178 Calyx Software

FHA and VA loans

• Select Refer to indicate that the lender is required to manually underwrite the

loan.

7 Complete the

Borrower and Property Information section.

a Select the type of property being purchased from the Property Type dropdown list.

b Specify whether the property is an

Existing Construction, Proposed Construction,

or

New (less than 1 year).

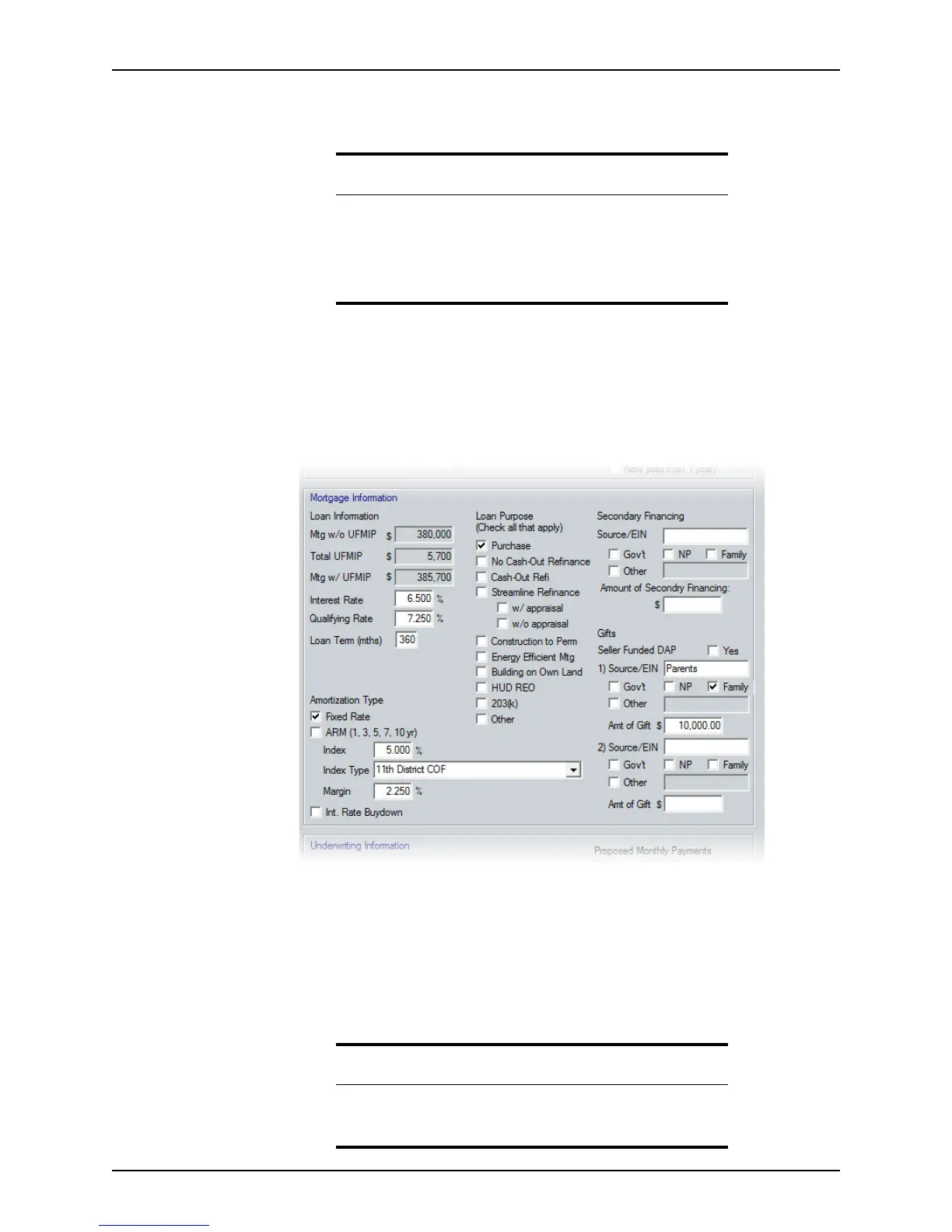

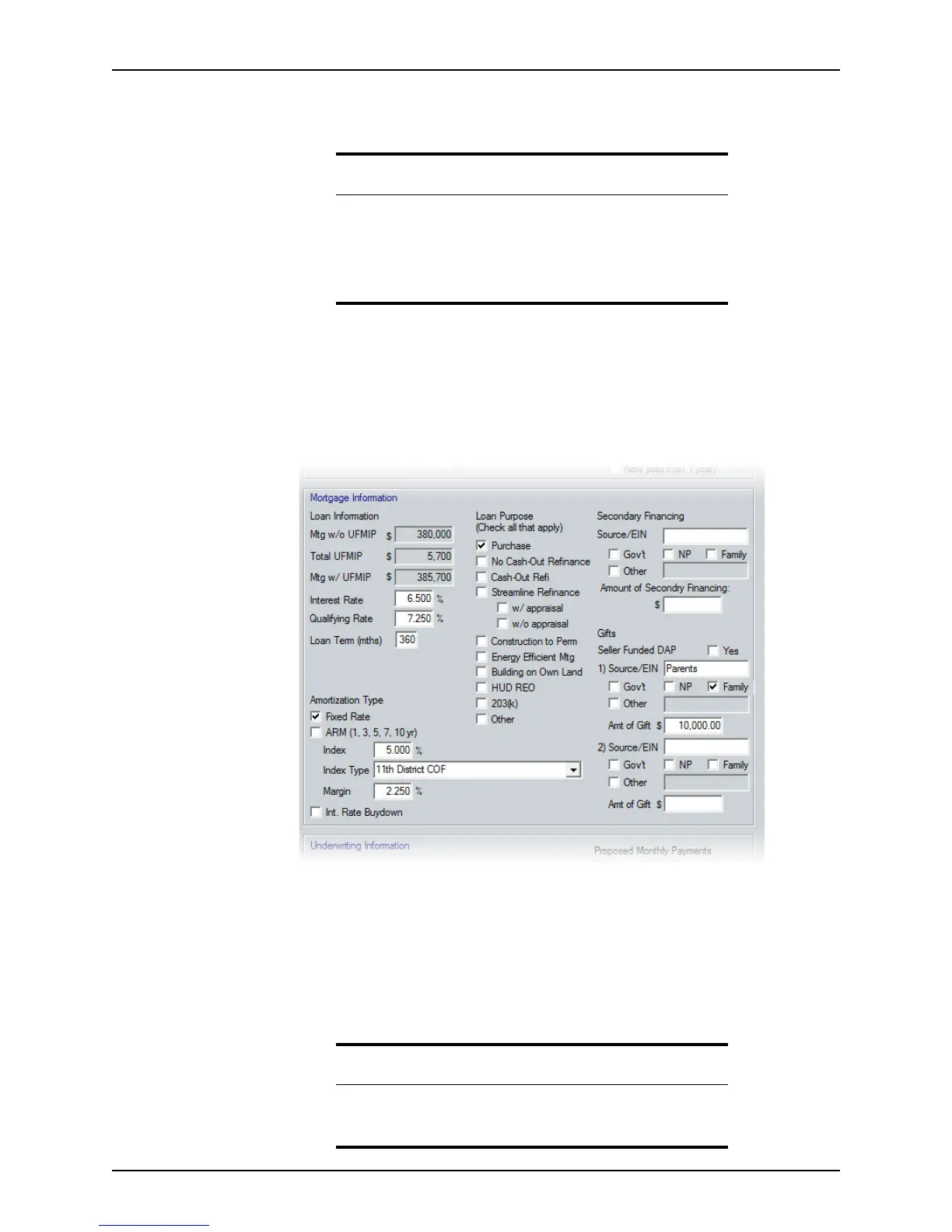

8 Complete the

Mortgage Information section.

Many of these fields are already populated from the

Loan Application, Truth-in-

Lending

, and Transmittal Summary screens.

a If the mortgage insurance information is not completed, click the Mtg Insurance

button and enter the necessary information in the

Mortgage Insurance

Premium/Funding Fee

dialog box.

b Complete the

InterestRate, QualifyingRate, and LoanTerm(mths) fields, if

needed.

Note

The Technology Open to Approved Lenders (TOTAL) Mortgage Scorecard

was developed by HUD to evaluate the credit risk of FHA loans that are

submitted to an automated underwriting system. To underwrite an FHA

loan electronically, a mortgagee must process the request through an

automated underwriting system that can communicate with the FHA

TOTAL Scorecard.

Note

For FHA loans, the qualifying rate is equal to the interest rate unless the

loan-to-value is less than or equal to 95% and the loan is a one year ARM

or less, then the qualifying rate is +1%.

Loading...

Loading...