Auto Sentry® flex - User Manual 172 Reports

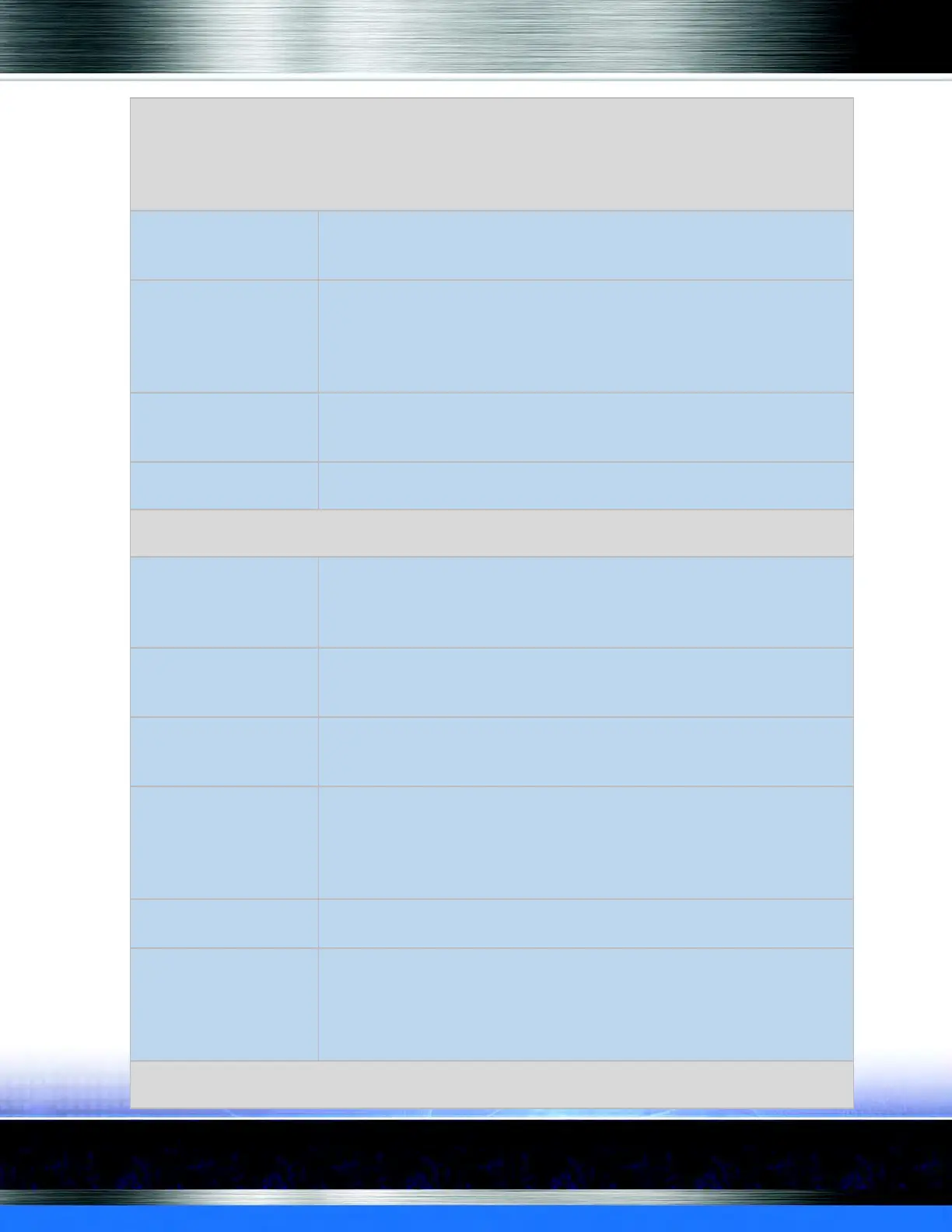

Sales Tax: This is to account for the amount of money that will be collected as Sales Tax

revenue, received from applying specified tax rates to specific Sales Items. This works with

the configuration of Sales Items to determine if they are nontaxable, subject to a single tax,

or subject to multiple taxes. Please see ‘Sales Tax’ configuration to learn how to setup the tax

tree structure and assign sites at the required tax rates.

Sales @ NonTaxable This entry will include all sales in all profit centers from PLUs setup as

Never Taxable. The amount reflects the sum on the nontaxable

items sold in the selected shifts.

Sales @ User Defined

Tax Rate 1(Example -

PA Department of

Revenue tax rate)

This entry will include all sales in all profit centers from PLUs setup as

Always, and possibly Conditional or Force Taxable. It includes all

purchased Sales Items that will apply this user defined Tax Rate.

For example, if Tax Rate 1 is 6% (the PA Department of Revenue tax

rate), and sales are $1000.00, then Taxes at Rate 1 are $60.00.

Sales @ User Defined

Tax Rate 2

This entry will include all sales in all profit centers from PLUs setup as

Always, and possibly Conditional or Force Taxable. It includes all

purchased Sales Items that will apply this user defined Tax Rate.

Total Sales The total dollars of revenue for all sales including tax received from

all profit centers within the selected shifts.

