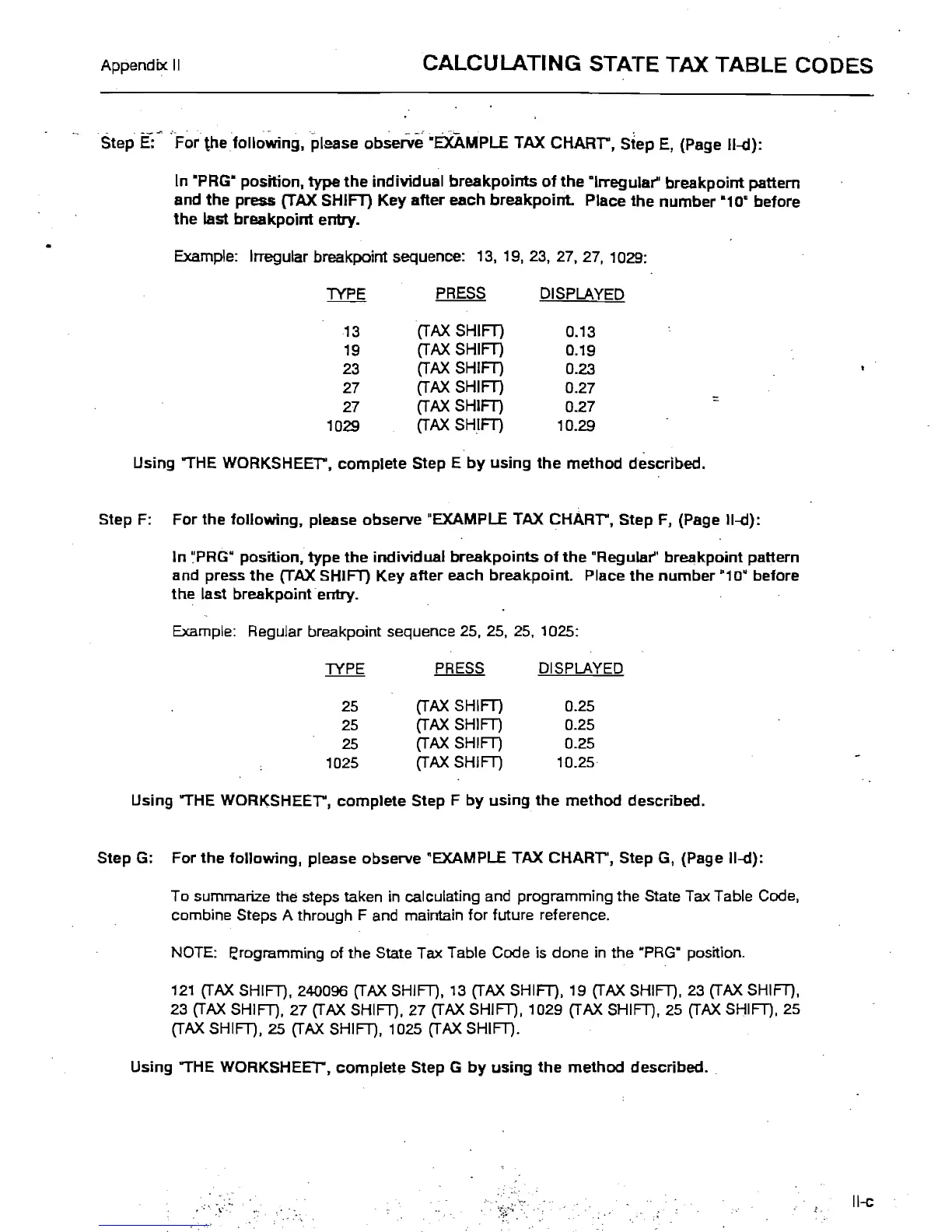

Step

E:

'-For

thefollo~ng,please

observe

-EXAMPLE TAX

CHAAr,

Step E, (Page H-d):

In ·PRG- position, type

the

individual

breakpoints

of

the

"Irregular"

breakpoint

pattern

and

the

press (TAX SHIFT)

Key

after each

breakpoint.

Place

the

number

"10· before

the

last

breakpoint

entry

•

..

Example:

Irregular breakpoint sequence:

13,

19,23,27,27,

1029:

TYPE

PRESS

DISPLAYED

13

(TAX

SHIFT)

0.13

19

(TAX

SHIFT)

0.19

23

(TAX

SHIFT)

0.23

27

(TAX

SHIFT)

0.27

27

(TAX

SHIFT)

0.27

'"

1029

(TAX

SHIFT)

10.29

Using "THE

WORKSHEEr,

complete

Step E

by

using

the

method

described.

