SPS-2000 Program Manual v1.30 P Mode Programming 143

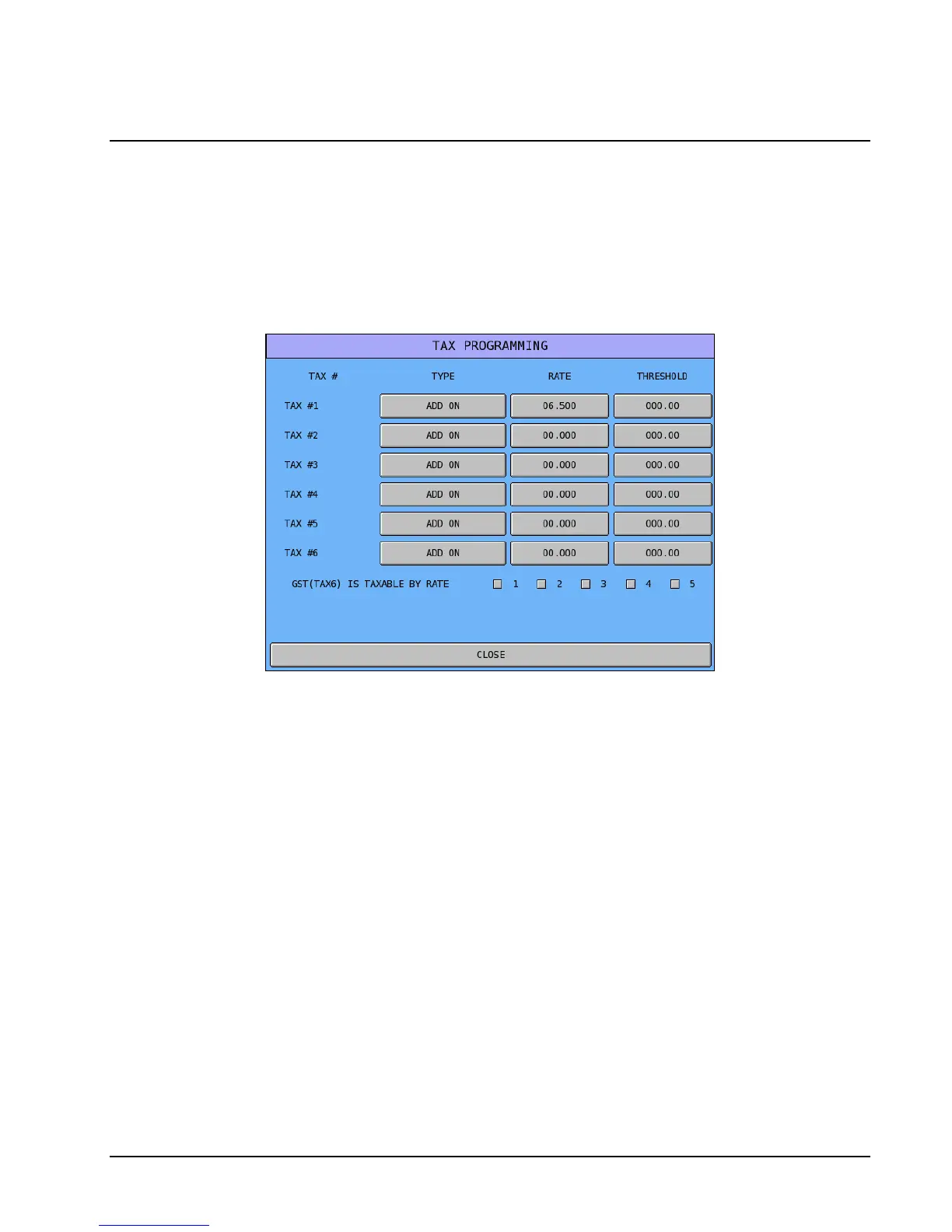

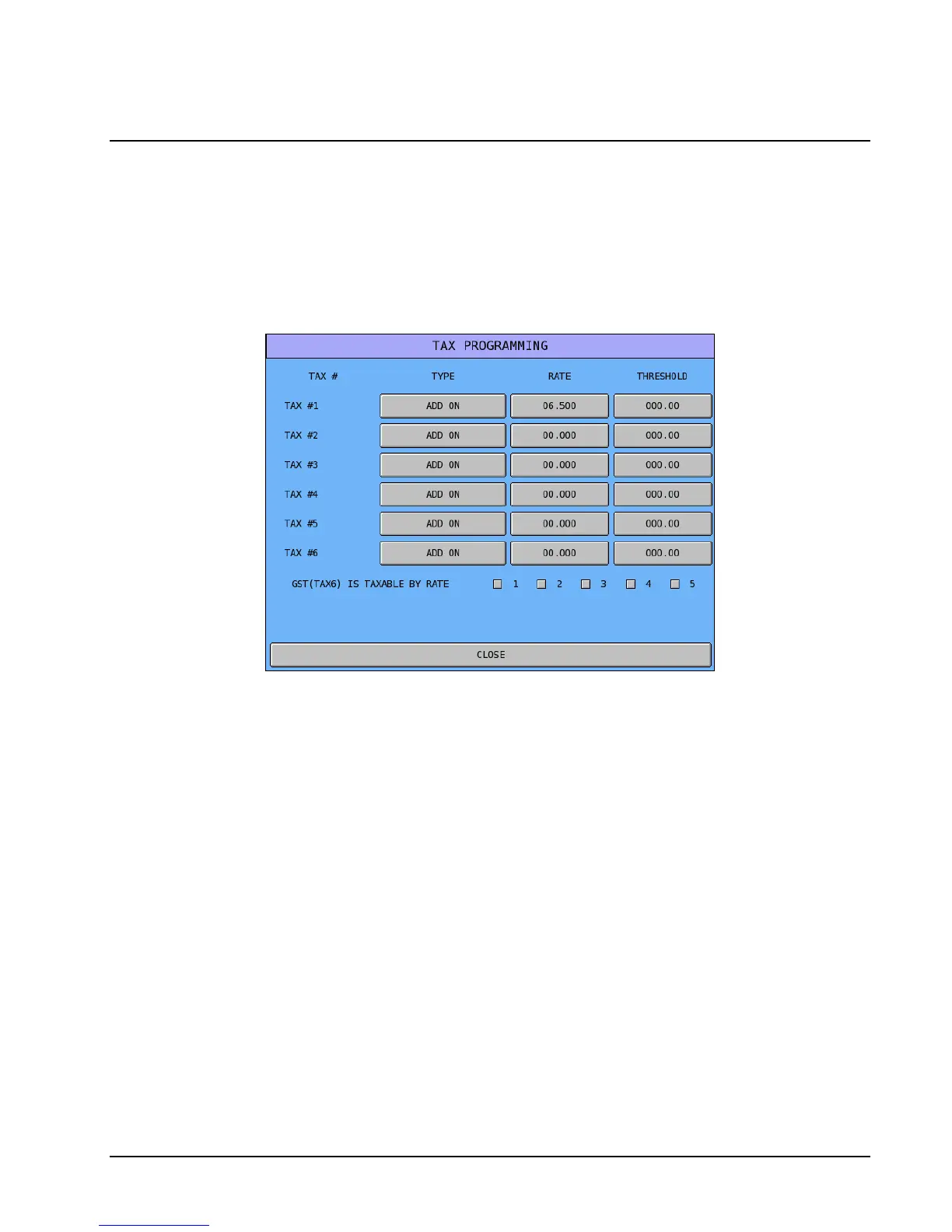

Taxes

The SPS-2000 provides calculation for up to six taxes. Tax calculation can be made by ADD ON percentage,

by TAX TABLE, or by VAT (value-added tax).

Provisions have been made for the Canadian Goods and Services tax (GST). If GST is to be taxable, you

have the option of taxing the GST by other applicable rates (tax on tax). Use TAX 6 for GST applications.

1. From the PGM mode PROGRAMMING MENU touch TAXES to view the TAX PROGRAMMING

Screen.

2. Touch the TYPE button to select ADD ON, TAX TABLE or VAT.

3. Refer to the notes that follow to program each type of tax.

4. Touch CLOSE to exit the program.

Add On Taxes Program Notes

RATE

Enter the tax rate. If fractional, press the decimal and up to three digits.

THRESHOLD

Enter the highest non-taxable amount.

Tax Table Programming Notes

MAXIMUM NON-TAXABLE AMOUNT

Enter the highest amount where no tax is charged. For this example the entry is 0.10.

FIRST TAX AMOUNT CHARGED

Enter the first tax amount that is charged. For this example the entry is 0.01.

Loading...

Loading...