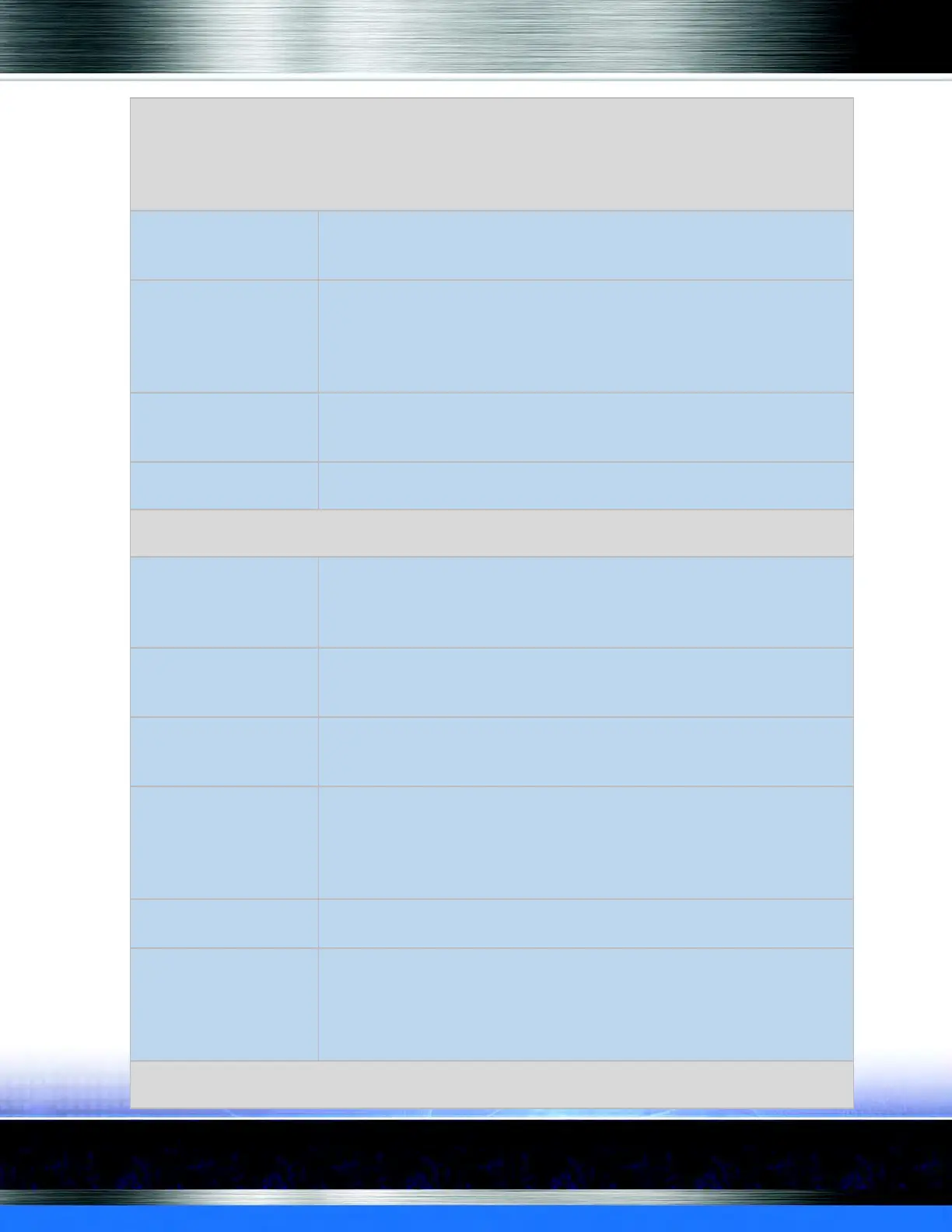

Total Income: This section will adjust the Total Sales number by including the following

types of additional sources of income:

Gift Card Sold This entry includes the total adjusted value of gift cards sold during

the selected shifts. This uses the total value of gift cards sold minus

any Gift Card Free value to create the adjusted total. This total is

added to the amount of Total Income.

Fund raiser This entry includes the total value of Fund Raiser sales sold during

the selected shifts. This total is added to the amount of Total

Income.

ROA This entry includes the total amount received as payment on an

account (For example: fleet). This total is added to the amount of

Total Income.

Gift Card Free This entry includes the dollar amount equal to the free percent or

amount given to the purchaser when buying the gift card or when a

customer adds value to a gift card. This value will be represented as

a negative amount and will reduce the overall amount of the Gift

Card Sales.

Gift Card Issued This entry includes the dollar amount of all Gift Card purchases or

the value added to an existing Gift Card.

Total Income This entry includes the total dollars of revenue for all sales made

from all profit centers during the selected shifts including all Prepay

and Post Pay Sales that have been paid for in the date range. This

adds the Total Sales section to additional revenue streams such as

Gift Cards, Fund Raisers, and ROA transactions.

Total Non-Cash Reconciliation - This section will sum up all non-cash payments to

determine what amount of revenue is tied to payments other than cash.

Loading...

Loading...