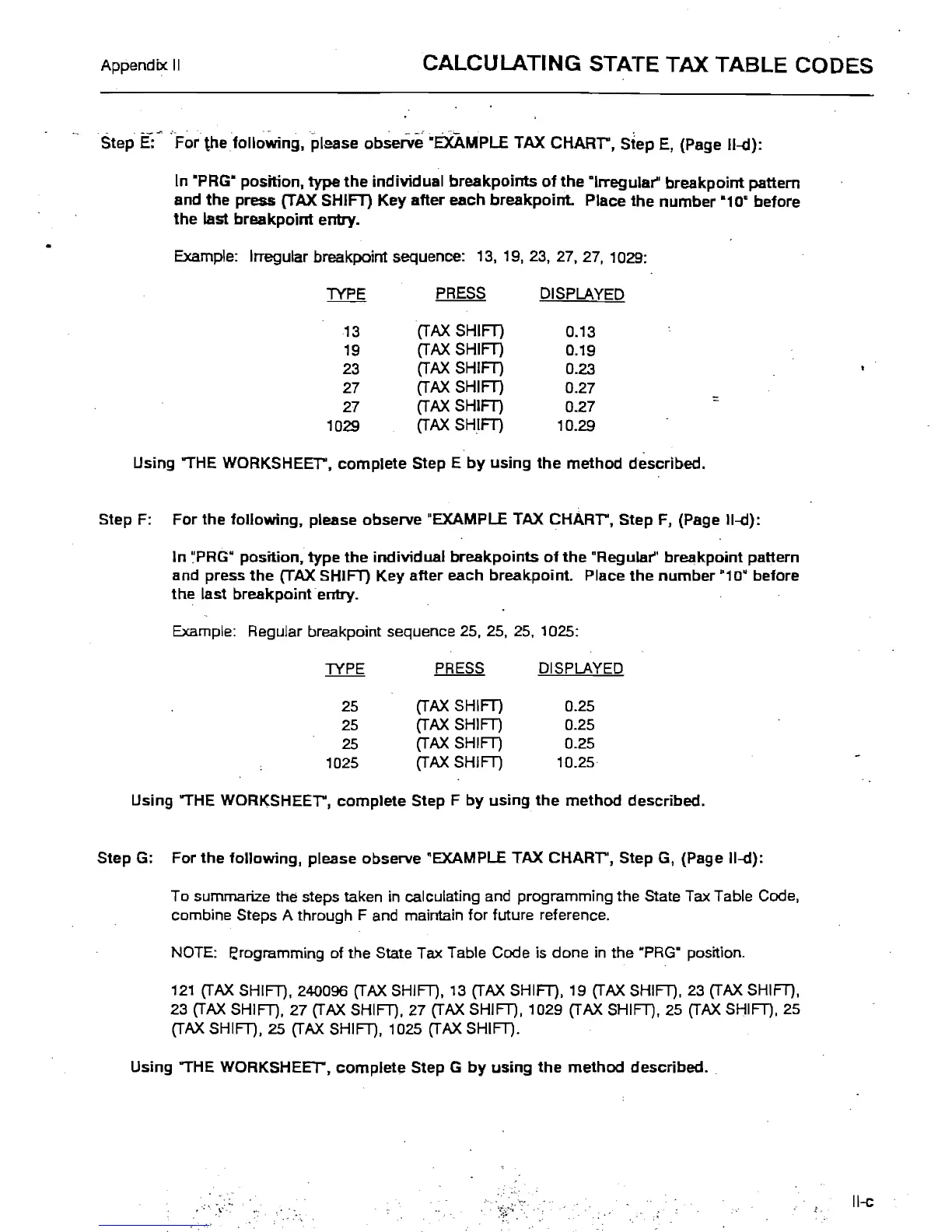

Step F: For the fol/owing, please observe "EXAMPLE

TAX

CHARr,

Step F, (Page 1I-d):

In

~PRG·

position,

type

the

individual

breakpoints

of

the

"Regular" breakpoint pattern

and press

the

(TAX SHIFT)

Key

after

each breakpoint. Place

the

number

"10·

before

the

last breakpoint entry.

Example: RegUlar breakpoint sequence

25,25,25,

1025:

PRESS

DISPLAYED

25

(TAX

SHIFT) 0.25

25

(TAX

SHIFT)

0.25

25

(TAX

SHIFT)

0.25

1025

(TAX

SHIFT)

10.25

Using "THE

WORKSHEEr,

complete

Step F

by

using

the

method

described.

Step G: For

the

following,

please observe "EXAMPLE TAX

CHARr',

Step G, (Page II-d):

To summarize the steps taken

in

calculating and programming the State Tax Table Code,

combine Steps A through F and maintain for future reference.

NOTE: I;rogramming of the State Tax Table Code is done

in

the ·PRG" position.

121

(TAX

SHIFT), 240096

(TAX

SHIFT),

13

(TAX

SHIFT), 19

(TAX

SHIFT),

23

(TAX

SHIFT),

23

(TAX

SHIFT), 27

(TAX

SHIFT). 27

(TAX

SHIFT), 1029

(TAX

SHIFT), 25

(TAX

SHIFT), 25

(TAX

SHIFT). 25

(TAX

SHIFT), 1025

(TAX

SHIFT).

Using "THE WORKSHEET".

complete

Step G

by

using

the

method

described.

II-c

Loading...

Loading...