104 Calyx Software

Loan Application

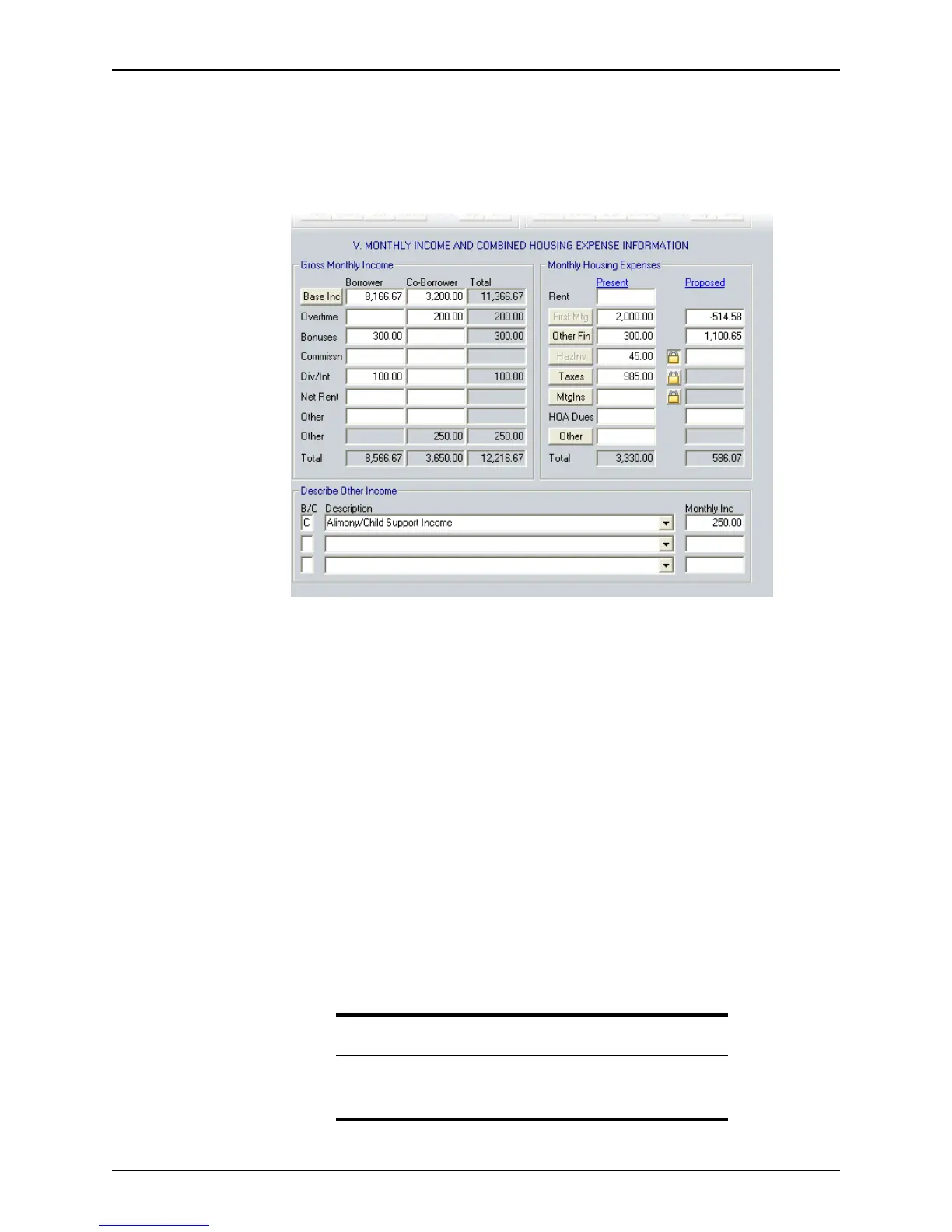

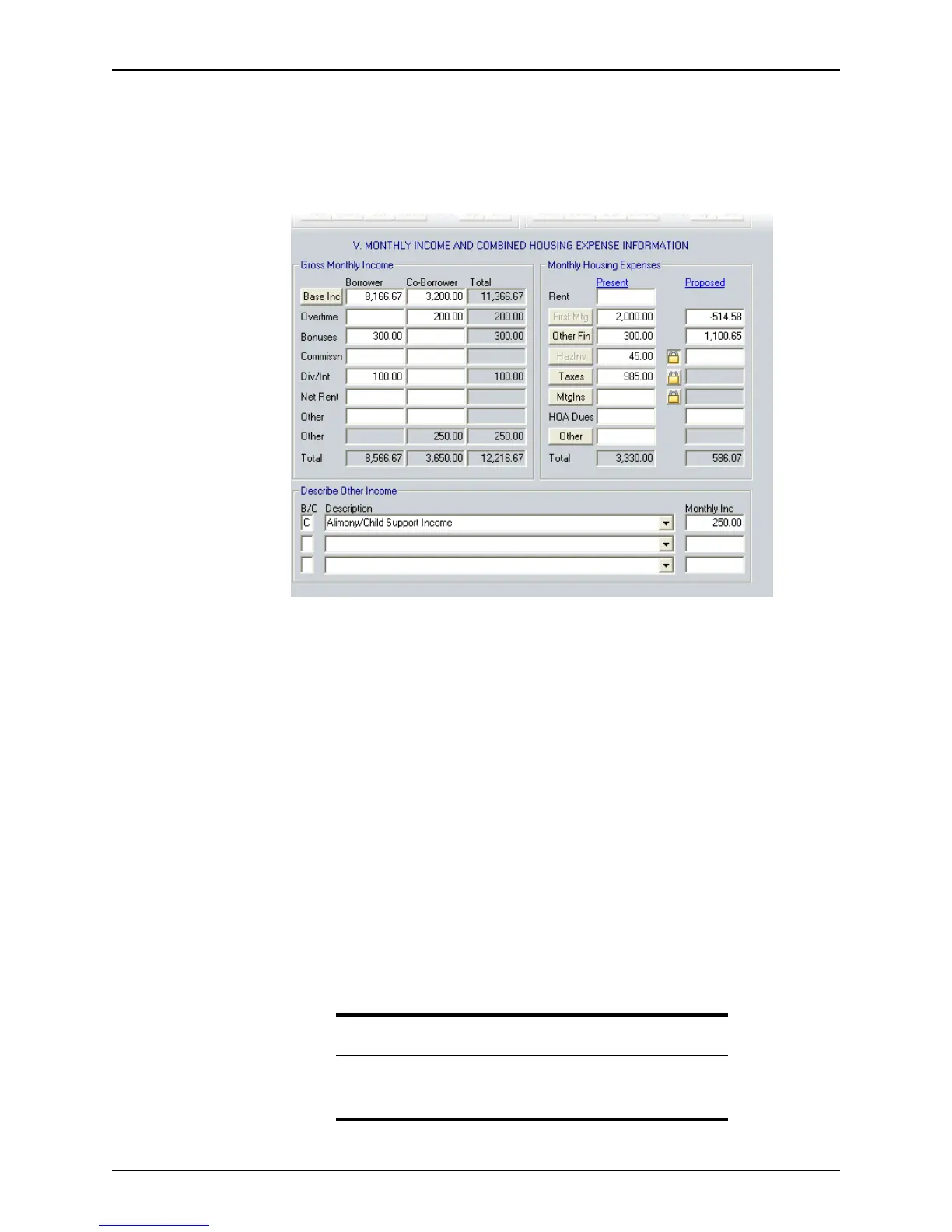

Entering income and housing expenses

To enter income and housing expenses:

1 Open page 2 of the

Loan Application and go to Section V. Monthly Income and

Combined Housing Expense Information

.

2 Enter the primary borrower’s monthly gross income in the

BaseInc field.

If the borrower’s income is based on an annual, semi-monthly, bi-weekly, weekly, or

hourly rate, convert it to a monthly rate by using the monthly income calculator. Click

the Base Inc button to open the

Monthly Income Calculator.

a Select the period that the income in

Amount field represents from the Period

dropdown list.

b Enter the gross amount that is earned for that period.

The

MonthlyIncome field is populated with the calculated monthly amount.

c Click OK to populate the

BaseInc field.

3 Enter the monthly income from

Overtime, Bonuses, Commissn, and Div/Int. Enter

these values as averages (usually over two or three years).

NetRent, if applicable, is calculated from property information that is entered in the

Schedule of Real Estate Owned.

4 Repeat the process for the co-borrower.

5 Enter additional income in the

Other field and in the Describe Other Income section.

a Enter

B or C to indicate whether the income is for the borrower or co-borrower.

Important

If you do not specify whether the other income is earned by the borrower

or co-borrower, the

Other fields are not populated with the total other

income.

Loading...

Loading...