Chapter 1

• There are many ways that you can enter the aligned input into L1. One method that you

may prefer is to start over from the beginning. Replace

L1 with the contents of L3 by

highlighting

L1 and pressing 2ND 3 (L3) ENTER . Once again highlight the name L1

and subtract 1900 from each number in

L1 with 2ND 1 (L1) − 1900.

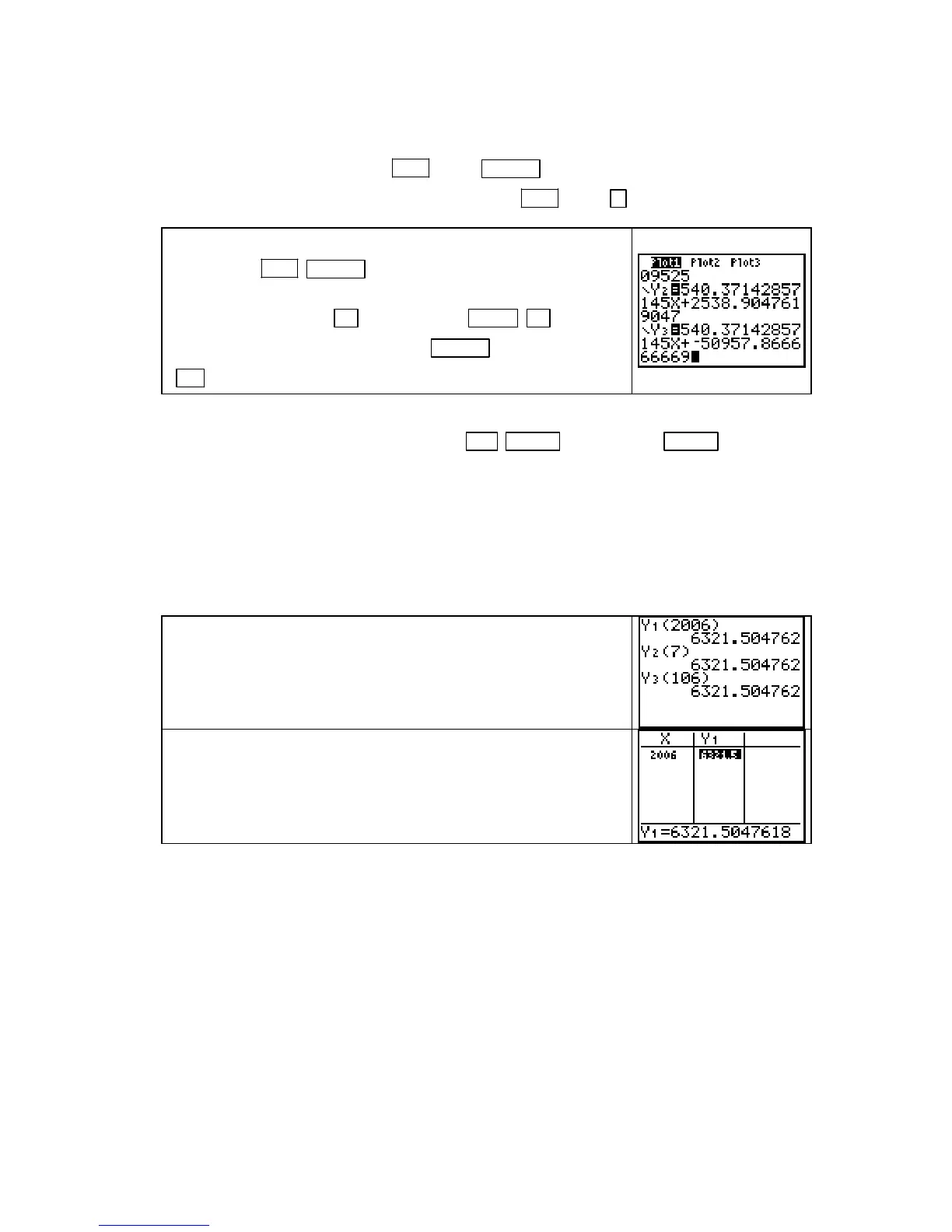

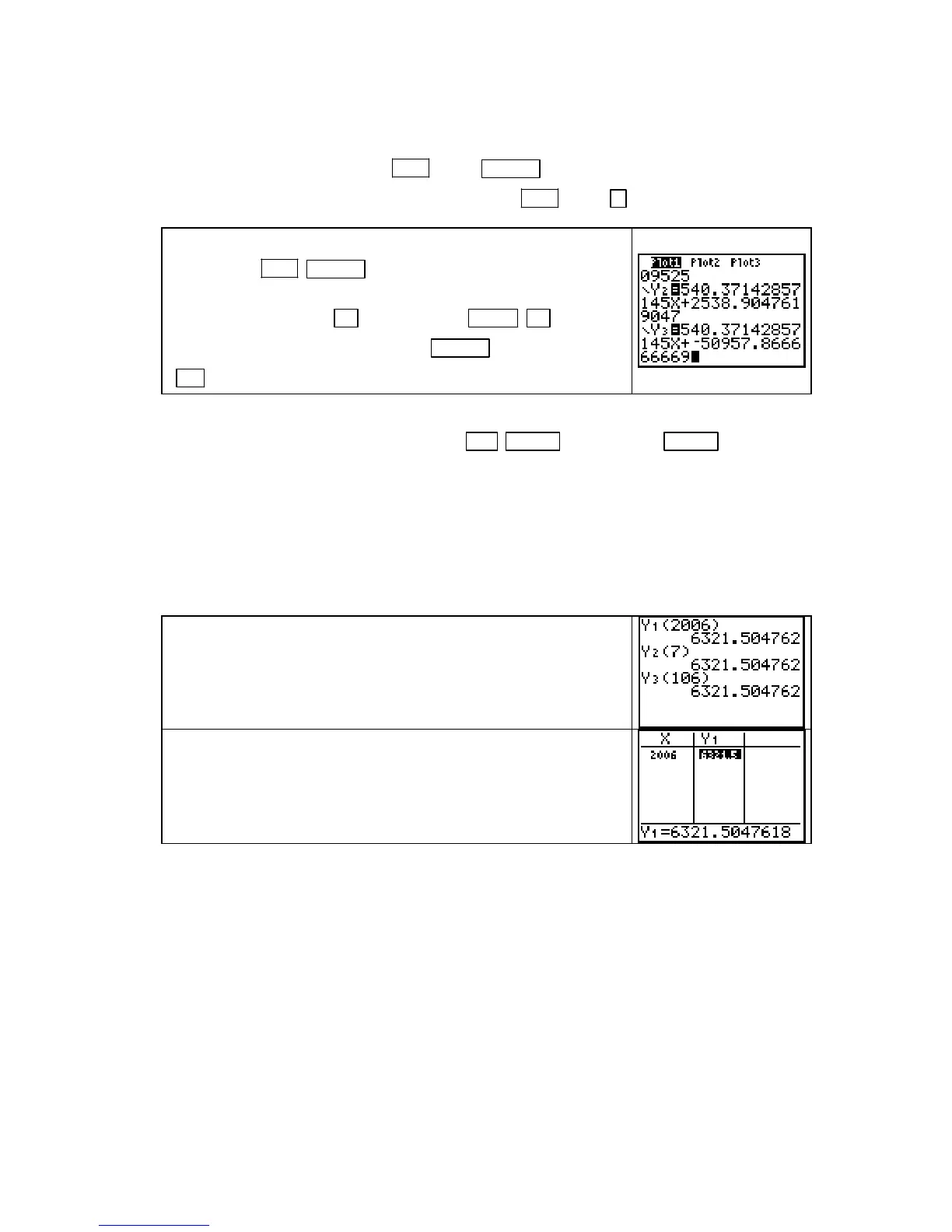

On the home screen, find the linear function for the aligned data

by pressing

2ND ENTER (ENTRY) until you see the linear

regression instruction. To enter this new equation in a different

location, say

Y3, press ◄ and then press VARS ►

[Y−VARS] 1 [Function] 3 [Y3]. Press ENTER and then press

Y= to see the function pasted in the Y3 location.

• To graph this equation on a scatter plot of the aligned data, first turn off the other functions

and then return to the home screen with

2nd MODE (QUIT). Press ZOOM 9 [ZoomStat].

USING A MODEL FOR PREDICTIONS You can use one of the methods described

previously in this Guide (see pages 6 and 7) to evaluate the linear function at the indicated

input value. Remember, if you have aligned the data, the input value at which you evaluate

the function may not be the value given in the question you are asked.

CAUTION: Remember that you should always use the full model, i.e., the function you

pasted in the

Y= list, not a rounded equation, for all computations.

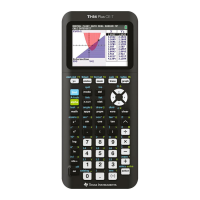

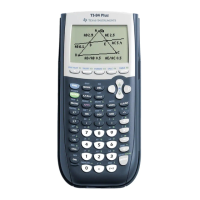

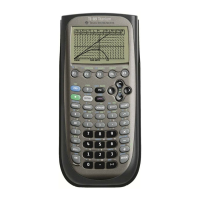

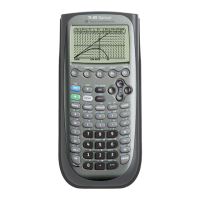

Using the function in Y1 (the input is the year), in Y2 (the input

is the number of years after 1999), or in

Y3 (the input is the

number of years after 1900), we predict that the tax owed in

2006 is approximately $6322.

You can also predict the tax in 2006 using the calculator table

(with

ASK chosen in TBLSET) and any of the 3 models found in

the previous section of this Guide. As seen to the right, the

predicted tax is approximately $6322.

NAMING AND STORING DATA You can name data (either input, output, or both) and

store it in the calculator memory for later recall. You may or may not want to use this feature.

It will be helpful if you plan to use a large data set several times and do not want to reenter the

data each time.

To illustrate the procedure, let’s name and store the modified tax output data from Section

1.2, page 32 of Calculus Concepts.

Copyright © Houghton Mifflin Company. All rights reserved.

24

Loading...

Loading...